High Food Prices & Negative Interest Good for You

This video was originally published 23/9/2019

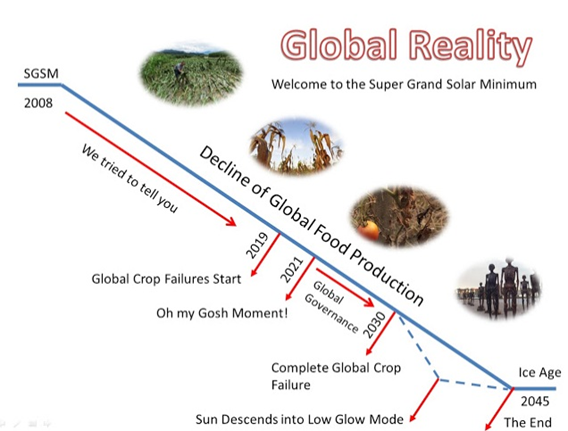

How to preserve food; how to start a fire; and how to identify the effects of cold temperatures & light frosts on different crops are basic skills that you must know to survive the effect of the Grand Solar Minimum.

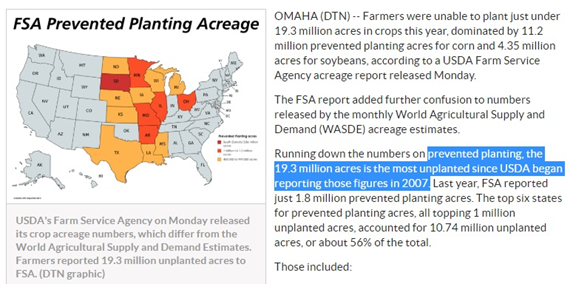

Being informed is also a necessity. DTN, for instance has the full Farm Service Agency (FSA) Acreage report that allows us to see the least number of acres planted in the United States since 1938.

Their recent market stabilizing report revealed that those who are claiming insurance on the books tallied up to this point is at 19.3 million acres. This is the most unplanted acreage that has ever been recorded, but they only started accounting in 2007. They do, however, have quite good records going back to 1938, and this bring us to the cusp of the lowest planting ever, since 1938.

So, you have to wonder, how do increasing food prices and decreasing crop yields put Hawaii in an extremely vulnerable position? That state imports 99% of everything they use every day, and oil prices are not the only thing going up, food prices are also increasing.

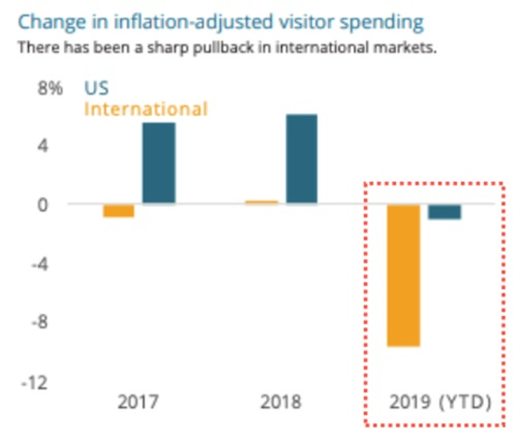

On top of that, the tourism sector is at a standstill, and as cited in this article, foreign visitors are facing an increase in the price of Hawaii vacation because of stronger dollar, so they are choosing to go elsewhere. The global economy is likewise showing signs of a market slowdown and as reiterated in the second paragraph, jobs in the accommodation & food service sector have been flat for the past two years, while jobs in the trade sector have fallen sharply.

This is an overall look at the tourism sector, and it can be observed that there has been a sharp pullback in international markets. 2017 and 2018 were positive, but when we swing over to 2019, it is negative.

As we move to 2020 to 2021, this is where the contraction is really going to occur, your food prices are going to spike. This is not a good inverse relationship.

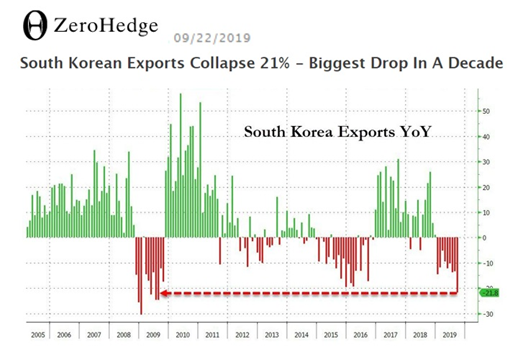

Most importantly, how is a higher oil price going to mix into everything? South Korean exports had already collapsed by 21%. Do you remember the last time it dropped like this back in 2009? This time, however, there is going to be no quantitative easing and bank bailouts. There would be no cavalry running in with helicopters carrying money to drop and save the economy. Markets have been filled with umpteen trillions of dollars since 2009 but look at where we are now, back to the same starting point again with all that money evaporated.

Now, how do South Korean exports collapsing 21% affect us? Japan is one of their biggest inbound and outbound markets, but looking at exports to Japan, it is at down 13%, imports from Japan are down 16%. If you look at other markets that are huge for South Korea, China sits at -30%, the US is also at -20%, and the E.U is down almost 13%.

