4 Main Yield Farming Risks, And Ways To Avoid Them

Yield farming is a strategy in which users allocate their funds in a DeFi protocol and get some extra tokens as a reward. The first platform to introduce yield farming was Compound, and after DeFi skyrocketed in 2020, the strategy remains popular to date. Yield farming has become one of the drivers behind the growth of DeFi as it offered users unprecedented returns that could be accessed in a permissionless way, i.e. by everyone with an internet connection.

Yield farming is very alluring, but there are some risks associated with it. In this article, we will explore them, and you will learn how to stay safe in the yield farming sphere.

How does yield farming work?

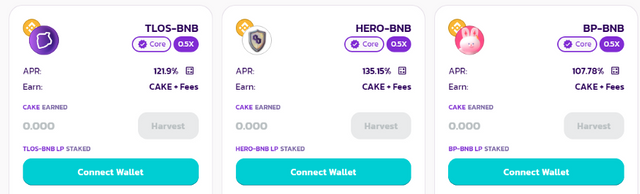

The main idea of yield farming is that you do the good for the community and it rewards you in return. One of the main strategies is providing liquidity to liquidity pools on decentralized exchanges like PancakeSwap.

These pools allow DeFi users to swap between different tokens. For making this possible, you get a share from all the swaps processed in a pool and some extra CAKE tokens as a reward. APR on PancakeSwap can reach hundreds of percent, but this number constantly changes as the tokens’ prices are very volatile, so your income isn’t guaranteed.

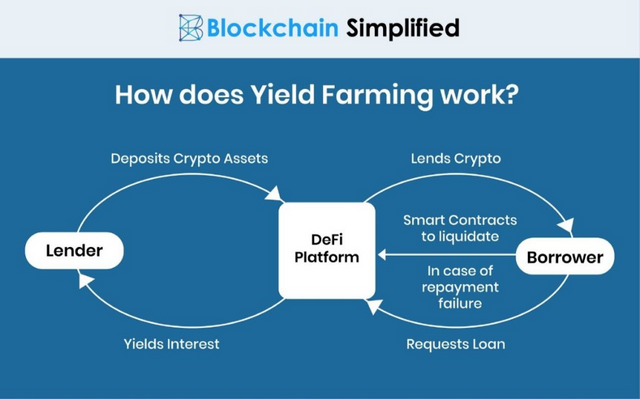

Other DeFi platforms such as borrowing and lending services also enable yield farming. For instance, Compound and Maker reward you for allocating money in these protocols, and the money further serves as loans for other users. This is basically the same liquidity provision, but the funds are used as collateral for loans rather than pool-locked tokens. For your assistance, these protocols reward you with COMP and MKR tokens, respectively. You can sell or reinvest these earnings to maximize your return.

4 critical risks of yield farming — and ways to avoid them

Token price drops

This type of risk is not specific to yield farming — it’s inherent to the entire crypto market. However, if we consider mastodons like Bitcoin or Ethereum, we know that they may drop in price dramatically, but we also know that they have long-term value, and soon or less, they are likely to recover.

When we invest in liquidity pools of small tokens in search of the best APR, we may forget that these tokens may not have real value and a roadmap, and they are likely to dump. Do profound research and invest only in projects whose teams you fully trust.

Impermanent Loss

One of the DeFi strategies is providing liquidity into pools where users swap their tokens. You get rewarded for this activity, but there’s a risk of impermanent loss. Let’s see how this works.

Liquidity pools where users allocate their funds are functioning on decentralized exchanges like Uniswap (Ethereum-based) or PancakeSwap (BSC-based). These exchanges don’t have order books like their centralized counterparts. Rather, prices in DEXes are formed not following the BUY and SELL orders’ balance in an order book, but based on the balance of tokens in liquidity pools, which is shaped algorithmically. This is called the Automated Market Maker (AMM) model.

So the price formation mechanisms in CEXes and DEXes vary, and the price of the same assets across them may be different. For instance, 1 ETH that you hold in your wallet or on Binance may be worth more than the same ETH held in an AMM. This difference is called impermanent loss. Whenever the token balance in your pool recovers, there is no loss. If you withdraw before it does, the loss becomes permanent — so it’s recommended not to withdraw before the price goes in your favor.

Smart Contract Risk

All yield farming is built on smart contracts — programs that run without human intervention. However, these programs were created by humans, so some of them have vulnerabilities. Hackers often target them to attack a protocol, which is another reason why you may lose your funds.

Yam Finance was quite a big incident last year. The protocol attracted $600 million of liquidity before even having been audited. Soon, it came out that there was a bug in Yam’s smart contract that made it impossible for the users to control the project. The community started to panic sell, and YAM price dropped by 99%.

One of the latest examples is the Polygon-based YELD token from the PolyYeld Finance protocol. This time, the price collapsed not because the users lost their faith in the project, but because there was a bug and it was exploited by hackers. The attackers minted 4.9 trillion YELD, and as supply boosted, the price immediately collapsed. Hackers managed to withdraw 123 ETH.

The lesson here is simple — invest only in audited protocols whose security has been validated by the community.

High gas price

While transaction fees on Binance Smart Chain are lower than a US cent, Ethereum gas prices are still high, reaching $50–100 at certain points. If you have to swap between yield farming protocols and your strategy implies frequent asset movement, you are at risk of catching extremely high gas fees. This is the reason why many farmers have transferred their funds to BSC.

Bottom line

Yield farming offers high rewards, but it also poses a high risk. Token price drops, impermanent losses, smart contract risks, and high gas prices are no strangers to the DeFi space. To stay safe, do you research, invest only in reliable projects, seize good moments to withdraw, and try avoiding money transfers in high gas periods.