Capital Structure and Its Theories - Debt and Equity

Introduction

.png) Link

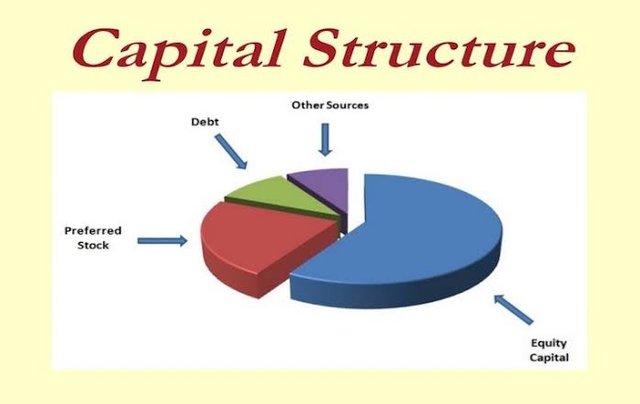

LinkThe capital structure is the combination of debt and equity used by a firm to finance its overall operations and growth. Debt comes in form of bond issues or loans while Equity in form of common stock preferred stock and retained earnings.

Capital structure and its components

.jpeg) Link

LinkThe capital structure is how a company funds its overall operations and growth. It raises debt which consists of borrowed funds that are due to the lender alongside agreed interest rates.

Equity of a company which constitutes part of its entire capital comes from the owners of the company who have automatic rights in the firm and repayment of its invested cash is called dividend.

The debt and Equity ratio in finance is used in determining the riskiness of a firm borrowing exercise. In simple terms, it's used to determine whether or not it's risky enough to borrow funds to start a business.

It also checks if the risk is worth undergoing the project and if the profit gotten is enough to sustain the business and pay investors.

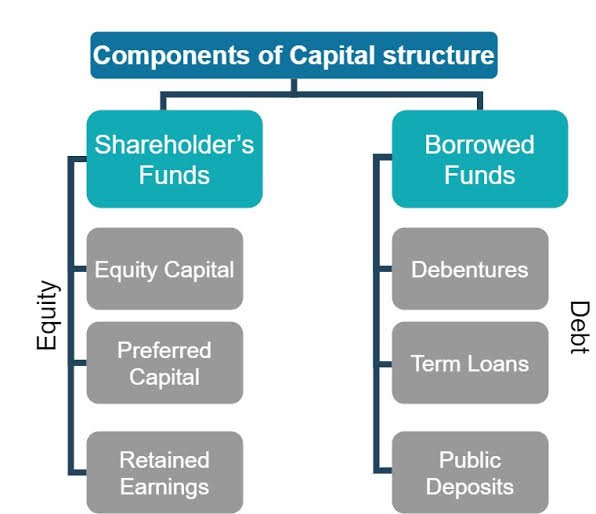

The components of a firm's capital structure can be seen below;

.jpeg) Link

Link1. It mixes the firm's long and short-term debt. Takes into cognizance the common and preferred stock of the company too.

2. There's utmost consideration in the company's proportion of short and long-term debt. It's should be balanced so it doesn't affect the company during repayment.

3. There's a rule in capital structure that states that "A firm with heavier debt base has more aggressive capital structure, poses a greater risk and has a high leverage ratio than a firm with lighter debt base."

4. A firm has a low leverage ratio when it pays for its acquired assets with equity than with borrowed funds.

5. Capital Structure rules state plainly:

- High Leverage Ratio equates Higher Growth Rate.

- Low Leverage Ratio equates Lower Growth Rate.

