ZPER: Problems and Solutions #3, #4

Hello, this is team ZPER!

We are back with another session of problems we’d like to point out of the traditional financial system and solutions that ZPER can offer.

https://steemit.com/investment/@zper/zper-problems-and-solutions-1

https://steemit.com/investment/@zper/zper-problems-and-solutions-2

Check our the links above for our previous posts about this very topic for information about how ZPER came to be.

In this post, we will cover two problems and how ZPER tries to solve this flaw. It can be a difficult subject to follow but please have patience as we will try to put it into simpler terms!

Problem #3: Difficulties in Liquidating Investment Products

Compared to investment products that the existing financial institutions provide, such as deposit/installment saving, stocks and funds, This is because the loans, which are the basic assets of investment products, are due to be repaid on a fixed date. Of course, liquidation through injection of funds from new investors is still possible before such a due date. However, currently it is hard to anticipate such liquidations due to the lack of platforms where investment products are standardized for transactions. Consequently, such a problem is preventing investment funds from coming into P2P finance and the market from expanding.

ZPER’s Solution:

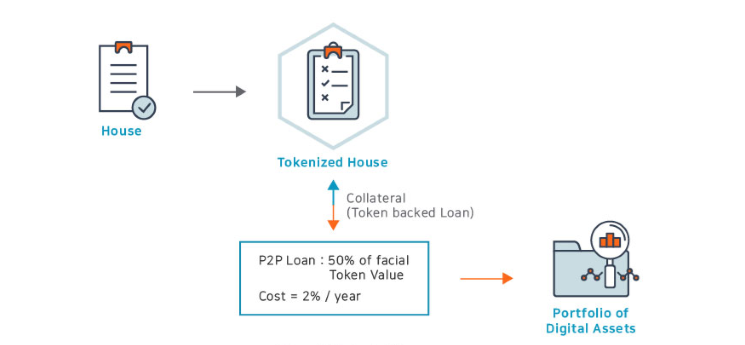

Securing Investment Flexibilities by Tokenizing Receivables for P2P Loans

In ZPER ecosystem, all loans will be made transformed into tokens (PLBT, P2P Loan Based Token). Investment products of each P2P finance companies will be delivered to investors in the forms of tokens, which will be linked to receivables that are the rights to the future cash flows generated from the loans concerned. Investors can freely dispose of the PLBT at issue, which will be traded at a price both parties have agreed upon. Furthermore, not only the content of the receivables but also all trade information and alteration of rights will be recorded in PLBT.

Problem #4: Difficulties in Utilizing Data for Innovative Credit Evaluation

In the course of matching loan applications of borrowers to the right investors, P2P finance companies are playing the role of reviewers who analyze credit risks of borrowers and collaterals to make safe investment. To thoroughly analyze and measure credit risks, alternative data on varied aspects of borrowers is critical. However, P2P finanace companies only have very limited access to such data as it is being collected and managed by centralized service platforms. This is acting as a huge obstacle to the development of the P2P finance industry, which is seeking new values that live up to the rapidly changing modern society through alternative data analysis and is also aiming to replace the existing financial institutions that maintain credit rating policies based on records of financial transactions or values of collaterals.

ZPER’s Solution:

Enhancing Utilization of Data through a Reasonable Compensation System

To enhance the reliability of data, a reasonable compensation system is applied in ZPER. Both data right holders and authenticators will receive reasonable compensation for providing data, in this way, we aim at expanding the scale scope of data neeed for innovative credit evaluation within ZPER ecosystem.

If the data provided are meaningful, even just a little, to innovative credit evaluation, the contributor will receive reasonable compensation (price) based on the level (scope) of consent and values of the data. The compensation can be given by anyone who participates in the ecosystem, e.g. ZPER, P2P finance companies or other data providers, who can receive such compensation.

So, here are the four problems that ZPER tried to solve from the traditional financial system. All of the information above can be found on our WHITEPAPER from our website, but we are trying to highlight their importance once again. These are the problems and difficulties that all of us must have experienced explicitly or implicitly oneday while we use the existing financial system. If ZPER did not show up to the scene, these problems might have endured much longer.

ZPER will try to become the right solution for all of these problems and create a decentralized financial platform in the blockchain network as we promised. We are working to create a safe and stable ecosystem through alliances with the verified Korean P2P lending companies and other diverse financial and blockchain enterprises.

You can follow our footsteps in this process through this blog and our other social networks! Please stay tuned for more.

Yours sincerely,

Team ZPER