Europe Green Cement Market Size, Growth, Trends & Opportunity Analysis 2025-2033

Market Overview 2025-2033

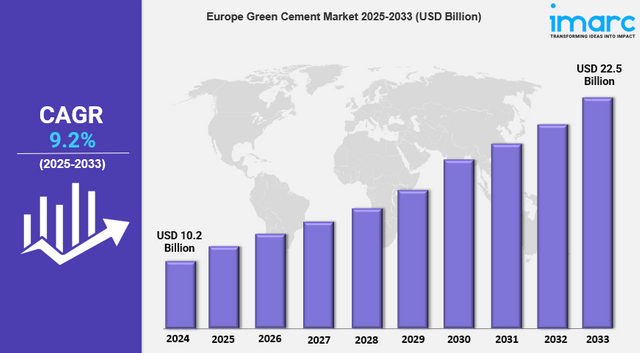

The Europe green cement market size reached USD 10.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.5 Billion by 2033, exhibiting a growth rate (CAGR) of 9.2% during 2025-2033. The market is experiencing steady growth driven by rising demand for eco-friendly building materials in both residential and commercial sectors, the increasing awareness of sustainable construction practices, and continuous advancements in technology facilitating the use of alternative raw materials.

Key Market Highlights:

✔️ Strong expansion driven by sustainability initiatives & urban development

✔️ Growing preference for low-carbon and alternative cement solutions

✔️ Increasing shift towards eco-friendly construction materials

Request for a sample copy of this report: https://www.imarcgroup.com/europe-green-cement-market/requestsample

Europe Green Cement Market Trends and Drivers:

The Europe Green Cement Market is witnessing a significant surge in demand as sustainability becomes a core focus in the construction industry. With governments tightening environmental regulations and setting ambitious carbon neutrality goals, the shift towards eco-friendly building materials has accelerated. Green cement, which reduces carbon emissions through alternative raw materials and energy-efficient production processes, is gaining traction among developers and infrastructure planners.

Major economies such as Germany, France, and the UK are increasingly adopting green building certifications like BREEAM and LEED, further driving market expansion. Additionally, consumer awareness regarding the environmental impact of traditional cement production is leading to higher preference for sustainable construction solutions. This trend is expected to continue in 2025 as businesses and governments collaborate to meet sustainability targets while maintaining the growing pace of urbanization across Europe.

Innovations in green cement production are playing a crucial role in reshaping the European market. Cutting-edge technologies such as carbon capture and storage (CCS), alternative binders like fly ash and slag, and AI-driven efficiency optimization in manufacturing are transforming the sector. Researchers and industry leaders are exploring ways to further reduce clinker content, the primary source of emissions in cement production, by using geopolymer-based and limestone calcined clay cement (LC3).

These innovations are not only making green cement more sustainable but also enhancing its performance and cost-effectiveness. Additionally, investments in research and development by key players, alongside collaborations with academic institutions, are driving breakthroughs in material science. By 2025, advancements in production technology are expected to lower costs and improve adoption rates, making green cement a mainstream choice for infrastructure and commercial projects across Europe.

Regulatory frameworks and financial incentives are acting as key catalysts in the expansion of the Europe Green Cement Market. The European Union’s Green Deal and Fit for 55 package are pushing for stringent emission reductions, encouraging cement manufacturers to transition towards sustainable alternatives. Carbon pricing mechanisms, subsidies for low-carbon cement production, and green public procurement policies are making eco-friendly cement more financially viable.

Moreover, cities and municipalities are prioritizing green infrastructure development, mandating the use of sustainable building materials in public projects. Tax incentives and funding support for green technology adoption are further accelerating market growth. As Europe moves closer to achieving its net-zero emissions target, government intervention will remain a driving force in the widespread adoption of green cement, fostering a cleaner and more resilient built environment.

Europe Green Cement Industry Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product Type:

- Fly Ash-Based

- Slag-Based

- Limestone-Based

- Silica Fume-Based

- Others

Breakup by End Use Industry:

- Residential

- Non-Residential

- Infrastructure

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145