Theories of Capital Structure

.jpeg)

Link

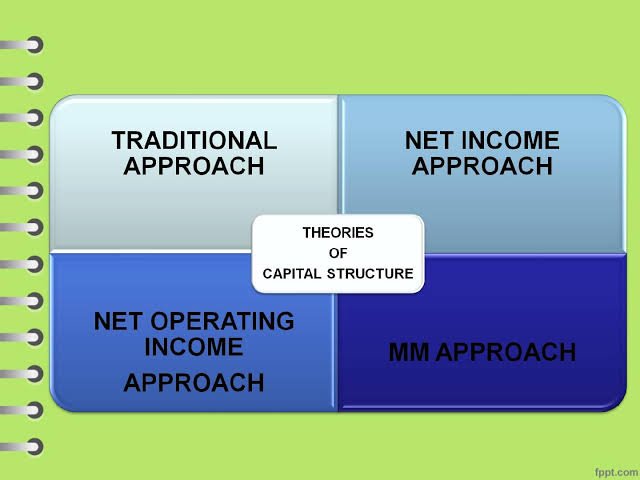

There are four major theories of capital structure I would be concentrating on. They can also be called Principles. They are outlined and explained below.

- Net Income Approach

- Net Operating Income Approach

- Traditional Approach

- Merton Miller and Franco Modigliani Approach

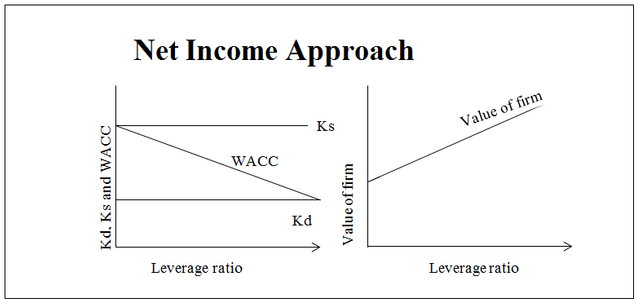

Net Income Approach

This theory is simple and it states that "a firm can minimize its weighted average cost of capital and increase its value alongside the market price of the equity shares through debt financing to the maximum possible extent.

A firm seeks to minimize its expenses in other to maximize profit. Under this theory, the theorist suggests that the organizations in a bid to increase their value can do by minimizing their WACC (Weighted Average Cost of Capital.)

.png) Link

LinkThis theory can't be compared or adopted without its probable assumptions which are;

- The cost of debt financing weighs less than the cost of equity financing

- There are no taxes involved under this theory of capital structure.

- Investors' view on whether or not to invest remains unchanged by the use of debt.

The cost of debt is assumed to weigh lesser than the cost of equity financing because interest rates happen to be lower than dividend rates. Also, the payment of interest is tax-deductible.

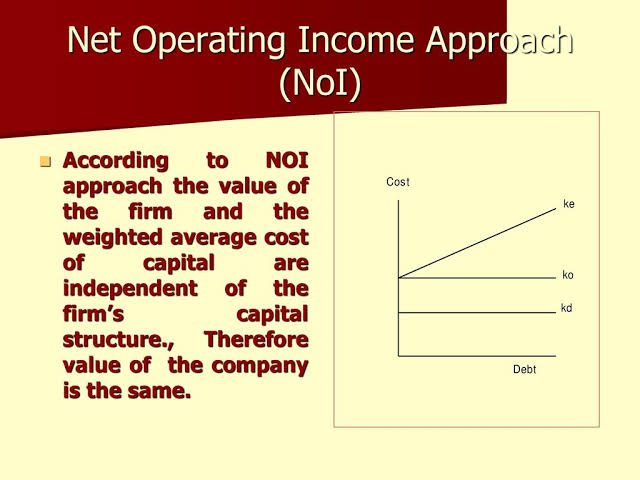

Net Operating Income Approach

This theory was propounded by famous theorist David Durand. In this, he argued that "a change (%) in the firm's capital structure doesn't affect its market value and the general cost of capital remains constant regardless of the method of financing employed by the owners of the firm."

.jpeg)

Link

This simply means that whatever ratio of debt to equity financing is employed to doesn't affect the market value of the firm. The firm still operates normally in the market despite the debt or equity in which it was conceived.

The ratios could be:

| Debt | Equity |

|---|---|

| 50 | 50 |

| 100 | 0 |

| 75 | 25 |

| 25 | 75 |

| 0 | 100 |

This theory can't be compared or adopted without its probable assumptions which are;

There is no existence of Optimal Capital structure. This is because there's a comparison of whether or not the debt to equity ratio affects the market value of the company.

The market sees the value of the firm as it is. It sees it for what it offers.

