VIX calls issue warning

Hi friends!

VIX options are at it again! The calls are far more expensive than the puts.

For example, yesterday the VIX closed just below 10. The VIX June $10 calls – which expire on June 21 – closed at $2.10. The VIX June $10 puts are offered for just $0.10. (You can find these and other quotes at quotes.freerealtime.com.)

In other words, VIX option traders are willing to pay 21 times more to buy calls on the VIX than to buy puts. VIX option traders clearly expect the index to move higher as we approach June expiration. And a rising VIX (rising volatility) usually accompanies a falling stock market.

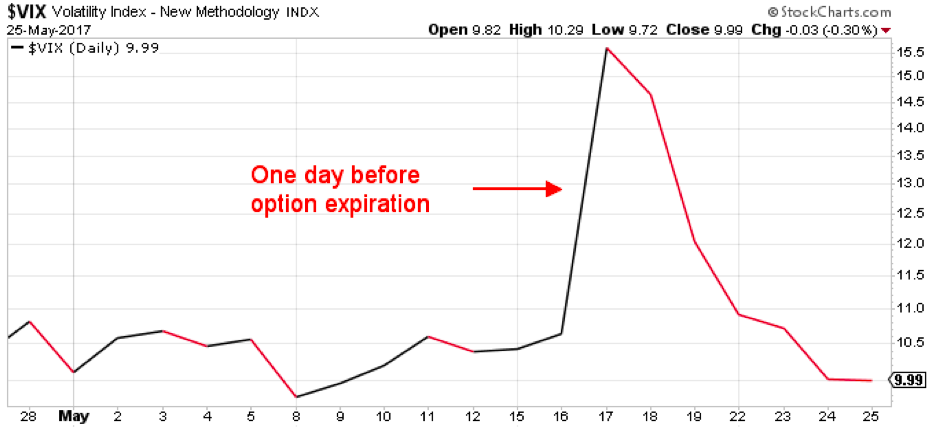

This happened just last month. Take a look:

The VIX call options that expired on May 17 were trading for a much higher price than the equivalent put options in April. Traders were willing to pay more than 10 times the price for VIX calls than for puts. The monthly VIX option contracts expired on May 17 (VIX option expiration is different than standardized option expiration). Here’s a chart of the VIX for the days surrounding expiration day.

The VIX did nothing between April 27 and May 15. Then, on May 16 – just one day before option expiration – the VIX exploded higher by 50%.

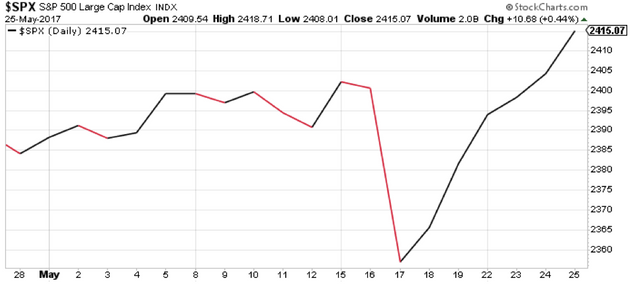

Here’s what happened to the S&P 500…

The stock market ground slowly higher between April 27 and May 15. Then we got a 43-point, one-day correction in the S&P.

Since then, the stock market has recovered everything it lost and then some. Even though the market can certainly press even higher from here, any short-term gains are likely to be given back in the weeks ahead.

(Thanks to Jeff Clark for this commentary.)

Bye for now!