Mark Zuckerberg lost a massive $4.9 billion yesterday, and other tech titans didn't fare much bette

Mark Zuckerberg’s fortune dropped $4.9 billion on paper Monday as investors weighed reports that a political advertising firm retained information on millions of Facebook Inc. users without their consent.

Facebook said Friday that Cambridge Analytica, the advertising-data firm that helped Donald Trump win the U.S. presidency, received user data through an app developer on its social network, violating its policies. The company harvested private information from the Facebook profiles of more than 50 million users without permission, the New York Times reported.

It was a punishing day for other tech billionaires too. Amazon.com Inc.’s Jeff Bezos lost $2.1 billion (all figures US) and the fortunes of Alphabet Inc. founders Larry Page and Sergey Brin each declined $1.5 billion as a technology selloff sent the Nasdaq indexes to the steepest losses in six weeks.

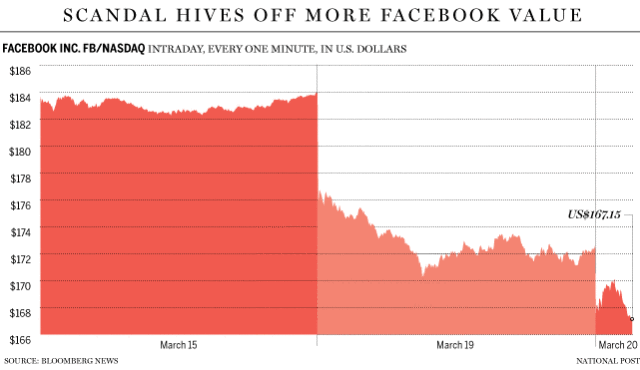

Facebook shares fell 6.8 per cent to $172.56, cutting Zuckerberg’s fortune to $70.4 billion and dropping him one place to fifth on the Bloomberg Billionaires Index. He’s now behind Bezos, Bill Gates, Warren Buffett and Amancio Ortega.

Facebook investors were making themselves heard, sending the stock to its biggest intra-day sell-off since September 2012. Lots of other people aired their grievances via Twitter.

A Bloomberg count of negative sentiment expressed on Twitter hit its highest level since Feb. 2, 2017, following reports that a political advertising firm retained information on millions of Facebook users without their consent. Tweet sentiment is measured by Bloomberg using proprietary analytics. It’s the fourth most negative day in the last four years for Facebook, according to data compiled by Bloomberg.

Despite all the political noise, it’s hard to see potential regulation seriously damaging the company’s dominance in online advertising, several analysts said.

This is more ‘headline risk’ at this point and does not overly concern us,” Daniel Ives, head of technology research at GBH Insights, said in a note to clients. Ives maintained his buy rating on Facebook shares, saying any stock weakness related to “regulatory and political headline risk” could be an opportunity.

The Cambridge Analytica breach is the latest in a procession of controversies for the internet giant. Zuckerberg has pledged to “fix” the platform after revelations last year that Russian agents used it to try to influence the 2016 presidential election. There’s also a growing backlash among pundits and journalists suggesting Facebook divides people rather than accomplishing its original mission of bringing the world together. Politicians in the U.K. and U.S. have called for enhanced regulations and transparency, especially when it comes to political ads on the site.

The core value of Facebook is the trove of highly specific information it has on each of its users, which number 1.37 billion worldwide. It’s possible the site will become a less appealing place for advertisers if politicians enact strict rules on how that data can be used, Debra Aho Williamson, principal analyst at research firm EMarketer, said in an email.

“This specific incident is not likely to cause advertisers to leave Facebook, but it will cause them to think twice about how data about Facebook’s users is handled,” Aho Williamson said. “If Facebook were forced to change the way it uses data or the way its ad products work, then advertisers may become less enamoured with it.”

Still, when it comes to digital advertising, Facebook and Alphabet Inc.’s Google have a lock on the market. Together, the two companies accounted for 58.5 per cent of the U.S. market in 2017, according to EMarketer. That means advertisers have little choice but to spend on Facebook if they want to get their message out to the widest audience online.

“Facebook and Google still very much enjoy an advertising duopoly, and although engagement is arguably at risk, there are no real alternatives of scale,” James Cakmak, an analyst at Monness Crespi Hardt and Co., wrote in a note. “This is an unintended, yet unavoidable, byproduct of operating a platform with 30 per cent of the global population

========================

Source : http://business.financialpost.com

Vote exchange site https://mysteemup.club