Next Genaration Crypto Exchange Platform

The popularity and diversity of cryptocurrencies and online trading have caused a number of exchanges to sprout up across the internet. Some are tailored to a particular currency while others offer an all-around experience. But there is one basic flaw that all these exchanges possess and that is lack of information.

Ideally, when a consumer wants to invest in any particular asset, he requires information on certain factors affecting it. This information is not often clearly available on popular exchanges and obtaining them requires in-depth digging past various degrees of sophistication. It can be quite cumbersome to decipher this and then pair it along with the technical analysis available on the exchange and understand how the investment will pan out and this is where the inconvenience begins.

These factors are mainly:

Market Sentiment

Almost all major players have a presence on social media like Facebook, GitHub, Reddit and Twitter, which attract people but don’t help investors get the complete picture. The opinions available are almost always biased, due to their involvement so the investor does not hear the opinions of other investors.

News

Whenever a new product arrives it is picked up and shared on social media, but only those who are fairly active on those particular ones will be able to invest when rates are favorable at the beginning. Later the news will be 3rd party and contain the opinions of the reporter.

Macroeconomic Views

Often industry experts and media houses report on the trends in various new products which a prospective investor uses to make his decision. These can also be misleading in certain cases, due to being sponsored by concerned parties.

Analyst Reports

Self-proclaimed experts with large followings on social media often provide opinions on assets, which may not often be well researched. These entities have no accountability or traceability, neither can they be compared which inevitably leads to a consumer losing his money.

Security tokens

There is much ambiguity around security tokens as not much is known about them, even to the investor and there is not much progress in educating them either.

This is where Nebula comes in. Nebula is a unique centralized exchange that along with the traditional features of an exchange also possesses additional facets like news, analysis, reviews and peer to peer messaging within the community. Trade currencies in a fun setting while gaining rewards for sharing your knowledge with others.

In an extremely competitive market currently dominated by exchanges like BitMex, Binance, and Huobi, Nebula aims to break into the top 20 by the end of the year. What works for Nebula is its focus on community building and information and support.

Centralized vs Decentralized

Centralized exchanges are built by teams dedicated to enhancing the user’s experience. They support higher liquidity and faster trading while FIAT pairings are also available. The drawbacks include KYC requirements for the trading higher value of stock and transactions are susceptible to manipulation by exchange staff ie, the funds are only as secure as the exchange’s security.

Decentralized exchanges, on the other hand, provide certain benefits. The funds are not stored with any third party and do not require KYC for trading larger amounts. Th chances of the server being hacked by unscrupulous parties are also low. They also suffer from a few drawbacks like having only basic support which makes it difficult to handle for beginners. They have no liquidity providers and trading speed can be slow due to their dependence on the blockchain.

Nebula believes that the centralized model is better suited to the growth pattern they foresee and provide the user with a better experience and that the dedicated team is well equipped to handle any issues that may arise.

Security

Nebula has a formidable array of security measures to handle any threats to the system.

Safety from DDoS attacks

2-factor authentication

Combination of multi-signature hot and cold signature wallets to ensure safety

Regular audit of smart contracts

Regular penetration and security tests by leading consultants

Trading Platform

The Nebula trading platform is robust enough to support the following features for the user.

Ability to register up to 10,000 transactions per second

Professional charts licensed from TradeView

Limit, Market and Stop Loss orders

Exportable trade and order history

Multi-signature wallets with round the clock monitoring

10x more leverage with market trading

Information Sharing

The Nebula Exchange provides users with a mechanism to separate the credible reports from the trash that is found all over the media.

Review system

Nebula employs a 5-star review system where the community reviews articles and rates them accordingly. This allows users to view top rated articles and newest submissions easily.

Reputation System

The reputation system comes in handy to differentiate between quality opinions and is something already being implemented on different platforms. Each new account starts with 0 reputation points (RP) and as they progress gain points, by being rewarded by other users or for referrals. The RP is displayed with each post and help find the respected members of the platform easily.

