My hint that Peter Schiff works for the banking cabal

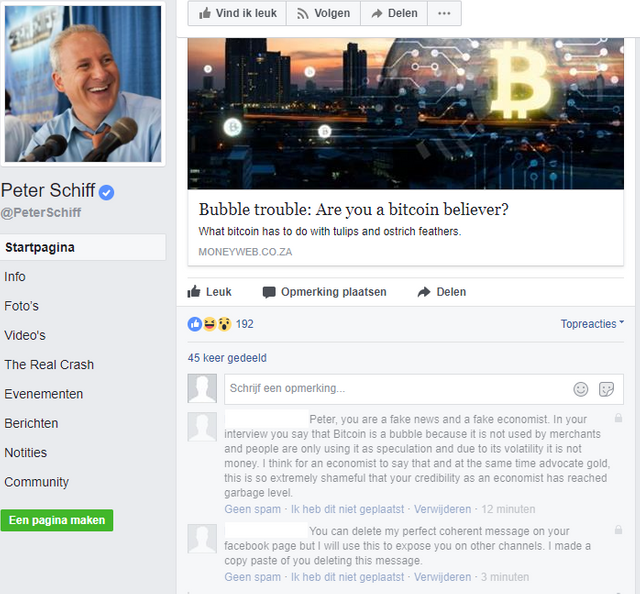

I went to Peter Schiff's Facebook page because I saw his anti-Bitcoin discussion on Facebook. He was making many anti-Bitcoin claims that are laughable. Especially for an advocate of gold because gold has the same (even more) flaws. This is what I told him which was instantly marked as spam and now even even deleted:

Peter, you are a fake news and a fake economist. In your interview you say that Bitcoin is a bubble because it is not used by merchants and people are only using it as speculation and due to its volatility it is not money. I think for an economist to say that and at the same time advocate gold, this is so extremely shameful that your credibility as an economist has reached garbage level.

Let me explain why. You say people are not using or pricing their stuff in Bitcoin. Can you please tell me which merchants are pricing their stuff in ounces of gold or silver ? Can you also please explain how people are not buying gold and silver for its future value after all these doomporn economists like you ? And how about gold and silver volatility ? Last time I checked the charts I didn't exactly see a very horizontal chart either.

So at the one hand you are downtalking issues that Bitcoin supposedly has according to you, on the other hand gold has the exact same issues but you magically don't see them.

To conclude, you keep calling tops for Bitcoin. I remember once you even called the top at 20 $. Bitcoin is now 100 times higher. That's the cherry on your nonsense pie.

Here I made some screenshots giving the proof that happened what I just said. Be careful following this guy. He clearly has an agenda. I am not 100 % sure but according to me he is paid by the elites to spread crypto fud so people keep pooring their money in gold and silver, which are very tightly controlled by the elites and hammered on daily basis.

Gold has intrinsic value. Bitcoin has none. Gold hasn't lost a third of it's value in the last month or so. Bitcoin was under $700 a year ago. There's no reason why it couldn't drop to $700 again. A year ago gold was at about $1340. It's at $1225 now. Gold has a 5000 year history of being money. Bitcoin, at 7 transactions per second, it's even a real currency.

Oh you want to have that discussion ? OK. Lets start with this fuzzy term: intrinsic value. What does it mean ?

https://www.sbcgold.com/blog/the-intrinsic-value-of-gold-and-silver/

"Their value comes from nothing less than their efficacy as a medium of exchange – as a form of money. It may sound weird at first, or perhaps tautological, to claim that gold is valuable because it can be used as value, but this is precisely the point."

Yep, Bitcoin does the same even better so my claim is: Bitcoin has more intrinsic value than gold and silver.

So summarized:

Bitcoin has more intrinsic value than gold. Bitcoin has lost 30 % of its value last month but gained 200.000 % since 2013 while gold has lost 50 % of its value since then. There is no reason why gold couldn't drop further just as much there is no reason that Bitcoin might go to 5000 $ in January. The history story is not a valid reason. Gold is also older than the internet but the internet is used more than gold. History has nothing to do here. The dollar is newer than gold and used more also. You don't need more than 7 transactions per second to be a store of value. Gold has even less transactions per second. But now come the advantes of Bitcoin. It is scarcer than gold, you can move value over the internet to the other side of the world in an instance, it is better dividable which makes it more flexible as a currency than gold. So basically Bitcoin is a store of value that can be used as a currency. And it is much easier and safer to keep at your home than gold. It can't be counterfeited (gold can as much fake gold coins already proved). ... Bitcoin >>> gold

he is talking about these kind of merchants.. lol