7 Smart Ethereum Price Prediction Methods for HODL'ers

It is incredibly difficult to predict where the price of Ethereum will go.

This is not a matter of talent, or how "smart" you are - I mean, shit, you have possibly made a good deal of money investing in Ethereum. But now you have additional money to invest, and are unsure if now is the best time to buy.

Even the best Ethereum traders/investors in the world are left dumbfounded about when to invest.

Luckily, Ethereum price prediction tools have emerged that are helping investors and analysts better predict where Ethereum prices are going to go.

Why is it so difficult to predict Ethereum prices?

Putting a value on a cryptocurrency is fundamentally different from a stock.

Stock valuations are typically heavily based around one big component: cash flow. The most well-known methods for valuing stocks: DCF, Graham Formula and EBIT Multiples are all based in some form or another on cash flow and profitability.

Cryptocurrencies do not have cash flow, and thus it becomes impossible to use the traditional methods of stock forecasting. What this means is we have to find alternative methods for pricing this amazing technology.

I have outlined 7 different ways we can come to an Ethereum price prediction to help out future investing.

1. Chris Burniske's cryptoasset valuation, aka "I am very thoughtful in my analysis"

Chris Burniske of Placeholder capital and author of the book "Cryptoassets: The Innovative Investors Guide to Bitcoin and Beyond" recently released a very promising and thoughtful piece on Medium outlining a new way to value Cryptoassets.

The outline of the model is this:

Instead, valuing cryptoassets requires setting up models structurally similar to what a DCF would look like, with a projection for each year, but instead of revenues, margins and profits, the equation of exchange is used to derive each year’s current utility value (CUV). Then, since markets price assets based on future expectations, one must discount a future utility value back to the present to derive a rational market price for any given year.

Said a different way, the goal of the model is to derive the asset's utility (for example, Filecoin's utility is price per GB)and what that utility will look like in the future. Then, discount the utility value to what it would cost today.

The model does have a good amount of subjective inputs, so the price estimates I came up with varied significantly. I highly recommend heading over to the Medium piece and completing your own analysis.

Complexity: High

Confidence level: Promising

Time to finish: High

Price estimate: $603-$1,532

2. Cost of Production Model, aka "The cake is a lie"

Initially created for Bitcoin, the cost of production model can be tailored for Ethereum. This analysis was completed by Adam Hayes in March 2015 at the New School for Social Research.The basis of the paper explains that pricing is not based on more traditional methods, but instead centered around the uniqueness of cryptocurrencies - mining statistics.

Directly from the paper:

Break-even points are modeled for market price, energy cost, efficiency and difficulty to produce. The cost of production price may represent a theoretical value around which market prices tend to gravitate.

The authors did state that certain factors such as future technology and utility may prove to be more valuable than the coin in and of itself. These factors could prove challenging for putting a true value on a cryptocurrency.

Complexity: Medium

Confidence level: Promising

Time to finish: High

Price estimate: $367

3. Economics of Price Formation, aka "I am most likely smarter than you"

The Economics of Price Formation method captures the relationship between BitCoin price and supply-demand fundamentals of BitCoin, global macro-financial indicators and BitCoin’s attractiveness for investors.

Written by Pavel Ciaian, Miroslava Rajcaniova, and d'Artis Kancs, the bones of the analysis focuses on vector autoregression (VAR) which I am definitely not covering here. However, the finding of the paper suggests that:

BitCoin market fundamentals have an important impact on BitCoin price, implying that, to a large extent, the formation of BitCoin price can be explained in a standard economic model of currency price formation.

Tweet: BitCoin market fundamentals have an important impact on BitCoin price

Since the inputs used in the paper are the same, the findings can be carried over to Ethereum. Also of note, is that one of the main inputs of the 1st method, velocity, is also used in this paper.

Complexity: Extremely High

Confidence level: Hard-to-tell

Time to finish: High

Price estimate: Incomplete

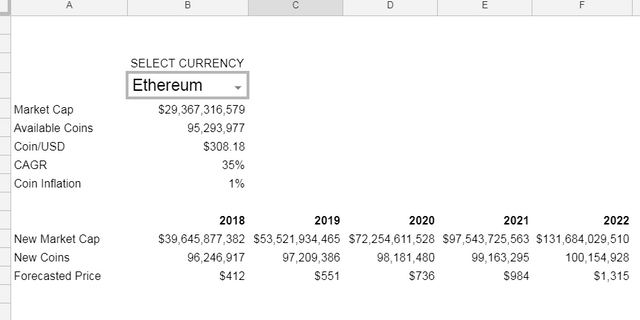

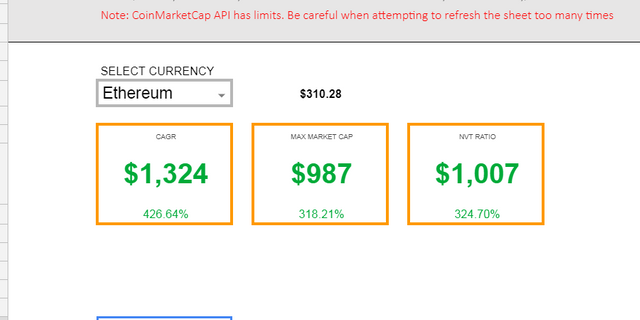

4. Compound Annual Growth Rate (CAGR), aka "I work in Finance"

Borrowed from the financial world, CAGR seeks to estimate the size of an industry (or in this case, market cap of Ethereum) over a period of a few years.

