Breaking Free of Financial Bondage

https://hubpages.com/business/The-Basic-Business-Model

Introduction

This is an article I did a while back. I wanted to update it and leave it up, because there were some good tips and money saving ideas on here. Financial bondage is a real thing. Whether you believe in Jesus or have any other belief system, we can all agree that money, specifically debt, can bind you and cripple you from living any type of productive life. I have learned a lot about finances over the years, and most of it was the hard way. I can tell you one thing for sure, it is all about mindset. If your mindset is not right about being financially free, then you won't be free. If you do have your mind right, it still may be a long and hard process, depending on how deep you went before you got right. Either way, I pray for your financial freedom and success.

Personal Finances: Income and Expense

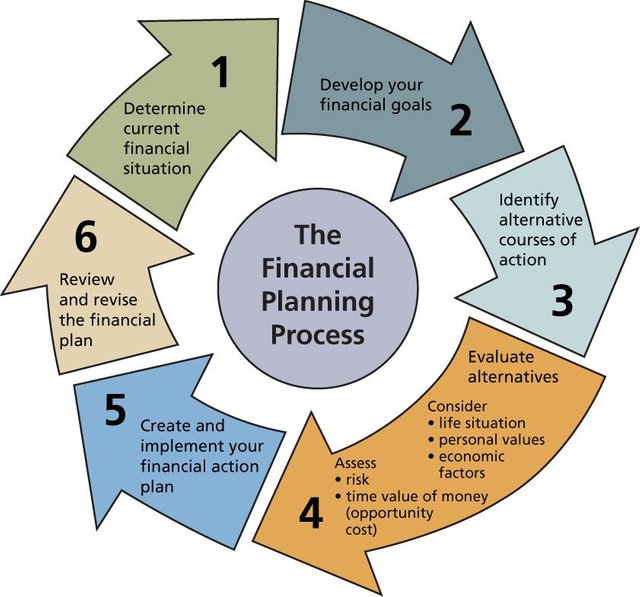

The basic business model is a practical, common sense approach to handling your finances. This approach is not exclusive to a business. Government and personal finance could benefit greatly from this approach. This article is intended for those individuals that could use a little financial freedom in their personal lives.

Lets begin with income. Income is the most vital aspect of any financial planning. You must first identify what your stable or average income is for your household. For example, if an individual makes overtime the overtime needs to be excluded. With the economy in a down state, overtime may come and go. It is when we depend on it that it seems to go away. Make overtime extra not the staple. I originally wrote this article a couple of years ago, and the previous statement is still true. Don't depend on what is not guaranteed. Use the overtime to start your emergency fund and your debt snowball, but don't count it as something you expect. If you are in a position that your budget doesn't balance without it, then I suggest you work as much as you can for a set period of time, and put all you can on the bills to get them below that threshold. We will discuss more about lowering bills later.

Once you have a solid idea of what your income is then you can begin your budget. If you don't take away anything from this article let it be this: keep your cost of living below your income. Seems like common sense, but the government has failed to do this for years, and more businesses than you can imagine fail to do this. They wouldn't have the term "living above your means" if no one did it. Don't be ashamed or embarrassed if this is you, just fix it. Add up all your bills and other expenses. Prayerfully, it is lower than your income. If it is not, then you are going to have to make some hard choices, and sacrifices. Millions of Americans are living above their means, and unfortunately this will catch up with them. We see this in the rising number of forclosures and bankruptcies, and in broken marriages.

Balancing your budget may be a painful process, but can be fairly easy. You have to know what you have going out. We already identified income, so now for the outgo. If you had a leak in your boat you would want to know where it was so you could stop it. Otherwise you wouldn't be able to pale out the water fast enough. Get the idea? Regardless of the institution, the only way to balance the budget is reducing costs and/or increasing income. Start by reducing costs. You do not have to go off the deep end here. Small cuts can make a big difference. The worse the situation, the deeper the cuts. There are many philosophies on this, but I suggest starting by reduction rather than elimination. reduce the cost of your cable bill rather than cutting off the cable. Cut eating out from 2 meals a week to 1 meal. it will be a lot easier to accept the changes if they are not drastic. From my personal experience, as you move towards financial freedom you will be more willing to make cuts because you see freedom as a reality.

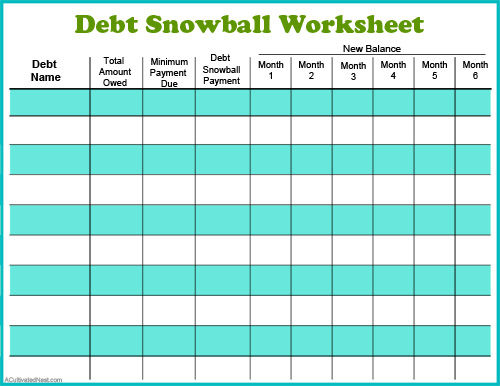

Debt Snowball Sheet

Cost Saving Examples

Below are a few cost saving tips that I have personally used:

Do you have all the premium channels on your cable? If so downgrading service can save you a good amount per month without actually having to give it up altogether. if you think you have the cheapest service, call anyway. They may have a new customer special. Tell them you want it or change services. Fight for your money. You need it, right?

Do you leave lights on in rooms no one is using? Paying attention to this small detail can make a significant impact on your electric bill. Increasing/decreasing the thermostat temperature a couple of degrees will also help without having to sacrifice comfort. Heating/cooling, washer/dryer, water heater, and oven are the main users of electricity in a house. What can you do to reduce their consumption? Wash clothes less often. Use cold water instead of hot. Most electric companies offer energy saving tips on their website. I have found them to be helpful.

Gas prices are dropping, but this is still a major cost for most people. If you have more than one car use the one that gets better MPG for the majority of your outings. Also, the family member that drives the furthest to work should drive the car with better MPG. Don't get wrapped up in the his car/her car thing. Be smart and practical. Gas costs over the course of a month can sneak up on you. Identify the hole in the boat and plug it.

Conclusion

There is no chance of one article covering everything about finances. I wish it were that easy. I wanted to put this out there for the people that are like I used to be. I didn't know where to start, or what to focus on first. I don't want to plug anyone specific or endorse anyone, but I can tell you that Dave Ramsey has some great resources available, and his methods have been proven successful over many years. Start your search with "debt snowball" and "emergency fund". Those are the first two steps of any financial freedom plan. They will start you on the path. I want you to know one thing: there is hope. Whatever your situation is you can rebound from it. I don't promise it will be pretty, but you can do it. Research, ask for advice from people that have their finances together, and rely on Jesus. I hope this article has been helpful. I pray for all of you, and that the Lord blesses you with abundance.

Hey there! By dividing the purchase price into convenient parts, users can manage their finances conveniently, which is why many use the Affirm app. This application makes it easy to buy expensive goods without paying all the money at once, which is very popular with many buyers. Problems with using the application almost never happen, but if this happens, the user just needs to contact affirm and the support service will provide qualified assistance.