The Flat Earth and Other Conspiracies

On July 20, 1969, Neil Armstrong and Buzz Aldrin walked on the moon…unless they didn’t. Whether you put your trust in NASA or the conspiracy theorists is your call, but there are other conspiracies that go all across the country that you may not be aware of. These conspiracies run through the media, banks, educational systems, and the home. You were most likely taught them from your parents at a young age, or you learned it along the way as you grew up just by living in society. I’m here to tell you today that you’ve been duped, but it’s not your fault.

The conspiracy I’m referring to today is that you were taught to save your money but it’s the wrong battle strategy. If you use the wrong tactic for 30 years, you will end up broke. The average American makes $58,000 a year and life costs more $58,000. How do you get out of that trap? 50% of American families have zero money saved for retirement. It’s not because half the people are stupid, it’s that the things we are all taught about money are a problem.

Here are 3 simple points to help you break the conspiracy that saving is your way to wealth:

1)The plan doesn’t work—You must challenge your assumptions. Your mommy and daddy’s plan was all about saving. This is the wrong battle plan. Ask yourself how “saving” has really worked out for you so far. I’m willing to guess that it’s left you with much to be desired financially, right?

2)Secure the job you have—Never hate on your job, but rather add income to your job. People complain about jobs and never learn to increase their income where they are already at. Never forsake your flow of money. Don’t worry about investing in wall street, worry about how you can add to the money you already make.

3)You need to prioritize income—This is the plan you need, you need to play offense, not defense. Make income your #1 priority. Saving $4 on a latte each day is not your problem. You need more dollars to buy as many lattes as you desire.

Many people have accepted a truth unquestioningly about money and are surprised later once they fully realize the depth of the conspiracy which has led them to a life of financial slavery. It’s no different than if you were taught your whole life that the earth is a globe and one day you came to realize there is no curvature—it would be shocking to realize your whole reality was flipped from the truth. Some people can’t handle the truth, but those that do can quickly recover and make up lost ground.

If you’ve been focusing on saving rather than on income, now is the time to flip your reality.

P.S. What do you really think about the "flat earth movement"?

@grantcardone My dawwggg haha

I first heard of you from the Ryan Moran Podcast, then read The Ten X Rule and Be Obsessed or Be Average. They quickly entered the ranks of my favourite books.

One piece of advice that you gave which in part lead to me to Steemit was to grab new technologies and go hard on it incase it has potential. Its nice to see you see you practicing what you preach by being here on Steemit!

Im part of the promo-team who try to get more people on Steem and Investing in Steem and therefore raise the Steem price.

Would you be interested in putting a message out about Steem out to your audience?

@grantcardone this is a fantastic article and sound piece of advice. You have hit the nail on the head. Society has led us to believe that we must save a small amount from the age of 18 to 65-70. Only then are we supposed to be 'Financially stable??' This is probably one of the biggest conspiracies of our time. How does this lead to us generating our wealth. It's fearfully worrying that the majority believe that the small % of savings they put aside is they're way to wealth.

To add too this article I would apply what you teach in 'Be Obsessed Or Be Average' & make sure you don't limit the investments you put into yourself. Make time work for you. Be open minded. Be curious. Learn from the best. Put in those extra hours in the office to become the top salesmen in your company...

Only then will you begin to start attracting the success and the small amount of investments that you put away for your so-called 'retirement' or 'rainy day pot' will be a pebble in the ocean to what can be achieved.

Well, there's two sides to the coin..

I am a big believer for Dollar Cost Averaging. I think it's one of the most powerful concepts out there, if you have patience. However, at the same time, don't let that limit the fact that you can't make a sh*t ton of money either. It should be there for a fail safe. A certain percentage that goes off every single week of your income, that you don't even think about. Then just spend all your energy focusing on building that income.

I think combining the two is powerful.

Talk soon!

Hey @enazwahsdarb I agree with you. Cover all bases. I too have started a pension pot and a small portion of my monthly income goes into that. However, for me this is another revenue stream I have & I don't even know how much I have in it. I'm not trying to gloat by making that point, but rather emphasise it's importance. I suspect most people will only have the one savings pot, which they hope to get when they retire. But the reality is, when they do retire it won't be enough.

I've heard that the average millionaire has 7 sources of income. I don't know how accurate that is, but it sounds pretty spot on to me. @grantcardone maybe you can confirm this for me?

Lol I think @grantcardone has a few more than that.. But I do like that as a great template to start building passive income to become a millionaire. Just start with 7 small incomes, and build them up each and every month.

Awesome! You have just given me some inspiration, as you reminded me about this concept.

Talk soon.

You always have killer advice Grant, love it! Been following you for years, got the audio books on repeat, has brought my game and businesses to a new level. Keep killing it brother, headed out to GrowthCon 2018! Flat earth though lol

Absolutely LOVE this post !!!

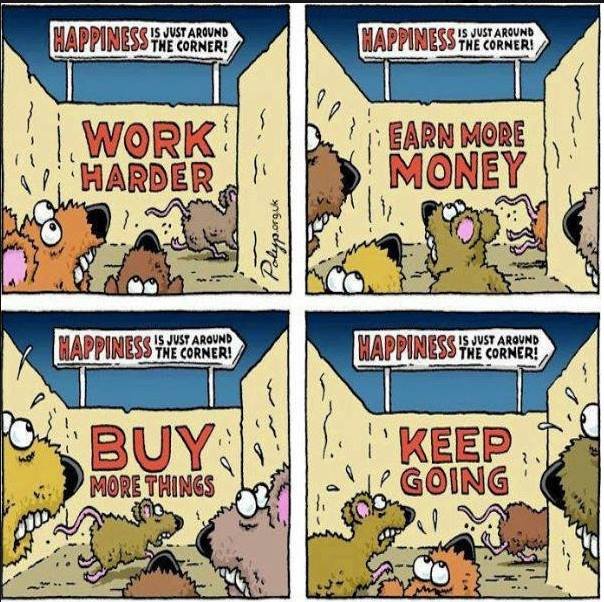

Does this seems familiar?!

Make money, invest your money, work smarter, don't underestimate your value and don't share your time with those who have nothing to give. I found this out later in life and I live by it now!

What flat earth? Lol

good stuff my man!

I'm a lady but it's ok haha

Lovely day to you and yours!

Great article @grantcardone! Or how about how people say to buy a primary residence instead of using that money to buy apartment buildings that pay you money each month...

UNCLE G!!!! Keep Steeming on brotha! So glad you're here, great post also. #10x

Some good tips on money.

I'm not sure about the whole flat earth thing. They make some valid points on some things but it gets right out to lunch on other things. Who knows what to believe any more.

I'm trying to add income to my job but I'm much more interested in other things so I'm taking my income into my own hands after being employed all my life. I'm adding income not through the job I have but through the work I'm doing outside my job. As of October I'm finally starting to go part time.

I have an Audible subscription. Your book The 10X Rule was hands down the most motivating book I've listened to yet. The chapter about middle classes being squeeze really hit me. Thanks

@wphelpandfix thats awesome! Good luck with your entrepreneurial efforts. I became self employed in 2015 and it was the best decision I ever made! You should also have a listen to Grant's other book 'Be Obsessed or Be Average'. I've finished it recently and its a huge winner!

this is spam, misleading title, had nothing to do with the Flat earth theory, he just wanted to tell people not to save money.