What is Ethereum? Difficult concepts made easy to understand.

Ethereum is the second largest cryptocurrency by market cap after Bitcoin. It is different from Bitcoin in several fundamental ways and boasts unique advantages over other cryptos. Let's discuss.

What is Ethereum? A brief history.

Like every other cryptocurrency, Ethereum was born out of Bitcoin. Its founder, Vitalik Buterin, believed that for Bitcoin to reach its full potential in decentralization that it had to implement features beyond currency exchange. To him, enabling decentralized applications and programming were the obvious next step for Bitcoin. Met with a tepid response after its initial proposal in 2013, he decided to develop the new platform on his own and Ethereum was born.

Upon its release in 2015, Ethereum was enthusiastically embraced as a counterpart to Bitcoin. The added functionality and ability to act as a platform for other applications has made Ethereum an attractive investment and as of December 2017 it has the second largest market cap of any cryptocurrency after Bitcoin.

Ethereum has not been immune from controversy and suffered a major complication in June 2016. At that time, a smart contract project called DAO got hacked and nearly $50 million worth of Ether was lost. DAO was supposed to epitomize the capabilities of Ethereum. It integrated smart contracts and other features of Ethereum and essentially formed a semi-autonomous organization that would allow users of DAO to fund different projects in a democratic way. Because DAO was so prominent both in terms of the potential applications of Ethereum that it represented as well as the sum total of Ethereum dedicated to it (representing approximately 14% of all Ether at one point), its failure represented a setback for Ethereum as a whole. Ether's value dropped over 60% as a result and the core developers were forced to institute a hard fork to mitigate the loss to the network and to reinstitute the Ether that was hacked. As a result of the hard fork, Ethereum Classic (which continued on the unforked blockchain) was born in addition to Ethereum (which continued on the forked blockchain).

[Note: This is super confusing. In short, DAO was meant to show what Ethereum was capable of. Once it failed, it instilled huge amounts of doubt into the overall reliability and usability of Ethereum. To restore the value lost by investors in DAO, Ethereum underwent a hard fork, aka a protocol level update. Some users disagreed with this move and continued development of the original blockchain. This is called Ethereum Classic. The forked blockchain is called Ethereum.]

Since then, development has continued on the Ethereum blockchain and has instituted several upgrades to stability, usability, and scalability.

