Pending Bail-In

Disclosure: The opinions expressed here are my own and should not be considered as investment, financial, legal and any other type of advice due to possible fallacies.

The purpose of this article is to inform readers on what a bail-in means and how it may affects them in the next financial crisis if interest rates remain at their current level. For simplicity sake, this article will focus primarily on how a bail-in will affect the United States.

Bailout vs Bail-In

A bailout is an act of the government providing financial support to banks that are in distressed while bail-in results in financial institutions taking creditors and shareholders money in order to recover losses.

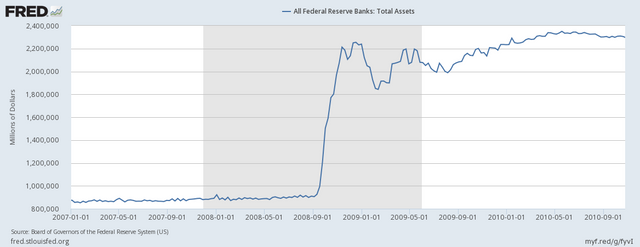

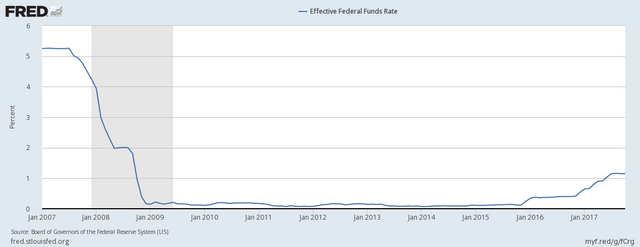

During the sub-prime mortgage crisis in 2008, the U.S. government had exhausted the former option of bailing out banks by using tax-payers money to fund quantitative easing. The charts below show the effects of quantitative easing on the Federal Reserve total assets and the causation of lower interest rates.

Interest rates went from 5.2% to ~.16%. The drastic change in interest rates help saved the economy by increasing the borrowing power which directly led to an increase in spending; however, this monetary policy cannot be used again due to interest rates only recovering to near 1.5% in September of 2017.

Last Resort: Bail-In

The FDIC and Bank of England released a joint document announcing their plan for providing stability for financial institutions in the future. Shown below is an excerpt from the document.

When a bank collapses, all of its assets will be used to satisfy secured debts (derivatives), before paying out the unsecured debts (deposits). The unsecured debt will be converted into equity to help cover the secured debts.

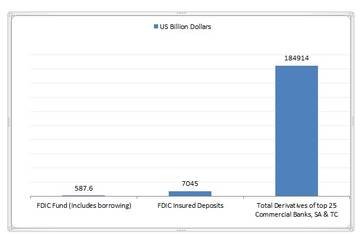

Creditors are the depositors that deposit cash in the bank; thus, they can be seen as loaning the bank money in order to receive minimal interests. These loans are considered unsecured debt because it’s not the bank that provides collateral, but the FDIC, a separate entity that guarantees depositors are insured up to 250k. However, the chart below shows that this responsibility is very difficult to manage with their current balance against the derivatives of banks that are too big to fail.

SA:Savings Association

TC: Trust Companies

Source:

https://www.fdic.gov/bank/statistical/stats/2017jun/fdic.pdf

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq217.pdf

https://www.fdic.gov/regulations/laws/rules/1000-1600.html

The FDIC deposit insurance fund current balance for 2017 is 87.6 billion dollars; however, it’s an independent government agency that has the backing of the government or technically the ability to borrow up to $100 billion dollars from the treasury. Stated within the 1000-Federal Deposit Insurance Act, from May 20, 2009 to December 31, 2010, it was possible for the FDIC to borrow, but not exceed 500 billion dollars. In the optimistic scenario, this extension would be allowed for the next financial crisis.

Depositors Protection

The FDIC fund covers less than 10% of the total insured deposits. Fortunately, the vast majority of Americans have a lot less than $250k saved in their savings account. According to GoBankingRates 2017 survey, 57% of Americans have less than $1000 in their savings account. By following this survey, a near best case scenario in which the average savings is tipped toward the lower income class can be shown below.

Near Best Case Scenario

Assuming every American citizen excluding children from 0 to 17, have an average of $1000 dollar in their savings account to counter balance between those who have less than <1000 and those with >>>1000.

2017, Americans excluding children =

(324.5 million – 73.8 million) =250.7 million

250.7 million x $1000=250.7 Billion Dollars

In the near best case scenario, with the assumption that the average American citizens have $1000 in their savings account, the FDIC fund is capable of insuring all depositors.

Unfortunately, an optimistic view does not provide as much value as a worst case scenario; nonetheless, speculation is a necessary tool to combat an uncontrollable environment. Future outcomes of the market are out of the general populace hands; however, how they choose to prepare and react—is very much within their own control.

Precautionary Measures

1