The cryptocurrency world is expected to grow by 35%, based on CoinDesk data. Using this data, we can estimate what the market cap of Ethereum will be in five years. The required inputs are:

As of 10/23

- Current Market Cap ($27B, sourced from CoinMarketCap)

- Available supply of coins (95M, sourced from CoinMarketCap)

- CAGR (35%, from CoinDesk)

- Coin inflation, or anticipated coins (1%, per Ethereum whitepaper)

In the picture below, we have forecasted the market cap and price of Ethereum out to 2022:

We have also provided a handy Google Sheets spreadsheet utilizing the Spreadstreet Google Sheets plugin to automatically bring in coin information for the calculation. You can find that sheet here:

Complexity: Low

Confidence level: Low

Time to finish: Low

Price estimate: $412-$1,315

5. Max Market Cap, aka "Ethereum will grow to be bigger than Bitcoin"

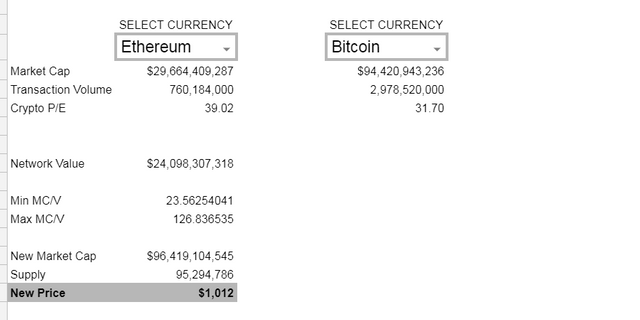

Max market cap is a theoretical maximum that is calculated taking the market cap of the most popular coin (in this case Bitcoin) and plugging it in for a seperate cryptocurrency.

In the Ethereum example, the formula is very simply:

Available Coins (Ethereum) / Market Cap (Bitcoin)

This results in a max theoretical value of $1,038 for Ethereum, which as of 10/23 would be a 364% increase. This analysis gets really hilarious when you start using some of the less popular coins such as BAT (46,000% increase) and the useless Dogecoin (88,000% increase). Take with a grain of salt, but still very interesting to see.

Complexity: Low

Confidence level: Low

Time to finish: Low

Price estimate: $1,038

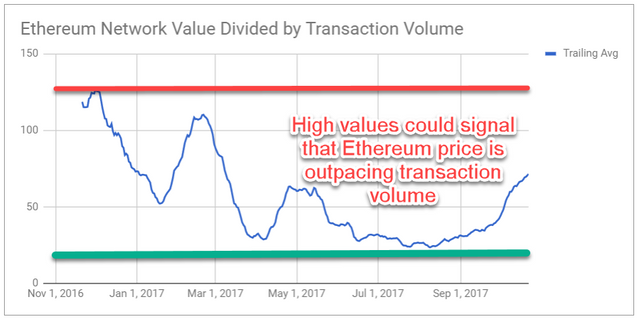

6. NVT Ratio, aka "I also sometimes engage in technical analysis"

NVT Ratio is another valuation methdology outlined by Chris Burniske, albeit at a much simpler calculation method.

The calculation is:

Network Value / Estimated Transaction Volume

Where I differ from Chris' advice is I tailored the calculation to give me the value of Ethereum if it were to hit it's max historical peak. For this example, the 30-day trailing average of transaction volume in the last year peaked on December 16th, 2016 at ~126. If we take the current daily transaction volume of ~$498M, this gives us a new market cap of $63B (126 * $498M).

Using this new market cap of $63B, if we divide that by the current supply of 95M, we get a new price of $664.

Once again, we have included this calculation in the Google Sheets found here:

Complexity: Low

Confidence level: Low

Time to finish: Low

Price estimate: $1,012

7. Dartboard, aka "Go f**k your methods, I don't need you"

Because, the dartboard method of Ethereum price prediction is honestly better than most of the crap out there. HODL.

Tweet: "Because, the dartboard method of Ethereum price prediction is honestly better than most of the crap out there. HODL."

Complexity: Extremely low

Confidence level: Higher than most

Time to finish: Extremely low

Price estimate: >$9,000

How you can implement these methods with the valuation spreadsheet

The spreadsheet can be setup to update as often as you like by using the following instructions:

- Download the Spreadstreet Google Sheets add-in

- Click the Google Sheets link here. In the new window, click File - Make a copy.

- Important Open the template, click the menu Add-ons / Spreadstreet / Help / View in store, and then click Manage and in the dropdown menu click Use in this document.

- All formulas should update as expected. If not, try refreshing the sheet

The sheet includes CAGR, Max Market Cap, and NVT Ratio. The sheet does not include the cryptoasset valuation, cost of production model, or the economics of price foundation as those methods are significantly more involved. This sheet also does not include the dartboard method, as that requires a physical dartboard.

Good HODL'ers aren't sprinters. They choose each and every investment with care. They know the rules. But they also know how to break the rules. Deliberately. Emphatically. Ruthlessly.

John