Understanding the Difference Between Bonds and Stocks

Investing can be frightening, particularly when you see words like “bonds” and “stocks.” Making wise judgments requires knowing the differences between these two investment vehicles, which are fundamental components of the financial industry. Let’s put it in plain language.

What Are Bonds?

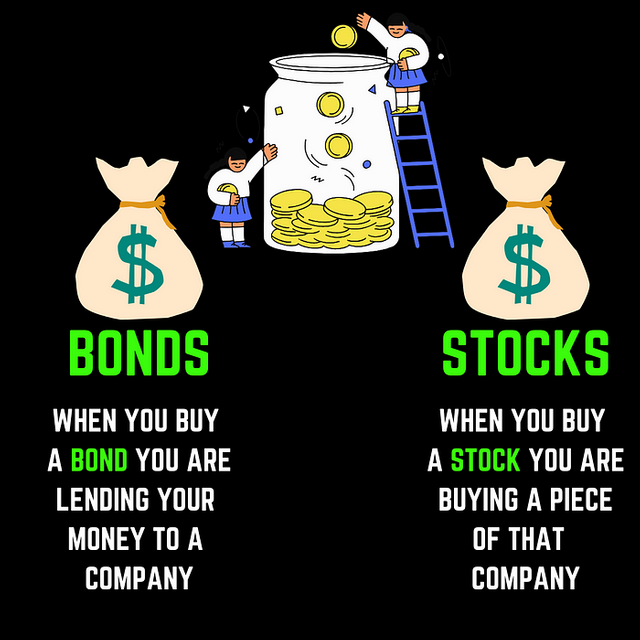

When you purchase a bond, you are essentially lending money to a corporation, the government, or another institution. In exchange, they guarantee to repay you the principle amount you deposited, plus interest, over a predetermined period. Consider it like granting someone a loan — they utilize your money for their needs while paying you interest for the privilege.

Here’s how it works:

- Issuer: The organization borrowing your money (like a company or government).

- Principal: The amount you lend them.

- Interest (Coupon Rate): The regular payments you receive, typically annually or semi-annually.

- Maturity Date: The date when the bond issuer repays the principal.

For example, suppose you purchase a $1,000 bond from a corporation with a 5% annual interest rate and a 10-year maturity. Every year, you will earn $50 in interest, and after ten years, the corporation will repay your $1,000.

Why invest in bonds?

- Stable income: Bonds are a relatively safe investment, providing regular interest payments.

- Lower risk: Compared to stocks, bonds are less volatile and are often considered safer, especially government bonds.

- Diverse options: From corporate bonds to municipal bonds, there are plenty of choices depending on your risk tolerance and goals.

What Are Stocks?

When you acquire stock, you are acquiring a share of ownership in a corporation. This means you become a shareholder, with your investment representing a claim to the company’s profits and assets. Stocks are also called “equities.”

Here’s what happens:

- Ownership: By owning a stock, you become a part-owner of the company.

- Dividends: Some companies share their profits with shareholders through dividend payments.

- Capital Gains: If the stock’s price increases, you can sell it for a profit.

For example, suppose you acquire 10 shares of a company’s stock at $50 each. If the company does well and the stock price climbs to $70 per share, you can sell your shares for $700, netting a $200 profit.

Why invest in stocks?

- Higher returns: Stocks have the potential for significant growth over time, outpacing bonds.

- Ownership benefits: As a shareholder, you benefit directly from the company’s success.

- Liquidity: Stocks are easier to buy and sell compared to many other investments.

Key Differences Between Bonds and Stocks

Ownership vs. Lending:

- Bonds: You lend your money to the issuer and earn interest.

- Stocks: You own a piece of the company and share in its success or failure.

Risk Level:

- Bonds: Generally safer, especially government bonds. However, corporate bonds can carry higher risks.

- Stocks: More volatile, with higher potential returns but also greater risk.

Returns:

- Bonds: Fixed income through interest payments.

- Stocks: Variable income through dividends and capital gains.

Priority:

- Bonds: Bondholders are paid before shareholders in case the company goes bankrupt.

- Stocks: Shareholders are last in line and may lose their investment if the company fails.

Investment Goals:

- Bonds: Ideal for conservative investors looking for steady income and lower risk.

- Stocks: Better for those seeking higher returns and willing to take on more risk.

Which One Should You Choose?

The decision between bonds and stocks is based on your financial objectives, risk tolerance, and time horizon. This is a quick guide:

- If you want stability: Bonds are a safer bet, offering predictable returns and lower risk.

- If you want growth: Stocks can provide higher returns over the long term but come with increased volatility.

- If you’re near retirement: Bonds can offer a steady income stream and protect your savings.

- If you’re young and starting out: Stocks may be a better option for building wealth over time.

Can You Invest in Both?

Yes! In reality, many investors employ a combination of bonds and equities to balance their portfolios. This method, called as diversification, helps to spread risk while increasing possible profits. For example:

- Young investors: Might have a portfolio with 80% stocks and 20% bonds.

- Retirees: May prefer a more conservative mix, such as 40% stocks and 60% bonds.

Conclusion

Bonds and stocks serve different objectives, yet both are crucial in the world of investment. Bonds provide stability and predictable income, whereas stocks bring growth and the excitement of ownership. Understanding these distinctions allows you to make better decisions and build a portfolio that corresponds with your financial objectives. Remember that investing is a journey; take the time to learn and make the best choices for you!