The risk involved in the business is the same across all the debt to equity ratio levels.

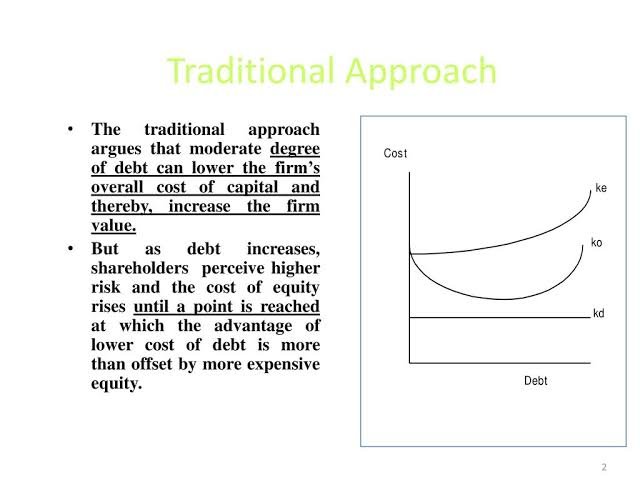

Traditional Approach

This theory believes that the "cost of equity financing and debt financing are separately and independently determined by the owners of the capital structure."

.jpeg) Link

LinkHere, a rule has been drawn up to state that: If the cost of equity is high or low, the highly or lowly geared become and the lower or higher the cost of capital.

This theory can't be compared or adopted without its probable assumptions which are;

- All the firms adopting this capital structure are assumed to be financed exclusively by debt that is borrowed funds.

- The cost of financing either equity or debt differs but stays in line with the degree of leverage or leverage ratio.

Merton Miller and Franco Modigliani Approach

.jpeg)

Link

This is my favorite theory and it's popularly referred to as M&M Theory. M&M Theory propounds that capital structure has no effect on the overall cost of capital of a firm except in extreme cases of gearing.

This theory opines that the total value of a firm solely lies in its ability to perform excellently and take up business risks.

M&M theory faced a lot of criticisms from the public about its view on the capital structure of firms.

Criticisms of M&M Theory

Link

A. Personal Gearing Carries Precisely The Same Risk As Corporate Gearing.

This recognizes the limited liability clause that exists that a company enjoys. An investor knows that its funds are safe if the firm borrows on its behalf than on an individual behalf.

For instance: Becky feels her invested funds in company X are safe if company X borrows on behalf of company X than on behalf of a shareholder in the company - individual A.

B. Personal Borrowing Is At The Same Rate Of Interest As Corporate Borrowing.

This criticism is valid because when a company or firm goes to the bank to borrow, the bank takes into recognition the possibility of the loan repayment based on a business plan or individual bases.

The bank also considers the customer's credit score and competence to ascertain whether or not the company or individual will be able to pay back.

The bank considers all these on the various basic and if the individual or company doesn't meet up to their requirement, the loan will be rejected.

Likewise, if one is guaranteed while the other isn't, it is at rates at which the firm or individual can confidently pay.

C. There Is No Taxation.

Taxes are neutral across equity or debt financing. So whichever method of financing is adopted, it's worthy to note that tax-deductible is the same.

Taxation is possible because debt interest is tax-deductible unlike when dividends on equity are not tax-deductible.

D. There Is No Transaction Cost In The Arbitrage Process.

Transaction costs in the course of buying and selling investment opportunities aren't considered in this approach.

E. There Is No Institutional Factors Against The Arbitrage Process.

The institutions involved are large corporations like Pension Funds, Life Assurance, Mortgage Banks, and Real Estate.

These institutions wouldn't want to adopt debt financing to fund their investment but rather mobilize their equity.

Smaller corporations who wish to fund their firms through debt financing find it difficult to do so as financial institutions wouldn't want to lend to them.

Conclusion

The capital structure is an aspect of financing that investors always considers before starting up a business.

There should be an appropriate weighing of the riskiness of the business and method of financing to avoid being thrown into a deadbeat.

Note: You must enter the tag #fintech among the first 4 tags for your post to be reviewed.