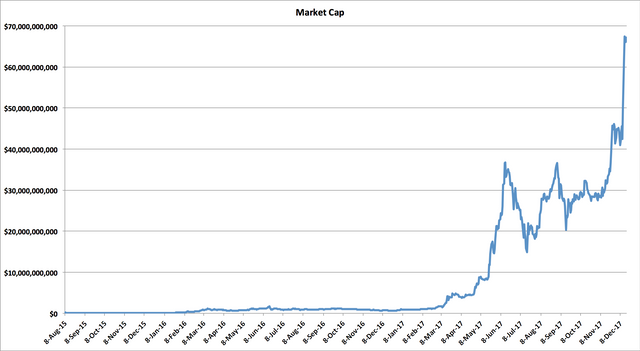

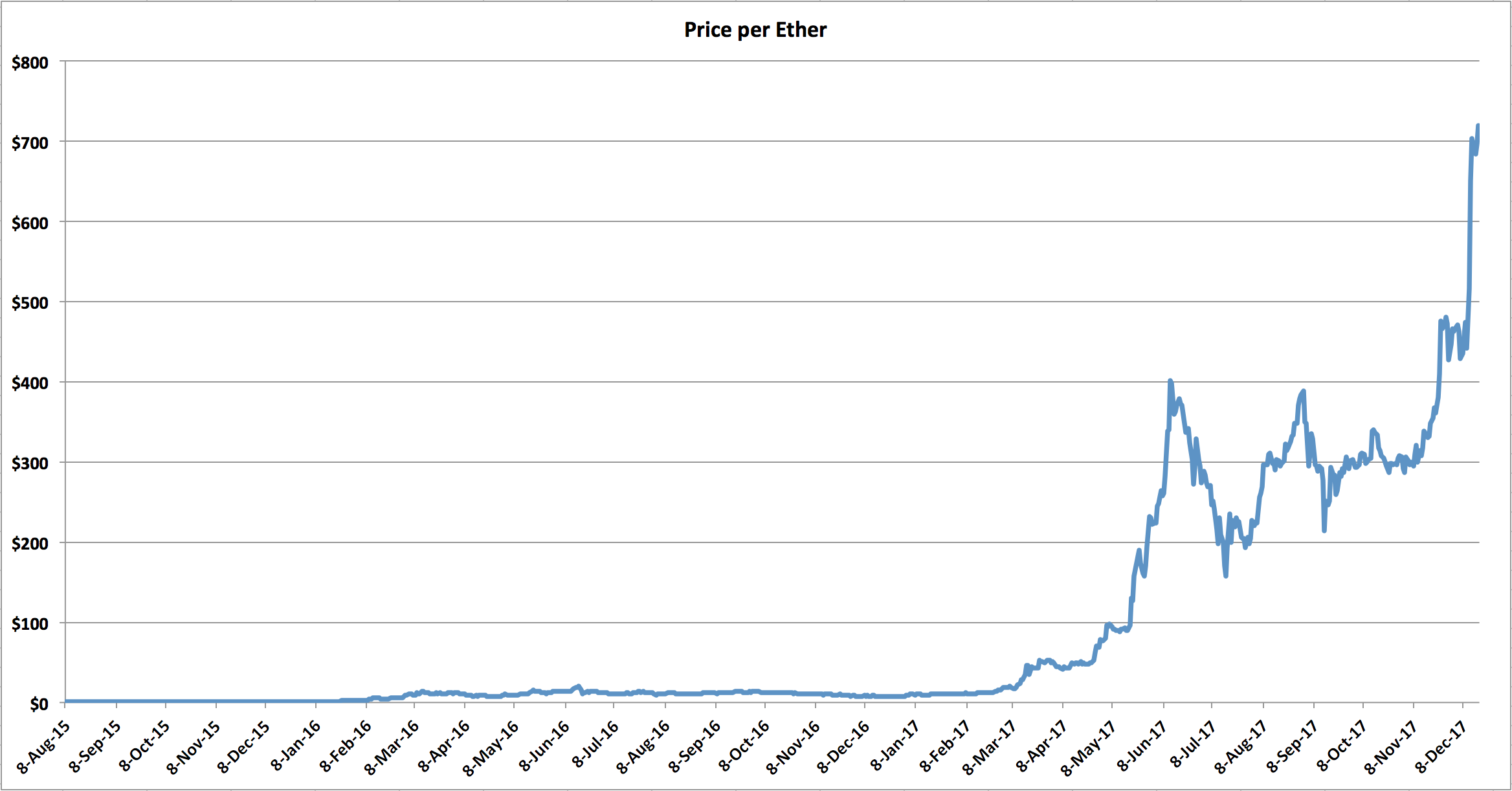

Ethereum has become the second most valuable cryptocurrency by gross market cap after Bitcoin. As of December 2017, the market cap for Ethereum is approximately $67 billion. The price of individual tokens of Ethereum have also skyrocketed from under $1 to nearly $750 a token.

What Ethereum does that Bitcoin does not:

The question next comes to what Ethereum can do that Bitcoin cannot. In essence, Ethereum attempts to provide the same value retention and ease of transactions that Bitcoin does, with the addition of several caveats.

Smart Contracts

One of the things that spurred Buterin to found Ethereum in the first place was Bitcoin's inability to execute smart contracts. In effect, Bitcoin is a "dumb" currency. It is only useful as a currency being exchanged between two parties. Buterin saw the digitalization of currency as an opportunity to instill logic into money and to make it "smart".

