Debt Rattle July 18 2018 by Raúl Ilargi Meijer

Paul Gauguin Van Gogh painting sunflowers 1888

| - Russia Dumped Most/All Of Its US Treasury Holdings, Disappeared from List (WS) |

| - Japan, EU Sign Trade Deal To Eliminate Nearly All Tariffs (AP) |

| - Going, Going Gone For Australia's House Price Boom (R.) |

| - Australia's Expensive Real Estate Problem Remains A Dirty Little Secret (D.) |

| - Right Now, We Are In A New Cold War -- Stephen Cohen (Fox) |

| - Is President Trump A Traitor Because He Wants Peace With Russia? (PCR) |

| - A Walk On The Wild Side As Trump Meets Putin At Finland Station (Escobar) |

| - Trump Haters Don't Get the "Art of the Deal" (Jim Rickards) |

| - Twelve Ham Sandwiches with Russian Dressing (Kunstler) |

| - The EU's New Data Protection Rules Are Already Hurting Europeans (Mises) |

| - Dear Europe, Follow Ireland, Not France (Lacalle) |

| - Balding Out (Christopher Balding) |

Russia goes for gold.

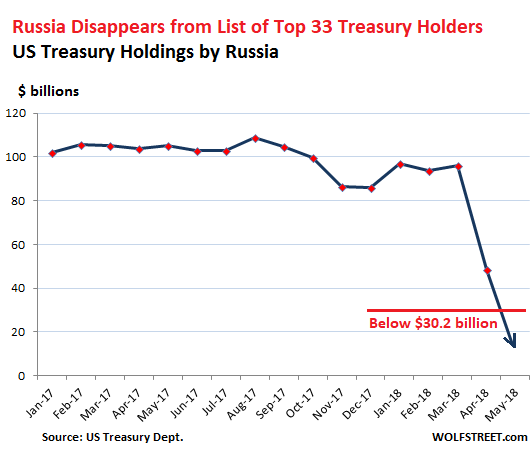

It's a good thing Russia never held as many US Treasury securities as China and Japan. The scenario would have been different. The "grand total" of US Treasury bonds, notes, and bills held by official foreign investors (central banks, governments, etc.) and non-official foreign investors rose by $44.6 billion to $6.17 trillion at the end of May, according to the Treasury Department's TIC data released Tuesday afternoon. This is in the middle of the range of the past 12 months. But Russia stands out by its sudden absence.

Russia was never a large holder of US Treasuries, compared to China and Japan. In March it was in 16th place with $96.1 billion in Treasury holdings. In April, it liquidated $47.4 billion of its holdings, and ended the month with $48.7 billion. That was down 69% from May 2013 ($153 billion). It knocked Russia into 22nd place behind the UAE and Thailand. And in May, Russia liquidated more of its holdings and disappeared entirely from the TIC's list of the 33 largest foreign holders of Treasuries. The smallest one on the list was Chile, with $30.2 billion. Russia's holdings must have fallen below that amount, and I can imagine to zero:

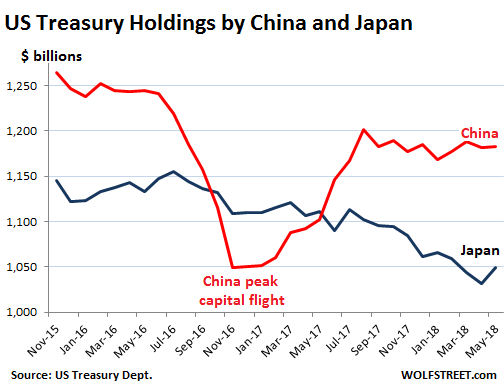

If there was a message in Russia's liquidation of US Treasuries, it was a pitch in the water: The 10-year Treasury sell-off that had started last September peaked with the 10-year yield at 3.11% on May 17. Since then, the 10-year Treasury has rallied under heavy demand, and the yield has fallen -- hence the handwringing about the inverted yield curve. The largest holder of US Treasuries is China, a position it had lost briefly during its era of peak capital-flight from October 2016 through March 2017. Its holdings in May ticked up by $1.2 billion to $1.183 trillion. Its holdings have remained within the same range since August 2017, despite escalating threats of a "trade war." Japan had been systematically reducing its Treasury holdings. In April its holdings had dropped to $1.031 trillion, the lowest since October 2011. But in May, it increased its holdings by $17.6 billion to $1.049 trillion:

99% of tariffs to be lifted.

