The great Ethereum question!

I am a digital currency enthusiast. I like reading about the possible uses for coins, seeing the current applications and watching the markets for trade ideas. I have especially enjoyed observing the volatility of the many alt coins and its always nice to find correlations and interesting movements among the coins. An interesting twist has occurred in the Ethereum space and I feel the need to discuss it on this platform.

The recent Ethereum hard fork has created two ether coins know as ETH (the new hard forked ethereum) and Ethereum Classic (ETC) it was given to owners of Ethereum at the time of the fork. This has created a lot of uproar especially since several coin exchanges have started to support the 'new' coin ETC.

Here is how ETC came to exist

Essentially the majority of Ethereum owners who were robbed on the DOA project decided to push the reset button and do a hard fork. I do not believe they anticipated another coin being created called Ethereum classic. Essentially it was created by Poloniex who offered tokens to old ether holders who held coins in their account at the time of the fork. These holders were given owenership of ETC and the revamped ETH thereby obtaining their original ETH position and an additional equity in ETC. By offering support for trading this instrument it has become a coin and thus value was created.

Barry Silbert Post.

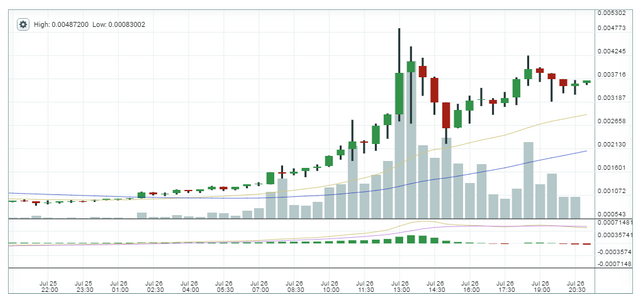

So ETC came to be! What I really found interesting was the hated online from Ethereum supporters (ETH) who seemed appalled at the exchanges decision to support ETC. The reality is that exchanges that service alt coins (espcially alt coin exchanges such Poloniex) tend to have the position to support coins that the people are want to trade. When Barry Silbert decided to post on twitter that he is investing in his only alt coin investment ever which was ETC at $0.50 cents per coin this created an incredible uproar. His claims of risk/reward sent the twitter trolls in uproar and it's probably this hype that helped propel ETC to the 285% return that is currently has in the last 24 hours.

How to Value ETC/ETH

The situation with ETC and ETH is unique. In order to value these coins they must be looked at together as one coin. in essence they are. Any value that one coin enjoys is coming at the expense (and market cap) of the other coin. the reality is that 'Ether' is now a sum of both coins. It is simply an argument over which is the legitimate coin. When looking at value here we must keep in mind some classic valuation ideals with adjustments.

The market cap of the new 'Ether' is simply the ETH + ETC value. you need to look at this combo as a market cap when comparing to BTC. The way in which I value new coins is by using a market cap comparison. I do this so i can standardize the coins compared to the market cap of BTC and to each other. When looking at the price of ETC vs ETH you are simply looking at where the market values the percentage chance that one coin wins out over the other. I find it hard to believe that two coins will exist in perpetuity I think one will eventually win out over the other. But until that happens.... there will be opportunities in this pair.

The risk/reward that Barry Silbert referred to was that at such a low price in relation to ETH, ETC has optionality. It has a sort of buoyancy that allows it price to become spring loaded. At $0.50 ETC has a lot of room considering its counterpart was trading around $14.00. If the total market cap of both coins increases in relation BTC, ETC will most likely have a nice move. If it gains legitimacy as a coin (which it appears it has) it will enjoy a much larger rally even if the total market cap of 'ether' has not changed all that much. It should be worth noting that such a prominent name in the bitcoin world would have a broad social media following and comments coming from him can have a profound effect on such thinly traded products (I made a career out of trading thinly traded commodities on small exchanges). And there you have it! The rally has begun and i'm sure it will be a choppy ride before things calm down.

Illiquid markets

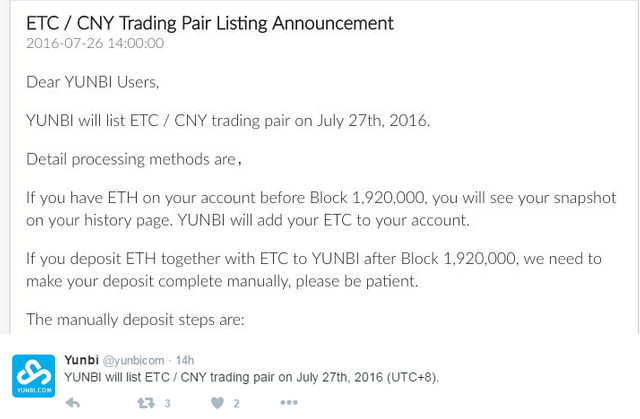

The speed at which these event unfolded will definitely contribute to the volatility of this event. it's the confusion in the market that leads to irrational trading. This is a well know phenomenon in illiquid markets that suddenly have a surge in interest and volumes as a result of an 'event'. I believe it makes sense to trade ETC/ETH as pair. This mean trading long one vs short the other. Allows you to manage the risk of these coins by related them in market cap. I see it hitting 40% of the value of ETH before it either takes off and takes over or comes back down. The simple mechanics of not being able to short ETC (with the exception of creating a short position using futures) leads me to believe ETC will see sustained rise in the short term. I have not yet found a way to short ETC aside from completing a true "over-the-counter" transaction with another individual, I do, however, foresee the creation of a method to short ETC soon. As I was writing this post I discovered that a site called Yunbi was creating a ETC/CNY contract to be released on July 27, 2016

Recommedations

I think ETH and ETC are going to survive in one form or another. I think getting long the ETH and ETC complex is a worthwhile trade. Until ETC hits 30-40% of the value of ETH I think i would lean heavier in ETC. There is still room to grow. As a hedge I would short 50-100% of my total 'Ether' investment (ETH + ETC dollar value) in Bitcoin. Keeping the portfolio dollar neutral wouldn't be a bad moved at this point considering the recent rally in BTC which was largely due to the halving event.

I plan on more about the digital currency space and look forward to ideas and comments and please upvote me!

#bitcoin

#digitalcurrencies

#BTC

#ETH

#ETC

#ethereumclassic

#fintech

Really good points for both sides :D