China, as of this moment, is contracting. Particularly year on year exports are the lowest in several years; and they are trending toward 2009 era lows as well.

An article on The Daily Independent suggests we should love negative interest because it is there to help us. The article says that problems arise when rates have been cut to zero and the economy still isn’t performing as expected. This is going to be the future, because global markets are already not performing as expected.

This is the theory about negative interest rates. “If banks cannot be bribed into putting that money out in the markets, maybe they can be coerced through penalty payments on reserves”, such as leaving your money in the bank, and in case it will actually cost you money to leave your money there.

Central banks are forcing the local banks to push money out by negative interest. So where is the problem? I thought the economy was rosy, and we had the most bountiful yields ever? It seems that both of those things are untrue.

On Zero Hedge, negative interest rates are the price we pay for these de-civilizations, they are asking Under what scenario would anyone lend $1,000 and would be happy to receive $900 back? Would you want to do that?

There is yet another point to note here. “Nobody would want to sell their capital by giving the buyer interest payments as well”. So, what is going to happen? There is going to be a constriction because in order to avoid the risk of lending, they are simply going to hold the assets, which means economic contraction.

As you know, the just-in-time food delivery system relies on credit and movement of money. If they are going to consider negative interests, there is going to be less money, which means less movement in the economy, which means higher prices. So, wherever you look, it is going to be higher prices and unavailability for your food in the very near future, plan wisely.

Myself and my co-author, Bill Porter talk about these types of scenarios in our book Climate Revolution where we revisit the last five Grand Solar Minima with discussions on how the economy contracted and where the opportunities were. Bring that to the modern age, we are at the biggest opportunities in human history, if you only know where to look.

ADAPT 2030 Climate Revolution Book

Thanks for reading, I hope you got something out of the article. If you like more content like this, I produce the tri-weekly Mini Ice Age Conversations podcast, 30 minutes of in-depth analysis on the GSM you can take on the go through out your day.

Lower CO2 I’m Not A Fan of Extinction — ADAPT 2030 Limited Edition Design, available in January ONLY. Wearing this shirt may trigger Al Gore.

https://teespring.com/stores/adapt-2030

Mini Ice Age Conversations Podcast

iTunes: https://itunes.apple.com/us/podcast/adapt2030

Soundcloud https://soundcloud.com/adapt-2030

Libsyn http://adapt2030.libsyn.com/

(MIAC #271) When You See These Events Again Your Society is Going to Change

http://adapt2030.libsyn.com/miac-271-when-you-see-these-events-again-your-society-is-going-to-change

For the bi-weekly Grand Solar Minimum climate update newsletter from myself, David DuByne, (ADAPT 2030) jump over to oilseedcrops.org you can enter your email and sign up. Move your mouse around for about 10 seconds and this box will pop up.

Join ADAPT 2030 NEWSLETTER http://www.oilseedcrops.org

“Help support the adapt 2030 channel on brighteon so we can keep Grand Solar Minimum information free to access.”

https://www.brighteon.com/channel/adapt2030

Support ADAPT 2030 by Visiting Our Sponsors

ADAPT 2030 & My Patriot Supply 2-Week Food Supply with 92 servings

www.preparewithadapt2030.com

True Leaf Market Heirloom Seeds ADAPT 2030 True Leaf Market Link

ADAPT 2030 Amazon Grand Solar Minimum Book Store https://www.amazon.com/shop/adapt2030

Upheaval: Why Catastrophic Earthquakes Will Soon Strike the United States https://amzn.to/2E7KbBt

*** Today’s Story Links ***

Negative Interest Rates Are The Price We Pay For De-Civilization

https://www.zerohedge.com/economics/negative-interest-rates-are-price-we-pay-de-civilization

Should we love or hate ‘negative’ interest rates?

Disaster Ahead? Hawaii’s Economy Will Slow To “Near Standstill”

https://www.zerohedge.com/economics/disaster-ahead-hawaiis-economy-will-slow-near-standstill

FSA: 19.3 Million Acres Unplanted

https://www.dtnpf.com/agriculture/web/ag/news/article/2019/08/12/farm-service-agency-cites-record

South Korean Exports Collapse 21% — Biggest Drop In A Decade

https://www.zerohedge.com/economics/south-korean-exports-collapse-21-biggest-drop-decade

*** ADAPT 2030 Social Media Links ***

PATREON https://www.patreon.com/adapt2030

YOUTUBE ADAPT 2030 Mini Ice Age 2015–2035 Series on YouTube

BITCHUTE https://www.bitchute.com/hashtag/adapt2030/

BRIGHTEON https://www.brighteon.com/channel/adapt2030

STEEM https://steemit.com/@adapt2030

MINDS https://minds.com/ADAPT2030

MEDIUM https://medium.com/@globalcooling

FB https://www.facebook.com/Miniiceage

TWITTER https://twitter.com/adapt2030

Thank you 🙏 for some great information and your great work 👏 👍