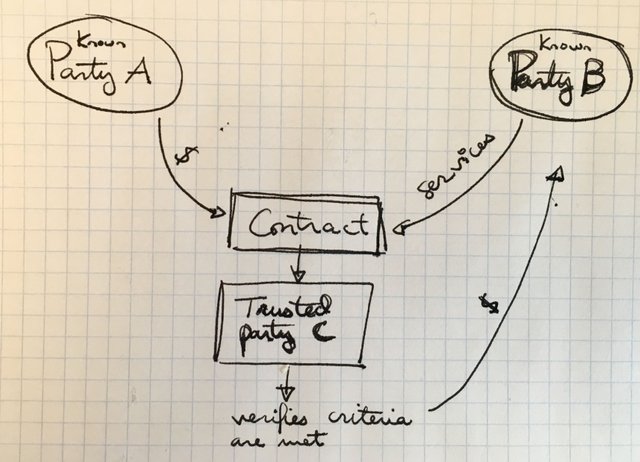

In the past, fulfilling this type of contract would generally require a trusted third party (Party C) to ensure that payment was made by a known Party A, that the services were provided by a known Party B, and that the money eventually got to known Party B. The trusted party would take a cut of this.

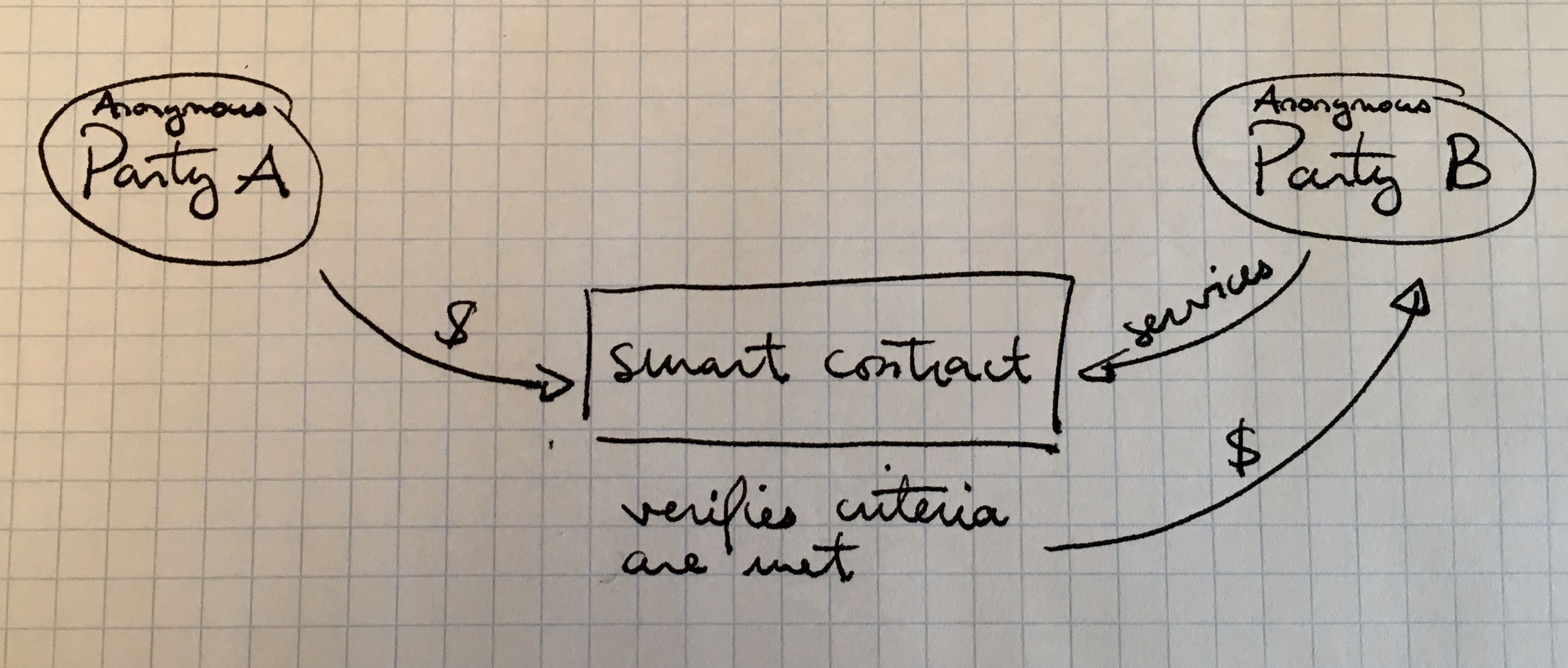

Smart contracts give Ethereum the ability to enact if/then criteria into transactions. In other words, Party A can say, "I want X amount of Ethereum to be transferred to Party B if Y criteria are met."

