What we can expect from GBPUSD next week? Technical Analysis

DISCLAIMER: The contents of this publication are for information purposes only and under no circumstances should be used or considered as a suggestion for trading or investment recommendation, and nothing that is included in it should be taken as a basis for making investments or making decisions.

Likewise, the announcement of past performance does not constitute a promise or guarantee of future returns.

You must be aware of the risks involved in trading these financial instruments before trading with CFDs and Forex. The high degree of leverage associated with this type of investment means that the degree of risk compared to other financial instruments or products is greater. The leverage (or commercial margin), can work against you, which can cause a substantial loss, as well as in your favor, which will cause a substantial gain.

NEGACIÓN DE RESPONSABILIDAD: El contenido de esta publicación es solo para fines informativos y en ningún caso se debe usar o considerar como una sugerencia para una recomendación de inversión o inversión, y nada de lo que se incluye en la misma debe tomarse como base para realizar inversiones o tomar decisiones.

Asimismo, el anuncio de resultados pasados no constituye una promesa o garantía de rendimientos futuros.

Debe tener en cuenta los riesgos que implica el comercio de estos instrumentos financieros antes de negociar con CFD y Forex. El alto grado de apalancamiento asociado con este tipo de inversión significa que el grado de riesgo en comparación con otros instrumentos o productos financieros es mayor. El apalancamiento (o margen comercial) puede actuar en su contra, lo que puede causar una pérdida sustancial, así como a su favor, lo que causará una ganancia sustancial.

Hola Familia de Steemit

FOREX- GBPUSD

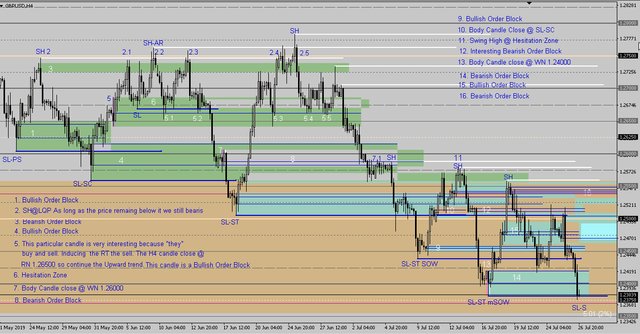

Today I want to share the technical analysis of the GBPUSD pair, which consists in the application of some methods with which I have found comfort in the market.

We can see highlighted many areas of the price, which, if you see in detail, become strong Support and Resistance points. Which we must take into account from the opening of the week.

We are currently at an almost optimal point of buy, however, there is another area that is around 1.2000 to which the market can go back, everything will depend on the movement of news that we have next week in this pair.

But undoubtedly stay tuned, because buying will be a good swing to take.

I hope you enjoy it.

Hoy quiero compartir el análisis técnico del par GBPUSD, el cual consiste en la aplicación de algunos métodos con los que he encontrado comodidad en el mercado.

Podemos ver resaltadas muchas áreas del precio, los cuales, si ven con detalle, se van haciendo fuertes puntos de Soporte y Resistencia. Las cuales debemos tener en consideración a partir de la apertura de la semana.

Actualmente estamos en un punto casi óptimo de compra, sin embargo, existe otra área que ronda los 1.2000 hasta las que puede retroceder el mercado, todo dependerá del movimiento de noticias que tengamos la próxima semana en este par.

Pero sin dudas estén atentos, porque comprar será un buen swing que tomar.

[source]MT4

Thank you for reading

If you liked reading this article, feel free to FOLLOW ME, UPVOTE and RESTEEM! It's always appreciated. Thank you all for your support.

@agromeror You have received a 100% upvote from @intro.bot because this post did not use any bidbots and you have not used bidbots in the last 30 days!

Upvoting this comment will help keep this service running.