Private Company Valuations Are Getting Absurd & With No Liquidity, There Is an Extreme Amount of Risk to Any Type of Market Downturn

We've all heard the news spouting out about private companies like Uber, Lyft, Slack, reaching the unicorn Club. What is a unicorn? It's a private company that is valued at more than $1 billion. This is a relatively new phenomenon as in the past many companies pushed to get to an Initial Public Offering (IPO). With 260 unicorns as of writing, 53 joining the club this year, it is quite clear that we are getting to the point where we ask are these valuations justified? With Uber going from $5.4 million valuation in 2010 to $68 billion in 2018 and still is yet to reach profitability. Fast-growing private companies are generally evaluated using price to sales (valuation/revenue) ratio. Because the companies are looking for growth and not aiming for profit generally, price to EBITDA or profits is not as applicable.

When you look back to the 1980's when Microsoft & Apple went public, they were going public for much smaller amounts in comparison to today and weren't incurring quarterly loss after quarterly loss.

Microsoft & Apple IPO's Adjusted for Inflation

Microsoft IPO (March 1986): $61 million ---> adjusted for inflation ---> ~$138.34 million

Apple IPO (December 1980): $1.778 billion (end of day) ---> adjusted ---> ~$5.37 billion

Apple had the largest IPO since Ford Motor Company in 1956 and instantly created 300 millionaires, with Apple's biggest shareholder, Steve Jobs, netting $217 million at the age of 25.

Fast forward thirty years or so and a dotcom boom later, more companies have opted to lengthen the time till they go public. For this reason, the unicorns have started popping up left and right. Also, you can't discount the role inflation plays in companies being valued at a billion dollars today versus a billion dollars in 1980 money.

Let's look at the difference in time between company founding too IPO. Apple was founded in April 1976 and went public 52 months later in December 1980. Microsoft was founded in April 1975 and went public 131 months later in March 1986. Although Microsoft took longer to go public, they were no where near a unicorn status, which would have to be adjusted for inflation, so unicorn status in 1986 in 2018 money would be ~$440 million before going public.

The grow big fast mentality really didn't set in till the dotcom bubble, we all know how that ended. Now Uber by no means is a dotcom company with no value, but at what point do they achieve profitability? Uber even stated it is a long way from proving it can be profitable. Running a net operating loss of $891 million, in the second quarter which is down from $1.1 billion net loss for Q2 2017. Didi Chuxing, the Chinese and second largest ride hailing service by valuation reported net losses in 2017 between $300-$400 million, while stating it is aiming to reach profitability in 2018. Uber is said to be looking into food delivery and freight hauling to seek new revenue streams. Where do you draw the line in the sand for Uber to reaching profitability? 15 years, 20 years, 25 years from founding?

Didi Chuxing is the result of China's attempt to keep foreign corporations out of it's country. China for years has not allowed U.S. companies like Google, Apple, and Uber products and services into the country. China has created a firewall and instead has created carbon copies of companies outside of their wall, promoting domestic growth.

The competition will only grow for these ride hailing services as large automakers like GM, create their own ride services. GM's Maven is a car sharing service, while it may not be a ride hailing service, this will definitely cut into revenue for ride hailing services.

Route to Liquidity for Unicorns

There are two routes two liquidity: Acquisition or IPO. For companies like Uber, Didi Chuxing, AirBnB, and others valued in the tens of billions of dollars, the acquisition is out of the picture, unless they are willing to cut their valuation down. And going public and getting their private valuation will be tough. Investors & analysts want to see profitability.

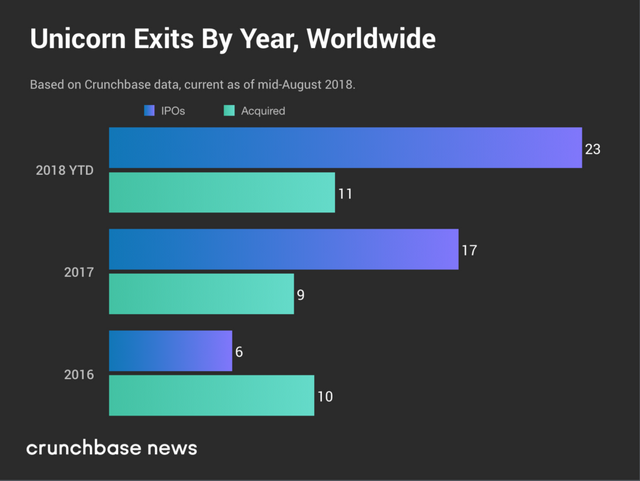

Then again, the market was willing to pay quite a hefty price for unicorns this year. Merger & acquisitions (M&A) of unicorns this year has hit 11 deals so far, including Walmart's purchase of Flipkart for $16 billion & Microsoft's $7.5 billion acquisition of GitHub. For now there is an appetite for large public companies like Walmart, Microsoft, Amazon, Google, etc. to keep consuming smaller companies to expand their reach into other sectors or improve processes. At some point though, these high private valuations won't be as tempting to them.

