Bank Lending, Bank Financial Statements and Bank Assets (25% beneficiary set to Null)

Introduction

Link

Banks constitute the center point of modern finance systems. They're financial intermediaries and primary custodians of liquidity in any market-driven economy.

Their traditional and important functions involve; Deposit Collection and Lending. In every economic situation, there exists three major beneficiaries: Household, Firm, and Government.

These units interact with one another in which the surplus economic unit - Government and Firms pass their funds to the deficit economic unit - Household.

This process is known as financial disequilibrium. The banks then play the intermediation role by mobilizing these funds to various economic units.

Bank Lending

The doctrines of financial disequilibrium and intermediation imply the financial concept of borrowed and lending.

.png)

Link

Every bank relies on the amount of money it can mobilize from its customers in other to carry out its lending functions.

The challenge always facing banks is their ability to always ensure that deposits lent to other customers are fully recovered and paid.

Failure of the banks to fulfill their obligations can result in the eventual collapse of the bank and its activities therein.

Bank Lending Functions

The lending functions of a bank are very important for some reasons which are stated and explained below;

- Profitability Needs

- Customer Allocation and Retention

- Public Confidence

- Meet Legal Requirements

- Credit Needs of the Community

Profitability Needs

These banks are in the business of making enough profit for themselves to pay their shareholders. Lending out to customers is a major way of achieving this.

Loans constitute the highest-earning assets of these banks that are in the business of lending and it helps them to meet higher expectations.

Customer Allocation and Retention

Various customers patronize these banks based on the variety of wonderful and captivating services they tend to offer and advertise.

A bank that provides credit needs to their clients as at when due will attract and retain more customers than a bank that doesn't attend to the credit needs of its customers.

Public Confidence

This refers to the ability of banks to lend to customers as to when due is one of the criteria its customers use to judge the stability of a bank.

This builds their client's confidence in them as long as they come through when they should, especially in times of borrowing and lending.

Meet Legal Requirements

All legal obligations by banks are meant to be fulfilled as at when due. Any form of documentation required and lending rate as set by monetary authorities should be handled with absolute care.

Monetary authorities often stipulate the rate at which banks must extend credit to particular parts of the economy.

Credit Needs of the Community

When a bank gets into a serious financial crisis, the problem usually springs up from irrecoverable loans due to:

- Mismanagement

- Illegal manipulation of loans

- Misguided loan policies

- Unexpected economic downturn.

Although the lending function is principal, lending serves as a means of satisfying the legitimate needs of the community in which the bank resides.

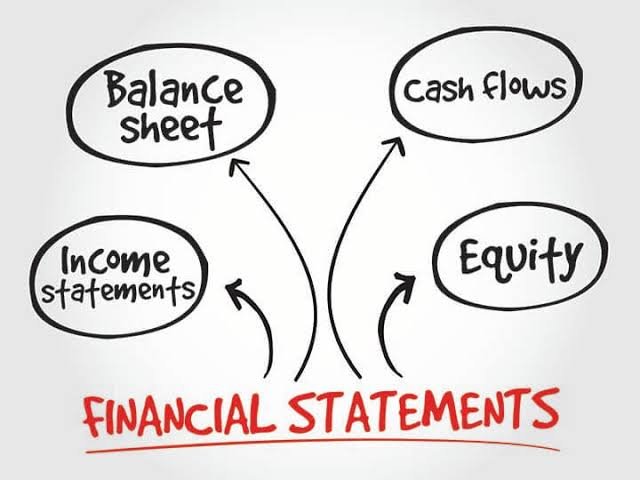

Bank Financial Statements

%20(8).jpeg)

Link

Bank Financial Statements is a formal record of the financial activities of the firm or a bank in a stipulated period.

The three main items that constitute a bank's financial statement in which bank managers, depositors, and shareholders are interested are.

1. Balance Sheet

2. Income statement

3. Funds Flow Statement

Nature of a Bank's Balance Sheet

It represents the summary of the assets, liabilities, and equity capital at any given date. This statement shows the sources of and various uses of funds.

