How to Predict a FINANCIAL MARKET CRASH

Joseph Kennedy, the 1st chairman of the S.E.C and father of President John F. Kennedy said "when even shoeshine boys are giving you stock tips, it’s time to sell," and sell he did, right before the US market crash of 1929. Now Kennedy wasn't being disrespectful but was rather articulating the fact that the market was being "pumped" by hearsay down a chain reaction.

Before Kennedy passed away his net worth was estimated to be 180 million USD, equivalent to $3.14 billion USD today, so lets just assume he knew a thing or two about making money. He survived the 1929 crash "because he possessed a passion for facts, a complete lack of sentiment and a marvellous sense of timing" as noted in a Time Article "Essay: The Merits of Speculation."

Fast forward 90 years or so and things have not changed much, rather they have worsened. A shrill reminder of the complexity and disorientating nature of the blueprints of the modern financial markets are vividly displayed in the documentary Quants: The Alchemists of Wall Street. (Its a great watch, since Game of Thrones is also over, might as well watch something useful)

To understand the way our financial markets are run in the current day would require graduate level education in mathematics and computer science, which most of the general population do not possess. So how are we supposed to understand when a bull market will continue or when everything will come crashing down when a majority of stock market trades are performed by machines that were programmed to trade by the math wizards and computer geeks? WE CAN'T!

Taking a note from Kennedy's approach, we need to be able to understand the facts, and the biggest fact is that there are always hints of an impending crash. Now I'm not saying that we should sound the alarm bells however, we should be more in tune with what the facts are.

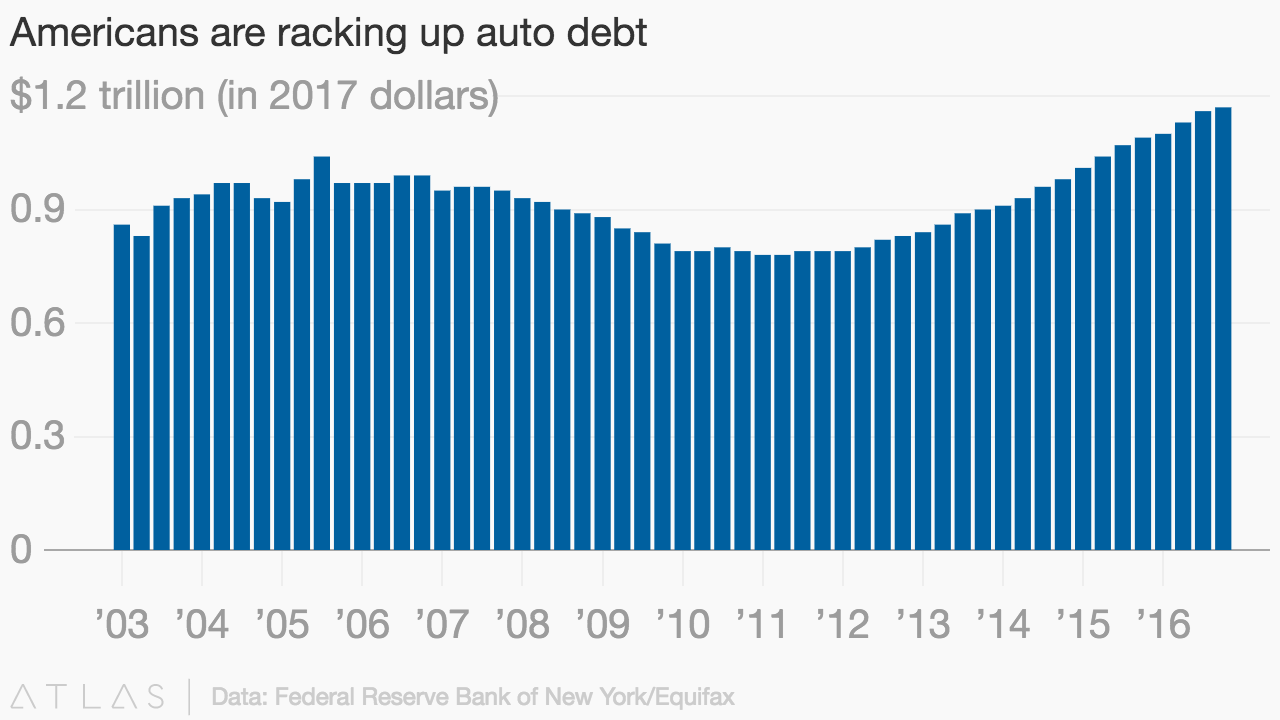

Looking back at 07/08, one of the biggest hints was the rise in defaults on subprime mortgage lending. 10 years later and subprime mortgage lending has been slowly decreasing, however auto debt has been steadily increasing and has been hitting new highs.