2018 has seen the highest amount of Unicorn IPOs, hitting 23 so far and we are only two-thirds done with the year. IPOs have been relatively quiet in previous years outside of the fabeled Snapchat (SNAP), which has still yet to come close to it's highest price at $29.44 on the IPO. We also saw Blue Apron (APRN) hit it's peak price on it's IPO at $11 and has been falling ever since it's July 2017 IPO and is currently around $2 or down over 80%. Is this a trend that will continue? Spotify did a direct listing on April third, and since has seen it's stock has risen roughly 20% from the IPO open of $165 to a peak of nearly $200. Spotify was in a situation where many employees and early investors will still stuck bag holding illiquid shares, so they did what was best for their employees, giving them a chance to capture some amazing gains.

I feel as we near the top of this market cycle, more and more of these unicorns will look to exit as being stuck in illiquid shares that get chopped down in valuation due to external factors such as a bear market, such as the ones currently seen in the emerging markets and the Chinese stock market right now. With Uber and AirBnB looking to go public in 2019, they may be to late to exit at the top of the market and may see severe valuation cuts once people realize the global economy is slowing down. In a market downturn, the appetite to be high valued, unprofitable companies will be tough, since they won't offer dividends, but instead growth, which tends to get hammered in bear markets, where we see investors flock to defense stocks.

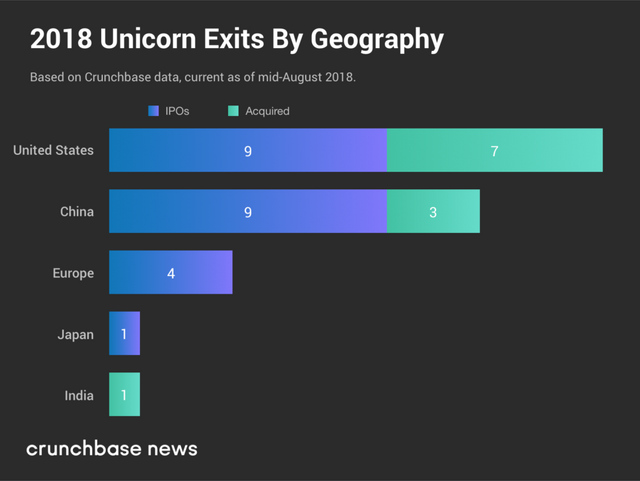

Unicorn Geography

The US and China dominate this taking most of the pie, with Europe having a small slice. It's no surprise that the world's two most economically powerful nations have created the most unicorns.

How does this Valuation Bubble End?

Unfortunately, over time the market rationalizes itself out and realizes that something isn't worth what it's supposed private valuation is. The bull market we are experiencing is the second longest in history and has been fueled by zero/negative interest rates, expansion of the FED balance sheet in the U.S., and share buy backs by companies to keep share price up.

When it all comes crashing down, these private companies won't be sheltered because they aren't listed publicly yet. They too will see valuations brought down to a fraction of what they were before, as the high price to sales ratio will be brought down, as investors will be seeking reasonable valuations, especially if a company is yet to turn a profit.

What are your guys thoughts on this looming valuation bubble? Tell me in the comments below!

If you liked this content, please upvote, comment, share, and resteem it!

Follow me @investoranalysis

Follow me on Twitter @Brett_Kotas to stay up to date with the market.

Follow me on Instagram @crypto_coitas to keep up to date on market.

Thanks!

Check out my website and my Contributor site, Influencive.

Disclaimer: The views expressed in this article are solely the author or analysts and do not represent the opinions of the author on whether to to buy, sell or hold shares of a particular cryptocurrency, cryptographic asset, stock or other investment vehicle. Individuals should understand the risks of trading and investing and consider consulting with a professional. Various factors can influence the opinion of the analyst as well as the cited material. Investors should conduct their own research independent of this article before purchasing any assets. Past performance is no guarantee of future price appreciation.