The European Union and Japan signed a landmark deal on Tuesday that will eliminate nearly all tariffs on products they trade. The ambitious pact signed in Tokyo runs counter to President Donald Trump's moves to hike tariffs on imports from many U.S. trading partners. It covers a third of the global economy and markets of more than 600 million people. "The EU and Japan showed an undeterred determination to lead the world as flag-bearers for free trade," Abe said at a joint news conference with European Council President Donald Tusk and European Commission President Jean-Claude Juncker.

Tusk praised the deal as "the largest bilateral trade deal ever." He said the partnership is being strengthened in various other areas, including defense, climate change and human exchange, and is "sending a clear message" against protectionism. The leaders did not mention Trump by name, but they did little to mask what was on their minds --- highlighting how Europe and Japan have been pushed closer by Trump's actions. [..] The deal eliminates about 99 percent of the tariffs on Japanese goods sold to the EU. About 94 percent of the tariffs on European exports to Japan will be lifted, rising to 99 percent in the future. The difference reflects exceptions on such products as rice, which enjoys strong political protection from imports in Japan.

China's clampdown.

It's a winter weekend in Sydney's bustling northern suburb of Chatswood and a three-bedroom family house sporting an endless garden is up for auction. It's priced to sell at A$1.88 million ($1.4 million) but no buyers bite and the sale is abandoned. On the same day, in the heart of the harbor-hugging city a two-bedroom apartment with panoramic views fails to sell as no bidders turn up. Auctions are a bellwether of demand in property-obsessed Australia, where attending sales is almost a national pastime. It is therefore telling that only just over half were successful the weekend last month a Reuters reporter visited some of Sydney's auctions, compared to more than two-thirds for all of last year.

And while that week was the worst since 2012, it wasn't a one off. Auction clearance rates have averaged in the mid-to-low 50 percent range for each of the past nine weeks. The recent weakness in the Australian housing market, which has been one of the drivers of an economy that has now grown for 27 years without a downturn, has some economists warning of heightened risks of a recession and even a financial crisis. In anticipation, some hedge funds are shorting the nation's financial assets and some significant investors are heavily underweight Australia compared to regional benchmarks.

The slack has been partly engineered by the authorities. Curbs on lending to foreigners, foreign buyer taxes and a clampdown on capital flows by Beijing have hurt bubbling demand from Chinese investors, who have been important contributors to the housing boom of recent years. There are signs of a similar fall in Chinese investment in Vancouver, Canada -- which has also been a red hot market in recent years and where the authorities have also intervened by raising taxes on foreign buyers. But a decline in Vancouver's sales is yet to translate into price declines.

Laundromat.

Nobody knows how many billions of dollars in dirty money is pouring into Australia's housing market, but global authorities describe local real estate as a prime target for money laundering -- and you may have paid more for your house because of it. The likelihood of cashed up crooks increasing house prices is much greater than many people realise, given the hidden nature of the problem, a lack of regulation in the Australian real estate industry and the staggering sums involved. AMP chief economist Shane Oliver says criminals willing to pay extra to wash illicit funds have probably already had an impact on the high end of the housing market. "Even one transaction can have a huge effect that pulls the whole lot up."

Real estate agents say corrupt money can also influence average house prices, because criminals paying more than market value for one house are likely to encourage higher asking prices for similar properties in the same street. "To the extent that money laundering may well have played a role in making houses unaffordable to the average Australian, even if it's marginal, there's a case to investigate that," Mr Oliver says. Estimates vary, however an International Monetary Fund calculation converted to local currency shows up to $5 trillion in corrupt money -- more than three times Australia's GDP -- flowing into global financial systems last year. Only 0.2 per cent of the illegal transfers were likely to be seized or frozen, according to a UN report.

