Rate Hikes and The Chopping Off of Presidential Legs

So let's talk about the magical world of interest rates...

Prime and WSJ

So to quickly break this down what this is and how it works with respect to banking...this is the standard upon which variable rates and fixed rate loans are based. (For example, home equity lines of credit rates are often determined by WSJ rate + variable component [ variable components typically vary based on FICO score Loan-to-Value ratio of collateral ] )

For example: John owns a house worth $100K. He owes $50K on his primary mortgage and takes out a Home Equity Line of Credit / Home Equity Flexline for $30K. Because John has an 820+ FICO score (which makes him almost immortal by comparison) and because his total Current Loan to Value is 80% ($80,000 in loans against the $100,000 property), John can expect his variable rate to be 3.99 (WSJ Prime Rate) + .25% which comes out to be 4.24%

Now that's a small example of how the WSJ Prime Rate affects a fictitious guy. Now imagine every loan, line of credit, etc. Bored? Stay with me!!!

The Fuck Does This Have to Do With Me?

THEY'RE SACKING THE GOD DAMN ECONOMY!!!! Okay so maybe it's a little less severe than that...but no, seriously, they're slowly BURNING US TO THE FUCKING GROUND. Period. WSJ Prime rates were kept at 3.25% for 6 years. December 2015 they raised it .25%, another .25% in December 2016 and another .25% in March 2017. And they're looking at doing it again in June of 2017.

Why were they kept low? The monetary policy theory is keep the banks getting low interest loans so they can loan that loot out dirt cheap to businesses to make them grow. Great in theory but as I'm about to show you, it aint fuckin' workin' no' mo'.

Where We Are

Short history lesson: after WW2 pretty much all of the other developed world has gotten their asses kicked. That means lots of people died, lots of land scorched and their factories bombed to oblivion. Since the U.S. pretty much avoided most of the conflict on their mainland we had a ton of women working in factories making bombs and weapons and all sorts of cool shit while the boys were out in Europe, Africa, the Pacific and Asia kicking some ass with em. When the boys got home, life was good. They had money in their pockets (because seriously as a soldier or marine kicking ass day in and day out, how much time do you have to spend money? You can only get so many stogies, hookers and such...) and jobs. Jobs where? In the manufacturing plants! We made shit for everybody in the world since they couldn't do it from their rubble piles they once called factories!

Fast forward to the 70's and you start to see the rest of the world rebuilt and making their own shit. So our factories start to leave, but we're still okay. Usher in the rise of the shopping malls and retail stores.

Fast forward to the 90's now you've got Slick Willy passing NAFTA so factories can relocate to Canada (or most commonly Mexico because it's wayyyy cheaper to use Mexican labor than higher paid U.S. workers) to build shit and roll it across the border to the U.S. to sell for the same prices. Some estimates are since 2000 we've lost 60,000 factories and at least 5 million manufacturing jobs. Why? NAFTA. The rise of China. Other slave labor markets and just more competitive economies.

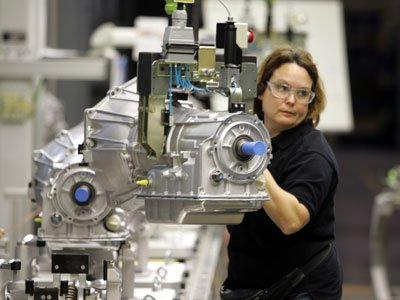

So our economy went from making shit:

To buying cheap shit made from somewhere else:

But now a bunch of those retail outlets are failing:

KMart, JC Penny, Rue 21, Sears, Macys, Bebe, Abercrombie and Fitch, etc. etc.

Why are they failing? People have to have jobs with good wages and less inflation in order to have excess money to buy shit. We're getting tapped out. Seriously. A couple making 90K in their late twenties paying $1300 a month in student loans, a $600 mortgage and servicing $8,000 in credit card debt is not buying a bunch of overpriced bull shit from Abercrombie & Fitch, just sayin'. It's not about the internet. It's not about saturation. We're broke. As Fuck.

To make matters worse, the way monetary policy is supposed to work is lower rates to stimulate the economy and raising rates to slow it down. As much as the Obama administration bullshitted its way through a miraculous recovery of 75,000,000,000,000,000 jobs they created (can you get the sarcasm here?) and doubled the size of the national debt in the process...the economy didn't really grow. In fact it's been puking all over itself like it huffed a violent cocktail of arsenic and viagra mojito shots. And just when the savage coughing of our poor COPD-affected economy might have had a minute to catch its breath....Janet Yellen (fed reserve chairman) raises the god damn rates multiple times.

This begs the question: does this mother fucker even know where the fuck she is on the time-space continuum?

My guess is probably yes. Raise the rates to kick the economy while it's down even further, then give political ammunition to throw at the incumbent president. That's all well and good, we all know a lot of good Trump bashers out there. But regardless of the politics, guess who gets sandbagged and their pockets picked while watching the show? You guessed it! The American middle and lower classes!

So we're all fucking fucked. It's a slow poisoning, but a poisoning no less. The government isn't going to save you. Jesus isn't going to save you (at least not from this economic calamity that's coming). Get out of debt, become more self-reliant and for the love of God learn useful skills!