Bitcoin and Oil: The Worst Investments or The Time to Buy?

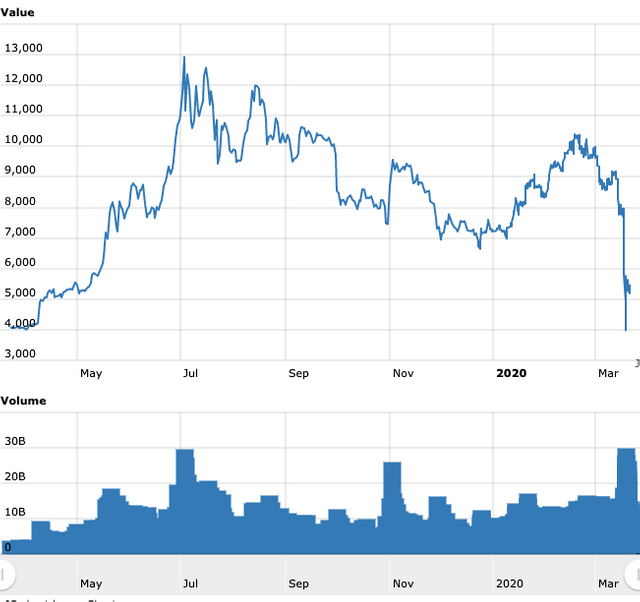

Bitcoin is sinking below $ 6,000 for the first time in over a year. It reached a price of US $ 5,950, almost half of the US $ 12,000 it reached averaging in 2019.

The decline of the most famous cryptocurrency is due to a massive sale of global risk assets due to the intensification of the coronavirus crisis .

Bitcoin's crash occurs at the same time that world markets collapse. Stock markets in Europe drop an average of 5% and those in Asia more than 4%. Also the futures of the S & P500 are in collapse and advance a black Thursday on Wall Street and the Latin American stock markets.

Bitcoin's latest downgrade is attributed to the decision of United States President Donald Trump to suspend all flights from Europe, except for the United Kingdom, in an effort by the world's leading power to stop the spread of the coronavirus.

Here's the last one year stats of Bitcoins!

In the past seven days, Bitcoin suffered a drop in value of almost 20%. And the decrease is much greater if compared with the values of January. Its historical maximum was US $ 19,870, established on December 17, 2017.

The rest of the cryptocurrencies also collapse, such as Ethereum (-23%) and XRP (-14%).

Oil, Bitcoin and Coronavirus:

"Oil prices are in a 'crater' after Trump banned travel from Europe due to the coronavirus pandemic.

Indeed, crude benchmark values (both Brent and WTI) fell more than 6% since Wednesday night after Trump's announcement.

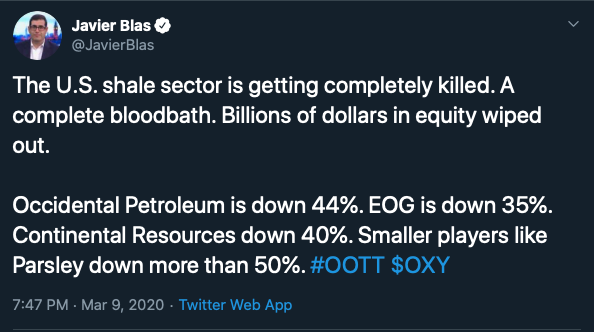

The value of a barrel had collapsed on Monday, after major producers in Saudi Arabia and the United Arab Emirates said they would increase production, intensifying a global price war between OPEC countries and Russia.

Although it later recovered, the news of the cancellation of flights for a month between Europe and the United States again brought down the values to very close to US $ 30, a price that makes extraction in the shale oil fields unfeasible , or unconventional crude, much more expensive to extract than the classic that abounds in the Persian Gulf.

To take one dimension of the problem of the drop in air traffic and its potential impact on the demand for crude oil and its products, suffice it to say that jet fuel represents 8% of total oil consumption in the United States.

Trump's country is the world's largest consumer of oil, with almost 20%.

On the other hand, if the United States took this measure (which is in effect as of this Friday), it is most likely that other nations will do the same, further complicating everything for the industry.

Both Brent and WTI have fallen nearly 50% since the start of the year.

For the lazy fellows out there, here's a TLDR for you.

TLDR:

- Bitcoin loses half its value: everyone runs away from risky assets

- Oil returns to low on Monday, when it plummeted with the start of the price war between Saudi Arabia and Russia

- They can be good investments in the future, but you have to have patience and support

Thank You for reading till the end. Like I always say at the end of my posts, HOPE is always there.

If you are interested to read more such informative topics, you can follow me @nirmal for regular updates. Check out my profile, I have written some informative articles which you may like.

By the way, I also run a blog HiTricks where I post about Technology and SEO. If you are from India, you will surely enjoy it.

Peace!

nice

hi @nirmal

It's surely not time to buy into any assets. We're still on a way down. People and businesses will be selling any asset they have to get their hands on FIAT. Why? Because with current virus outbreak most businesses and people do not have enough income coming to pay for loans and morgages.

Any idea why spamminator blacklisted you?

Yours, Piotr

Yes absolutely right @crypto.piotr

Hoping for this coronavirus outbreak to stabilize first, so that no more lives are lost.

Maybe the market will start to stabilize gradually.

For now keeping my portfolio untouched.

And that blacklist thing maybe because I posted an article about YES BANK (an Indian Pvt Bank, which got into trouble recently, and its stocks fell). The post is from Groww.in Digest (a weekly newsletter from Groww.in). Although I mentioned the source after the article, it was a copied post. :(

Congratulations @nirmal! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!