The sources of funds are financial inputs from creditors and shareholders while its various uses of funds are financial outputs or assets.

The relationship between the three components of a bank's financial statements can be expressed in the following way;

Assets = Liabilities + Equity Capital

The published financial statement is usually represented in vertical format and four segments;

- Assets

- Liabilities

- Shareholders Funds

- Off-Balance Sheet items

%20(7).jpeg)

Link

A good understanding of the nature and composition of a bank's balance sheet is important to bank shareholders because it helps them access the performance and profitability of the bank.

What Constitutes the Assets of a Bank

%20(9).jpeg)

Link

Six major items constitute the assets of a bank and they include;

A. Cash Assets

These are cash and short-term funds of the bank. They include:

- Vault Cash

- Balances with the Central Bank of Nigeria.

- Balances with foreign correspondent banks

- Balances with banks in Nigeria or Abroad

- Cheques in the process of collection

These cash assets are idle funds and primary reserves since they don't earn any interest income for the bank.

Cash assets serve as the bank first line of defense against deposit withdrawals made by depositors or clients.

B. Investment Securities

Components of investment securities are;

- Short term securities

- Long term securities

- Trade securities

Short term securities include holdings of short-term government securities and privately issued money market securities such as; treasury bills and certificates, commercial papers, and banker's acceptances.

These instruments are the liquid assets of the bank. They serve as secondary reserves and are the second line of defense a bank fails to meet demands for cash.

Long-term securities are also known as Held to Maturity Securities. They include; Government bonds, and debentures of limited liability companies. They bring adequate yields to banks.

Trade securities are equity investments in publicly quoted firms, investing in banks' subsidiaries, etc. Banks receive the dividend on trade securities.

C. Loans and Advances

They constitute the largest item on a bank's balance sheet and account for ½ or ¾ of all bank's short and long-term assets.

They provide banks with most of their earnings and could cause the collapse of any bank if not fully recovered.

Loans and Advances are among the assets keenly monitored and regulated by the monetary authorities to guard against;

- Excessive lending

- Minimise losses and

- Ensure the safety of customer deposits.

One of the items on the loan and the advance list is Money-at-call. This item represents loans given out to other banks or discount houses daily.

This can be done directly through banks or the Central Bank of Nigeria and are payable on demand.

Money-at-call constitutes one of the liquid assets of the bank which can be easily converted into cash for usage when due.

D. Equipment on Lease

Banks sometimes acquire equipment under lease finance terms. The rental payment of the equipment the lease is to pay to the lessor (bank) also constitutes an asset to the bank.

E. Fixed Assets

%20(10).jpeg)

Link

Fixed assets are represented by buildings, plants, and equipment needed to carry on daily operations within the banking premises.

They're assets with a useful life span greater than one year accounting period. They form a small percentage of back assets and are among the most illiquid assets of the bank.

F. Other Assets

This is a general term used in describing assets that haven't been specifically classified under fixed assets headings.

They include Advance payments made by the bank. For instance:-

- Prepaid Insurance

- Accrued Income

- Deferred bad and doubtful balances.

Classification of Bank Assets

Bank Assets can be classified into major aspects:- Liquidity and Profitability

A. Based on Liquidity

Under this, we have liquid assets and illiquid assets.

Liquid assets are assets that can easily be converted to cash in a short amount of time. They're cash, money market instruments, and marketable securities.

Illiquid assets are assets that are difficult to sell because of their expense, lack of interested buyers, and many others. These assets are; real estate, a stock with low trading volumes, and collectibles.

B. Based on Profitability

Under this, we have earning assets and non-earning assets.

Earning assets are those assets that generate income or profit for the bank. They include loans and advances, investment in interest-bearing assets such as treasury bills and certificates, commercial papers, and so on.

non-earning assets are assets that don't earn any income for the bank but provide liquidity needs for the bank. They include all cash assets.

Conclusion

Bank lending, financial statements, and assets are elements of bank activities. Banks are held accountable for their actions through public opinion and as such, they can't afford to make unnecessary mistakes.