There are a few things that make this special.

- The Ethereum Virtual Machine (EVM) is software built into the Ethereum protocol that is run on every Ethereum node (read: computers that provide decentralization that allow the network to function). Once a smart contract is verified by consensus, the smart contract is run and the affected parties compensated.

- The EVM is Turing complete, meaning that given enough memory, the EVM can solve any reasonable mathematical problem. This means that Ethereum is incredibly adaptable and malleable to many different conditions that can be set in the contract. It also means that it is compatible with many programming languages. The potential applications for this are nearly limitless and range from industries such as financial tech, to agriculture, to real estate.

- Rather than relying on a trusted third party, the "trust" is inherent in the smart contract. The criteria for payment are baked into the contract and available for all parties to view. Without the need for a trusted third party, payments are made in full without a third party taking profit.

- Unlike the "dumb" contract mentioned above, smart contracts allow all parties to remain anonymous, since payment does not depend on the identity of the parties and instead relies on their fulfillment of the preset logic in the smart contract.

- Smart contracts can be integrated with applications to form Decentralized Applications (dApps). These are similar to applications that we are all familiar with, but they run in a more trusted environment connected to the blockchain.

Tokens

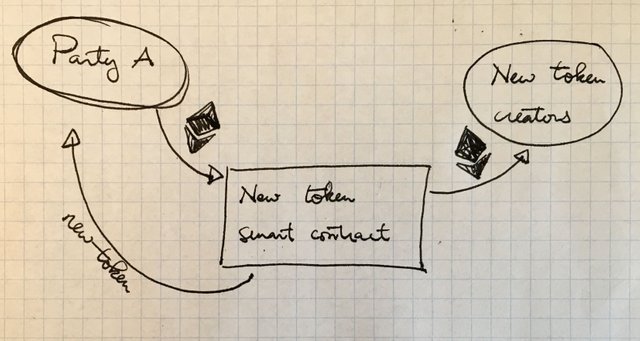

Because of the ease with which smart contracts are implemented, Ethereum has become the favored platform for the launch of new cryptocurrencies. These Initial Coin Offerings (ICOs) utilize the security and trust built into Ethereum smart contracts to securely distribute and launch new cryptocurrencies. Ethereum has standardized this process with the ERC-20 protocol. ICOs can be though of as an evolution of Initial Public Offerings (IPOs). ICOs and IPOs are similar in many respects:

In IPOs, new companies receive money from known parties. In exchange, the new company issues shares or bonds at a predetermined price to these known parties. Another company underwrites the process to instill trust. After the IPO, the stock hits the market and its price fluctuates.

Similarly, in ICOs using the Ethereum ERC-20 protocol, new cryptocurrencies receive Ethereum from anonymous parties. In exchange, the new cryptocurrency issues tokens at a predetermined price to these anonymous parties. No trusted third party is needed, as the smart contract is all that is needed to instill trust in the process. After the ICO, the cryptocurrency hits the market and its price fluctuates.

The invention of the ERC-20 protocol has been a boon to new cryptocurrencies. Ethereum is the overwhelmingly favored platform for these launches and accounts for nearly 60% of all new ICOs.

