Decentralized Exchanges - Explained for an idiot

This was an answer I wrote for someone on beta.cent.co.

1. What exactly constitutes to an exchange being decentralized?

- P2P (No middleman controlling your funds

- Users control their own funds

- Commonly using a smart contract escrow system

Decentralized exchanges, also known as DEX, are peer to peer platforms with funds controlled by users rather than the * exchange yourself. This means that their is no "exchange wallet", all of your tokens are owned by yourself.

Trades are controlled by escrows, which are smart contracts, programmed code built on top of the blockchain that will release funds when certain conditions are met.

In contrast, in centralized exchanges functions sort of as a bank. You give them some bitcoin or some fiat, and they promise to pay it back later. Transactions don't happen on the blockchain, the exchange keeps a ledger itself. They will match up customers who wish to buy/sell on an agreeable price.

- To a five year old: Decentralized exchanges are exchanges where trades are regulated with secure code directly. *

(Source: Google images)

2. What are the different types of decentralized exchanges?

Exchanges can be split into 3 types:

On-chain orderbooks and settlements

Off-chain orderbooks with on-chain settlement

Smart contract-managed reserves

On-chain orderbooks and settlements:

All transactions update the state of the blockchain, including updates of orders. Each trade is a real transaction on the blockchain. (Pro: Security, Con: Slow, expensive)

Off-chain orderbooks with on-chain settlement

Order books hosted by 3rd parties known as relayers allow users to hold funds until the trade, while the relayer matches users. From what I can understand (may be incorrect), the relayer sort of acts like an exchange, matching users with each other, while transactions still happen on the chain.

Smart contract-managed reserves

There are reserves of a coin held in smart contract and the price depends on the amount of token inside the contract. The user trades directly with the smart contract.

(Source: Google images)

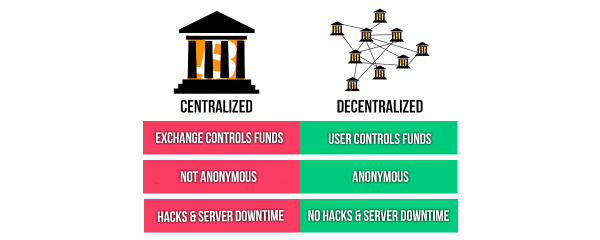

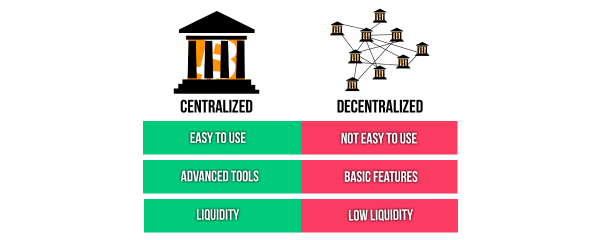

3. What are the tradeoffs?

The two images below sums it off, source:https://www.cryptocompare.com/exchanges/guides/what-is-a-decentralized-exchange/

In particular, the only real difference is the middleman, so all pros and cons revolve around this. (ease of use, bad security etc) I believe the UX of decentralized exchanges can be improved in the future.

Also, it misses the effect of gas! It adds up costs for quick day trades, bot and smaller margin users very quickly.

The most important difference preventing DEX to overcome centralized exchanges is low liquidity. Heres a source to further read up on.

The foremost issue of centralized exchanges is security (remember mt.gox hack?)

https://medium.com/outlier-ventures-io/decentralised-exchanges-whats-the-point-8260d558ccf8

Fundamentally, there is not enough volume which makes it difficult to execute trades, potentially increasing the costs of a particular asset.

Source: https://www.cryptocompare.com/exchanges/guides/what-is-a-decentralized-exchange/

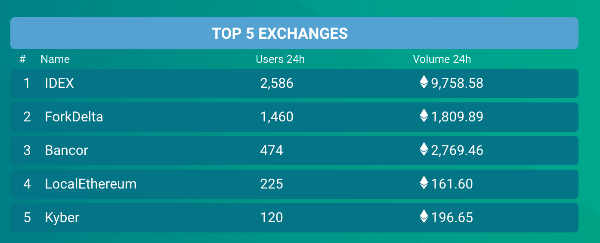

4. Who are the top platforms and why?

Reference: https://coinsutra.com/best-decentralized-exchanges-dex/

IDEX

Clean interface, easy to use with Metamask, biggest trading volume by far (more liquidity)

Waves

Decentralized trading with a centralized matching service. Has its own ICO. Also a lot of lesser known coins which are interesting.

Bancor

As I may have mentioned earlier, Bancor is class 3 DEX, Smart contract-managed reserves so it comes with all the benefits of that. Note that it was recently hacked, so be wary.

Other

Airswap (Ease of use)

Local Ethereum (Not really an exchange, smart contract escrow trading between fiat and ethereum like local bitcoin)

Stellar

Oasis

(Source: Dapp radar)

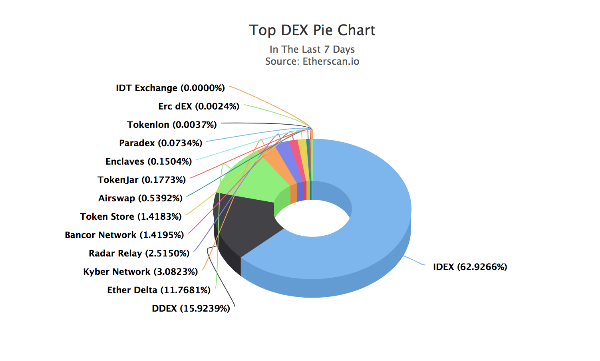

5. What is the current state of the decentralized exchange space

Rapidly expanding and being adopted, albeit with a lot of catching up to do. Even the largest DEX is ranked around 70 currently on all exchanges. Go here for a more detailed overview: https://etherscan.io/stat/dextracker

6. Future

No one can say. Like the rest of crypto, there are a lot of factors and risks involved. The obstacles Dex faces are huge, but so are the benefits. Time will tell. Everything currently depends on the security of the Ethereum blockchain, so if that breaks the bubble will be popped. (rising electricity costs, hashing algorithm broken)