Sirius XM Satellite Radio Great Stock Investment

When evaluating stock ideas I like to look at a number of factors to determine the attractiveness of investing in the stock. The primary factors are cash flow, financial strength, competitive advantage, growth of business and profit, and finally the price of the stock. With these factors in mind Sirius XM Satellite Radio (SIRI) is a great investment idea that I believe is poised to grow considerably over time. I have been following the company for many years and have invested in the stock in the past five years after the company combined with XM Satellite Radio.

The combination of Sirius Satellite Radio and XM Satellite Radio into Sirius XM Satellite Radio created a company that dominates the satellite radio market with market share over 90%. Before the combination both Sirius Satellite Radio and XM Satellite Radio struggled with profitability as the market proved to be too small for two individual companies. The combination gave the combined company enough subscribers to achieve profitability and also pricing power in the satellite radio market. In addition Sirius XM Satellite Radio is able to produce a very compelling product that has been able to keep subscribers and also steadily grow it's customer base every year. With satellite radio the costs of the business included substantial up front costs (cost of the satellites and sending them into orbit) and low recurring costs (cost of radio programming) so that once the up front costs are paid for the company generates significant recurring cash flow that is very stable and growing.

Looking at the financials of Sirius XM Satellite Radio you can see that the company has been able to grow both profits and more importantly operating cash flow over the years at a very good growth rate. In three years the cash flow of the company has grown over 30% as new subscribers and the revenue from them are pure profit. With new subscribers there is no additional cost to the company for having them added to the network as these customers simply get access to the radio that is broadcast regardless of the size of the listening audience. Sirius XM Satellite Radio has about 28 million subscribers and adds about 1.5 million a year which is growth of 5-7 percent. As this additional revenue is pure profit the company is able to growth profits and cash flow at a much faster rate. I expect the company to growth profit 15-20 percent a year.

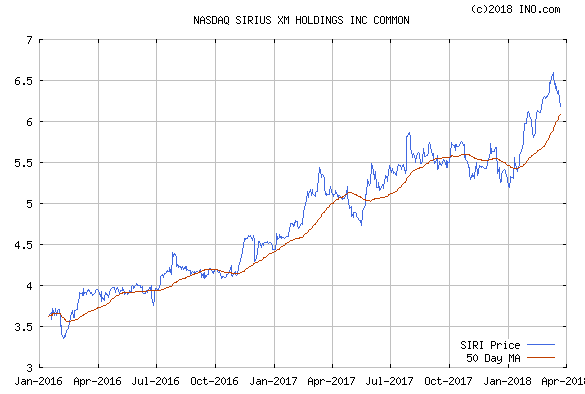

One great aspect of owning stock in Sirius XM Satellite Radio is the fact that John Malone, billionaire and the CEO of Liberty Media, is helping run Sirius as Liberty Media owns a considerable amount of the stock in Sirius XM Satellite Radio. Therefore the company is well managed and you can see that in the more aggressive tactics the company has undertaken in order to improve shareholder returns. The company's business and operating cash flow has proven very stable and resilient and therefore the company can afford to take on more leverage. With this in mind the company has borrowed money and used the proceeds to buy back and cancel shares. The company has also used much of its cash flow to buy back stock and also provided investors with a regular dividend. The considerable share buyback strategy has enabled the company to substantially reduce its share count and is a large reason the share price has appreciated from $3 to $6 in the last 5 years which is 20% growth per year. As the company's cash flow has increased it has used this to buy more shares on the market. Given the business does not require much investment to operate and grow it can use excess cash to eliminate shares.

The satellite radio business may not be a business with competition internally from many satellite radio operators though Sirius XM Satellite Radio faces competition from other entertainment sources like traditional radio, Pandora, and other technology like Apple Music and future entertainment innovation. This competitive threat exists so Sirius XM has to continue to improve its satellite radio services and as a user of the service I feel they have been able to create a great product that has much loyalty. The success of the company can be seen in the high amount of recurring subscriptions Sirius XM achieves showing that customers like the product and are willing to continue to pay for it every month or through annual subscription payments. The cost of satellite radio is around $10 a month so it's seen as an affordable luxury and it's business model is much like that of Netflix. As long as customers feel that the price of these services are relatively low and affordable they will continue paying for them. The business model of getting recurring revenue from a product or service is great and I feel much better than one-time product or service pricing offerings as the revenue gets paid all the time and often ends up being much greater over long periods of time.

The price of Sirius XM Satellite Radio shares are around $6 a share. Five years ago I loaded up on the shares around $3 and made some money on the shares though I had to sell them two years ago to buy my house in White Rock. So I missed out on the recent appreciation in the stock over the past two years, however, I feel the shares can continue appreciating. The market cap of the company is around $27 billion and the business generates around $2 billion a year which is growing 20% a year. So the cash flow yields a return at current prices of around 7% which is growing at a relatively fast rate of 20% a year. Most stocks trade at much higher prices and are not growing a near the rate of growth while facing much tougher levels of competition. It is for these reasons I think Sirius XM Satellite Radio is an attractive investment at current prices. I personally have started building up my position in the stock and I think for long term investors it offers compelling value.

Nyc

Yeah Sirius Satellite Radio trades in New York on the New York Stock Exchange under the stock ticker SIRI. I hope this answers your question.

You slydogg you, Lol.

Good stuff I agree it is a good investment for the long term, but I hope (SIRI) get's a nice pop soon, got some contracts on a Sep18 call and am looking where to go next.

Oil?

Any thoughts...