Risks

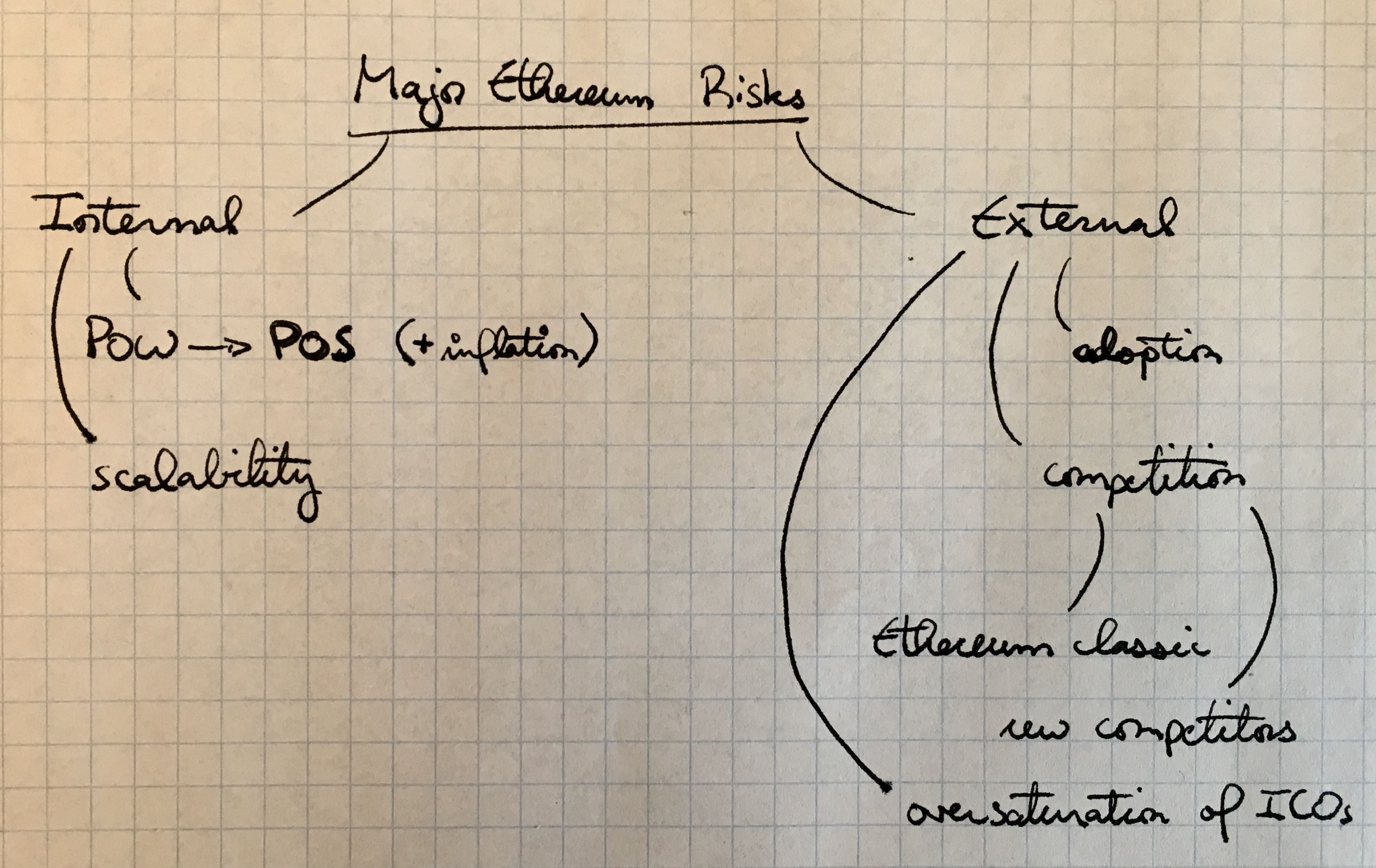

Internal

Proof of Work (POW) -> Proof of Stake (POW) (and inflation)

Like every other cryptocurrency, Ethereum requires verification of transactions before they are added to the blockchain. Similar to Bitcoin, Ethereum relies on a proof of work system.

To review, in a proof of work system, miners expend computing and electrical energy to verify that transactions are legitimate. Once the miners confirm the veracity of the transaction, they are compensated with new Ethereum. The amount of Ethereum with which they are compensated is proportional to the percentage of transactions which they were responsible for verifying.