I know, I know, it's Fox and Tucker Carlson. But this is Stephen Cohen.

NYU Russian studies Professor Emeritus Stephen Cohen says President Trump had no choice but to meet with Putin, blasts 'pornography passing as analysis' in the news coverage of Trump.

"Russian weapons are so superior to the junk produced by the waste-filled US military/security complex that lives high off the hog on the insouciant American taxpayer that it is questionable if the US is even a second class military power."

The US Democratic Party is determined to take the world to thermo-nuclear war rather than to admit that Hillary Clinton lost the presidential election fair and square. The Democratic Party was totally corrupted by the Clinton Regime, and now it is totally insane. Leaders of the Democratic Party, such as Nancy Pelosi and Chuck Schumer, my former co-author in the New York Times, have responded in a non-Democratic way to the first step President Trump has taken to reduce the extremely dangerous tensions with Russia that the Clinton, George W. Bush, and Obama regimes created between the two superpowers.

Yes, Russia is a superpower. Russian weapons are so superior to the junk produced by the waste-filled US military/security complex that lives high off the hog on the insouciant American taxpayer that it is questionable if the US is even a second class military power. If the insane neoconservatives, such as Max Boot, William Kristol, and the rest of the neocon scum get their way, the US, the UK, and Europe will be a radioactive ruin for thousands of years.

House Democratic leader Nancy Pelosi (CA), Minority Leader of the US House of Representatives, declared that out of fear of some undefined retribution from Putin, a dossier on Trump perhaps, the President of the United States sold out the American people to Russia because he wants to make peace: "It begs the question, what does Vladimir Putin, what do the Russians have on Donald Trump---personally, politically and financially that he should behave in such a manner?" The "such a manner" Pelosi is speaking about is making peace instead of war.

"Russophobia is a 24/7 industry.."

"The Cold War is a thing of the past." By the time President Putin said as much during preliminary remarks at his joint press conference with President Trump in Helsinki, it was clear this would not stand. Not after so much investment by American conservatives in Cold War 2.0. Russophobia is a 24/7 industry, and all concerned, including its media vassals, remain absolutely livid with the "disgraceful" Trump-Putin presser. Trump has "colluded with Russia." How could the President of the United States promote "moral equivalence" with a "world-class thug"? Multiple opportunities for apoplectic outrage were in order. Trump: "Our relationship has never been worse than it is now. However, that changed. As of about four hours ago."

Putin: "The United States could be more decisive in nudging Ukrainian leadership." Trump: "There was no collusion... I beat Hillary Clinton easily." Putin: "We should be guided by facts. Can you name a single fact that would definitively prove collusion? This is nonsense." Then, the clincher: the Russian president calls [Special Counsel] Robert Mueller's 'bluff', offering to interrogate the Russians indicted for alleged election meddling in the US if Mueller makes an official request to Moscow. But in exchange, Russia would expect the US to question Americans on whether Moscow should face charges for illegal actions. Trump hits it out of the park when asked whether he believes US intelligence, which concluded that Russia did meddle in the election, or Putin, who strongly denies it. "President Putin says it's not Russia. I don't see any reason why it would be."

How it works.

I'm continually amazed at the legions of politicos, pundits and so-called "experts" who don't understand President Trump or how he conducts policy. These elites have a mental model of how a president is supposed to behave and how the policymaking process is supposed to be carried out. Obviously, Trump does not fit their model. Instead of trying to grasp the model that Trump does use, they continually berate and disparage Trump for not living up to their expectations. A more thoughtful group would say, "Well, he's different, so why don't we try to understand the differences and analyze the new model?" Really, these people need to get out of Washington, New York and Hollywood more and get away from their screens.