News System

News related to trade and market are often found to be rumors and can cause the market to fluctuate accordingly. Nebula counters this by displaying only articles from the most credible sources and a dedicated channel to provide users with the unfiltered news.

P2P Messages

All users can communicate privately with each other through personal messaging boxes or through the multi-language toolboxes.

Tokens

A utility token is any token that gives access to any utility or service provided by the company developing the token.

A security token is a digitized equity in any company, ie, the digital equivalent of buying stock in a company. Unless these tokens adhere to rules prescribed by bodies like SEC or FINMA, they can only be held by accredited investors.

What this does in an equity market is that it removes the need for stringent KYC norms when tokens are traded between retail, accredited and institutional investors as there is no FIAT involved.

In a traditional Cryptographic market, extensive KYC is required to ensure that trader is accredited and Anti Money Laundering is followed. Allowing a retail investor to invest in tokens is the responsibility of the company provided that all rules are adhered to.

Nebula aims to tackle these challenges by using a significant amount of the funds they acquire through the ICO to :

Acquire the licensing required to list security tokens from relevant regulators.

Enable a strict KYC and accreditation process.

Expand geographic presence and add FIAT pairings.

Nebula supports new projects by providing them listing and an avenue once they pass the required tests allowing them to use their funds for product development. Nebula has a unique shareable referral system where each user has a unique id. If any user signs up using it, the referee is entitled to 50% of the transaction fee.

Revenue Model

Nebula has 3 main sources of revenue generation.

Transaction Fee - a standard fee of 0.1% will be levied for all transactions.

Withdrawal Fee - a fee is charged when funds are withdrawn from the exchange

Listing Fee - a fee is required when new projects are listed

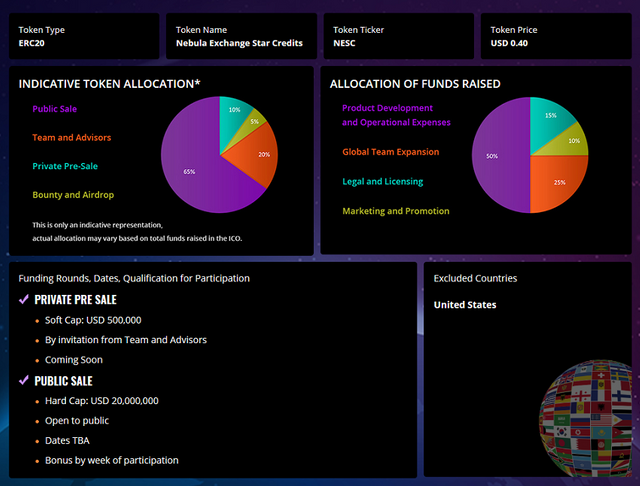

The official token used by the Nebula exchange is the Nebula Exchange Star Credit (NESC). Users can pay transaction fees in NESC and are then eligible for 50% discounts. Fees collected in NESC are promptly burned. Nebula buys back NESC every quarter and burns them until half the originally released number of tokens is reached.

Risks Involved

Regulatory risks, Market risks and Security risks with concerns over money laundering and other activities leading to scrutiny by councils. Markets are volatile and vulnerable to threats like hacking.

Team

Nebula is led by founder and chairman, Vincent Jaques - a successful investment banker and experienced hand in the blockchain development industry. Other lead members of the team include Rohan Juneja, CEO and Nathan Collins, Chief Product officer who are both respected members of the blockchain development sector.

For More Details Of Nebula ICO:

Official Website: https://nebula.exchange

Official ICO Website: https://nebula.exchange/ico

Whitepaper: https://nebula.exchange/wp-content/uploads/2018/04/Nebula-Exchange-Whitepaper.pdf

Telegram: http://t.me/nebulaexchange

ANN Thread: https://bitcointalk.org/index.php?topic=4583209

Twitter: https://twitter.com/Nebula_Exchange

Post by Anton De Mel

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1770640

Bitcointyalk Username: cryptosinhaya