.png)

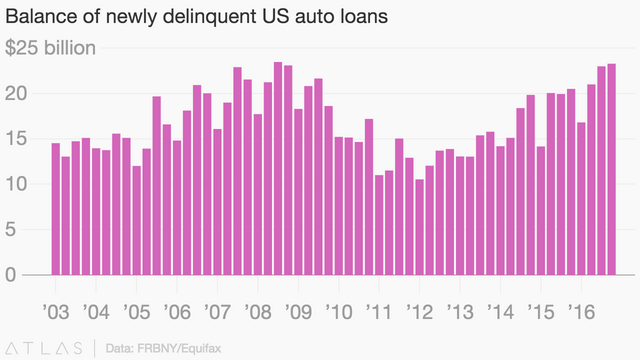

The real issue here though is that roughly 30% of all auto loans are subprime and more than 6 million American consumers are at least 90 days late on their car loan repayments, according to the Federal Reserve Bank of New York. This sparked my interest and it should spark your interest as well. As the economy licks its fresh wounds from the 07/08 fiasco we should not be quick to dismiss the gravitas of subprime lending in any manner.

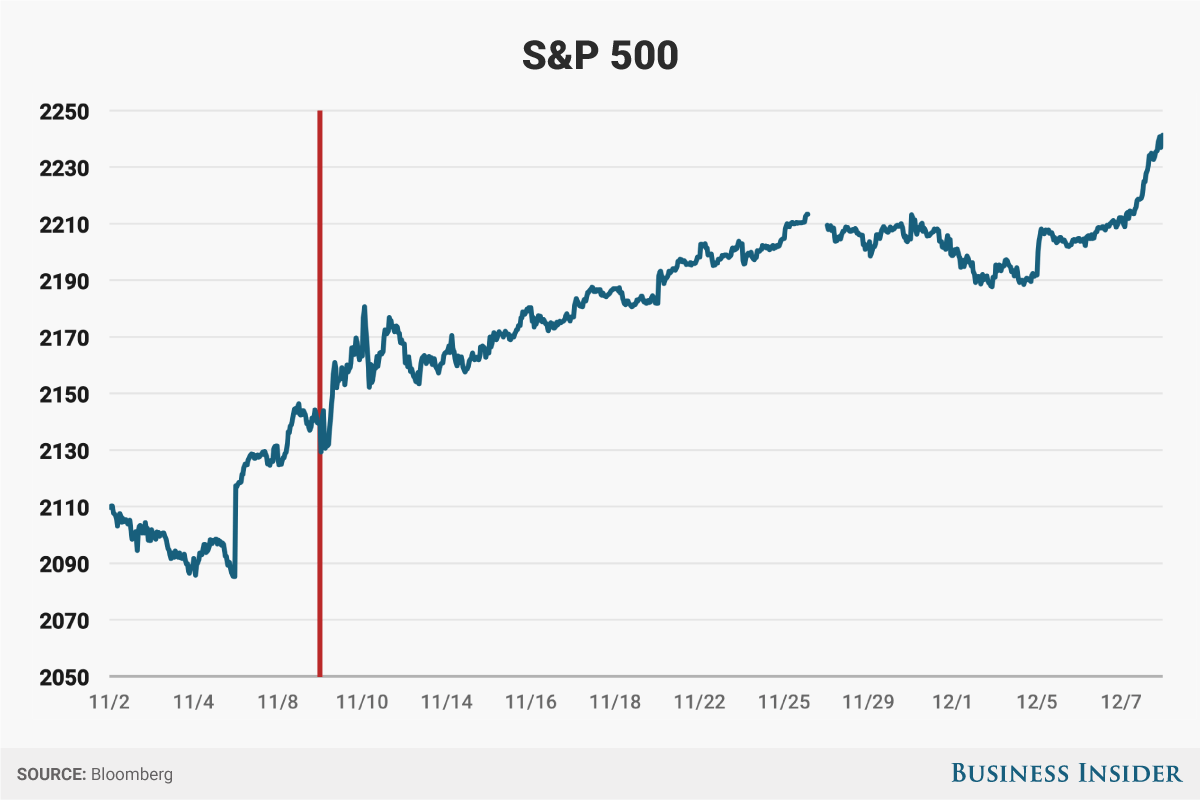

If you look back a few months to the US election and study the financial markets during President Trumps election campaign and first few months in office you can see that the S&P 500 did not show any signs of going down but rather increased and has been since Trump's election. Most of the momentum was from the promises Trump proposed such as lower corporate taxes, reduced legislation and creation of American Jobs, however, Trump has not been able to show much progress on any of these fronts. Granted, the political sewage his administration must muster through to get many of these complex acts/laws in place will take more than a few months. Trump was not effectively able to repeal the Affordable Care Act and replace it with a new one as promised (this should have been a slam-dunk for the Trump Administration) which shows me that Trump may not be able to deliver on the larger promises he has made which has been propping up the financial markets.

I'm not going to waste your time by talking about useless financial metrics and leverage ratios which anyone can look up to show the current health of our economy. The idea of this article was to push people to think twice about the world around them and to look at the macro environment of the financial/political market in which everyone can be the judge of where they think the financial markets are headed.

Your level lowered and you are now a Red Fish!

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes

Congratulations @jemerson! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!