If they knew more everyday Americans, they would come a lot closer to understanding how Trump gets things done. It's not chaos; it's just a little different and more down to earth. This is because of Trump's "art of the deal" style described in his best-selling book by that name. Bush 43 and Obama were totally process-driven. You could see events coming a mile away as they wound their way through the West Wing and Capitol Hill deliberative processes. All you had to do was understand the process and you could forecast big developments in a relatively straightforward way. With Trump, there is a process, but it does not adhere to a timeline or existing template. Trump seems to be the only process participant most of the time.

Here's the Trump process: 1) Identify a big goal (tax cuts, balanced trade, the wall, etc.). 2) Identify your leverage points versus anyone who stands in your way (elections, tariffs, jobs, etc.). 3) Announce some extreme threat against your opponent that uses your leverage. 4) If the opponent backs down, mitigate the threat, declare victory and go home with a win. 5) If the opponent fires back, double down. If Trump declares tariffs on $50 billion of good from China,and China shoots back with tariffs on $50 billion of goods from the U.S., Trump doubles down with tariffs on $100 billion of goods, etc. Trump will keep escalating until he wins. 6) Eventually, the escalation process can lead to negotiations with at least the perception of a victory for Trump (North Korea) --- even if the victory is more visual than real.

"..the entire exercise is a joke and a fraud.."

After two years of Trump-inspired hysteria, it's pretty obvious what went on in the bungled Obama-Hillary power handoff of 2016 and afterward: the indictable shenanigans of candidate Hillary and her captive DNC prompted a campaign of agit-prop by the US Intel "community" to gaslight the public with a Russian meddling story that morphed uncontrollably into a crusade to make it impossible for Mr. Trump to govern. And what's followed for many months is an equally bungled effort to conceal, deceive, and confuse the issues in the case by Democratic Party partisans still in high places. It was very likely begun with the tacit knowledge of President Obama, though he remained protected by a shield of plausible deniability.

And it was carried out by high-ranking officials who turned out to be shockingly unprofessional, and whose activities have been disclosed through an electronic data evidence trail. Mr. Trump's visit to confer with Russian President Putin in Helsinki seems to have provoked a kind of last-gasp effort to keep the increasingly idiotic Russian election meddling story alive --- with Robert Mueller's ballyhooed indictment of twelve "Russian intel agents" alleged to have "hacked" emails and computer files of the DNC and Hillary's campaign chairman John Podesta. The gaping holes in that part of the tale have long been unearthed so I'll summarize as briefly as possible:

1) the bandwidth required to transfer the files has been proven to be greater than an internet hack might have conceivably managed in the time allowed and points rather to a direct download into a flash drive device. 2) the DNC computer hard drives, said to be the source of the alleged hacking, disappeared while in the custody of the US Intel Community (including the FBI). 3) the authenticity of the purloined emails by Mr. Podesta and others has never been disputed, and they revealed a lot of potentially criminal behavior by them. 4) Mr. Mueller must know he will never get twelve Russian intel agents into a US courtroom, so the entire exercise is a joke and a fraud. In effect, he's indicted twelve ham sandwiches with Russian dressing.

When anti-spam leads to more spam.

It's finally over: the flood of e-mails that every single human being who possesses an inbox has received in the last few weeks thanks to the new data protection rules by the EU. These rules, called GDPR, have caused havoc even before becoming effective on May 25, and have probably caused the greatest spam wave of all time -- all in the name of fighting against spam of course. The GDPR rules were designed to protect European consumers from data violations by big tech companies (Brussels thinks that Facebook, Google and Co. are abusing the rights of its people), and include -- just as a best of -- a "right to be forgotten" (meaning that Europeans can ask companies to delete all their data), "consent" (meaning that the data being processed by a company has to be consented to by the individual -- though what "consent" means is still disputed), an obligation to hire a data protection officer if you are a bigger company, and above all else, hefty fines for infringements.

