Misconceptions of token utility

Tokens are tokens, NOT a currency

Tokens are meant to interact with a few tasks within an application. The exact same way you put tokens into a machine for golf balls at a driving range. Those range tokens are useless anywhere else. It is a closed circle of events for golf courses to simplify purchasing practice balls. The range tokens hold no value; just what the golf course says they’re worth, x amount of golf balls. This is a one sided market.

Customer pays Golf Course (USD) > Receive Token > Use in Machine > Practice Balls dispense

ICO/Token offerings should offer utility in similar ways the golf course uses range tokens.

The golf course doesn’t need to sell those tokens again on an open market in order to pay employees, utilities, etc. They already received the fiat value for the goods provided. The token is the mechanism for the consumer to interact with the golf ball dispensing machine.

Issues with peer-to-peer exchange of value tokens

For the sake of raising money via an Ethereum ICO, a lot of tokens are advertised as a method of payment between people within their platform. There is one major issue with that being the token utility… you need a market with liquidity.

Why? So the receiving end of payments can exit the market with the original value sent to them.

That’s beauty of markets like BTC, ETH, LTC… They are all liquid. Sure sometimes volatile, but they are liquid. If someone pays you $10,000 worth of ETH, you can market sell to USD for nearly the same value.

If someone pays you $10k worth of XYZ (only trades on EtherDelta, Market cap of 10million) for completing a task, you can market sell to ETH for ~50–70% of what you were “paid”. Why? Because the order book depth of these tokens are very small. In addition, two more transactions are needed because XYX token does not have a fiat gateway (XYZ/USD market).

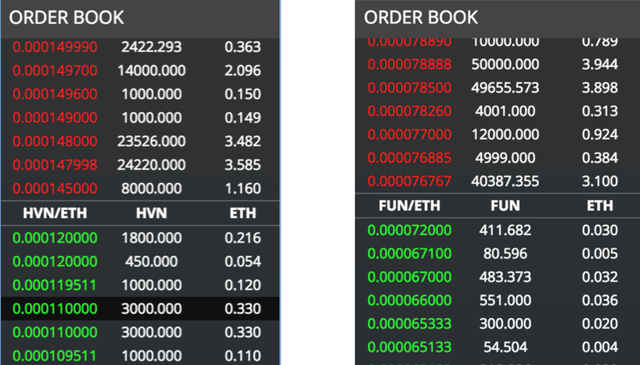

Below is an example of a low and high cap tokens traded on EtherDelta. For most blockchain startups, they will have to accept the fact that your token will only be available on lower volume decentralized exchanges (DEX’s) until you have significant traction.

15mil market cap — — — — — — — — — — — — — — — — — — — 110mil market cap

Most recipients of these P2P payment tokens are like the golf course; they need the set fiat (USD) value to operate daily. When there are order books as thin as above, that is virtually impossible.

Proper Token Utility

An example of a token with a clear-cut utility is the Salt membership token (SALT).

Consumer buys SALT (with liquid token/shapeshift) > Receive 1-year access to Salt Lending Platform > Put up digital assets as collateral > USD/Fiat loan granted

This method allows Salt Lending, the company (not token holders), to operate with the inflow of liquid crypto currency paid in membership sales. Another thing to note, this utility case keeps blockchain startups safe from their token being a security.

Another example is the future Open Bazaar Token. If you are unfamiliar with OB1, please check it out. This decentralized and open sourced marketplace is very underrated crypto currency use case because they didn’t hold a token sale in 2017.

The Token utility doesn’t revolve around users paying in the native OB1 token in exchange for products/services with sellers. The full details aren’t released yet but one function will involve paying for advertising. Sellers of goods won’t have to worry about a customer paying in OB1 tokens with the potential of not being very liquid.

Future of tokens

In the end, there are protocols being built like the 0x Protocol that will help bridge the gap of illiquid tokens, but when there is a two sided market, there needs to be an equal or greater amount of buying pressure for the recipient to receive the true value of the tokens delivered.

A project built on 0x that has the potential to answer all liquidity and volatility issues is MakerDAO’s stablecoin DAI (read more here). If DAI is sustainable, I predict most Ethereum DApps switch to accepting DAI based on user demand.

Please Note

Before starting your project based on a ICO/Token offering, make sure the utility is clear, and does not leave the receiver of transactions with a devalued payment. Not everyone is accumulating tokens in hopes of future wealth.

Tokens are for interacting with native DApps, not as an international currency, that is what Bitcoin is for.

Please comment or follow on Twitter ( https://twitter.com/ysgjay ) to discuss further

Best article I've read all day! Great job!

Congratulations @young-elder! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @young-elder! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!