Those infringements shall "be subject to administrative fines up to €20,000,000, or in the case of an undertaking, up to 4 percent of the total worldwide annual turnover of the preceding financial year, whichever is higher." What has been the result of these data protection rules after a little over a month? Summing it up in one word would probably be: chaos. As the trillions of e-mails that were sent around the globe showed, no one really understands what the rules are all about -- or what to do about it.

On the day the rules came into effect, several US pages panickingly switched off their platforms in EU countries, among them the Los Angeles Times, the Chicago Tribune, New York Daily News, and Orlando Sentinel. But not only newspapers have blocked Europeans ever since: the list also includesShoes.com,Instapaper, and the History Channel. Meanwhile, ad companies, being hit the most by the new rules, have pulled out of the EU altogether, including Drawbridge and Verve , citing the GDPR as the reason that they can't continue their business on the Continent anymore. Those staying have had to incur gigantic costs: British companies have reportedly sunk 1.1 billion dollars, and Americans 7.8 billion in preparation for GDPR.

There's always some miracle nation in the EU.

Whenever we talk about tax cuts and growth-oriented tax programs in Europe, many tell us that it is not possible and that the European Union does not allow it. However, it is false. Attractive, growth-oriented tax systems are not only possible in the European Union, but those countries that implement them have higher economic growth rates, less unemployment, and a first-class welfare state. To deceive us, we are forced to ignore Ireland, The Netherlands or Luxembourg as well as most of the technology and job creation leaders. Lower taxes and greater liberalization than in the rest of the Eurozone means higher growth, better wealth and greater social welfare. The economic miracle of Ireland is not statism.

Its secret is to put budgetary stability, investment attraction, private initiative and maximize disposable income of citizens as the pillars of its economic policy. Ireland has a corporate tax of 12.5% and a rate of 6.25% on income from patents and intellectual property, a key factor to attract technology companies. Its minimum salary is almost double that of Spain, Portugal and other Eurozone countries, the average pension is higher as well and its health and education systems are of the highest quality, with nine universities among the best in the world according to the Best Global Universities Ranking 2018. Ireland's debt to GDP is 73%, unemployment is 5.1% (youth unemployment at 11.4%), public deficit is just 0.7% of GDP.

Only a few years ago, Ireland was close to the edge financially, and its 10-year bond yield rose to 14%. Ireland was considered one of the highest risk of default countries with Spain, Portugal, Greece or Italy. Since then, low taxes, budget control and reforms oriented at attracting capital have made Ireland become the fastest-growing European economy, with an unemployment rate that is less than half that of Spain, for example. Deficits have been slashed, debt is under control, the economy is expected to grow 5.1% in 2018, and the economy is expected to reach full employment in 2019.

Economist Christopher Balding is leaving China after 9 years. Great farewell.

One of my biggest fears living in China has always been that I would be detained. Though I happily pointed out the absurdity of the rapidly encroaching authoritarianism, a fact which continues to elude so many experts not living in China, I tried to make sure I knew where the line was and did not cross it. There is a profound sense of relief to be leaving safely knowing others, Chinese or foreigners, who have had significantly greater difficulties than myself. There are many cases which resulted in significantly more problems for them. I know I am blessed to make it out.

I leave China profoundly worried about the future of China and US China relations. Most attention here has focused on the Thucydides Trap where conflict results from an established and a rising power. This leaves out probably the most important variable not just the distinction between an established and a rising power but the values inherent within each state and the system they want to project defining relations between states and the citizenry to the state.

The United States under Trump and the GOP is facing a significant test and re-evaluation of its principles. However, I remain decidedly confident in the US to handle those tests. The self correction nature of democracy is on clear display. The best case scenario for the Trump administration is to minimize congressional losses with the very real possibility of losing control of the house. President Trump has lost more in the courts than he has won and is under investigations by law enforcement headed by registered Republicans. His own party has been unable to pass consequential legislation except for a tax cut. While none of this confronts the international challenges facing the United States, it speaks to the evolutionary, self corrective nature of US democracy.