While Proof of Work is a proven method, it has several downsides. The first is that huge amounts of electricity and processing power are needed. To put this into perspective, one recent estimate had worldwide Bitcoin mining using more electricity than Ireland. While Ethereum use is not quite as widespread as Bitcoin, similar conclusions can be drawn. Still, as the price of Ethereum continues to grow, it stands to reason that there will be more and more miners entering the pool.

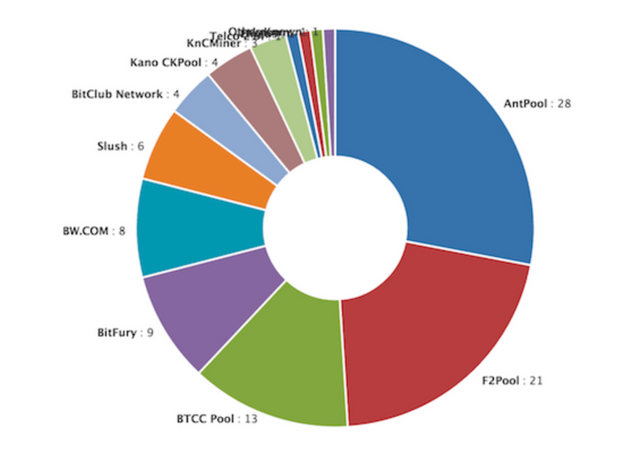

The second problem with Proof of Work is that it has the potential to centralize a process that was intended to be decentralized. Miners have the power to verify or reject transactions. Part of what makes cryptocurrencies so special is that the network (as manifested by the miners) is decentralized. No single miner can make a decision and everything is done by consensus. The issue today is that with the cost of mining hardware increasing, and existent miners concentrating, the idea of miners representing a disparate disconnected group is false.

The above is a pie chart of Bitcoin mining pools and the share of the market which they hold. Essentially, mining pools are groups of miners that have banded together. Regardless of which individual miner actually verifies the transaction, the pool receives prize and divvies it up amongst its members. This is done because competition is so fierce that on his/her own, no individual miner could hope to win the verification prize.

The downside is as previously stated: what was once completely decentralized is not concentrated between just a few parties.

As a result, Buterin has suggested transitioning away from Proof of Work towards Proof of Stake. Unlike Proof of Work, Proof of Stake does not rely on specialized hardware. In Proof of Stake, all Ethereum holders can participate in voting on transaction verification. Their voting power is relative to the size of their stake in Ethereum. The rewards for verification are also distributed amongst all voting parties based on the size of their stake.

This process would solve both the centralization problem associated with Proof of Work as well as the amounts of electricity needed to make it function.

The third issue that Proof of Work would solve is inflation. Unlike Bitcoin, Ethereum does not have a hard cap. There will only ever be 21 million Bitcoin in existence and the last will be created in 2140. With Ether, however, 18 million new tokens will be created annually in perpetuity. Two things: First, the rate of inflation caused by these new coins decreases as more coins exist. In other words, while the absolute amount of new coins being created stays the same, the effect that those coins has decreases because more coins already exist. Second, while this is the current issuance rate, it is expected to be reduced once Proof of Stake is implemented. Per Ethereum's website, the 18 million tokens per year is needed to incentivize mining. Once mining is no longer needed, neither will the incentive.

Scalability

Ethereum is presently caps out at around 15 transactions per second. Impressive! Only sort of. VISA can handle around 45000 transactions per second. In order to compete with companies like VISA, Ethereum will have to scale tremendously. There are several proposals as to how to accomplish this. Still, there is a large gap between having the idea and implementing it and until one of these solutions proves feasible, this will be a problem that hangs over the utility of Ethereum.

Adoption

Unlike Bitcoin, which can be pretty easily explained, the true value of Ethereum is relatively difficult to convey. Not only is it a currency, it's also a platform. Not only can you install logic into transactions, but those transactions can be run on individual nodes in the network. Also Ethereum allows other cryptocurrencies to launch securely. If you were making an elevator pitch for Ether, you'd need a 45 story building.

But there's a ton of value here. It's just that convincing people of that is slightly more difficult.

External

Competition

Like anything else, Ethereum can be overtaken by competition. Unlike Bitcoin, which seems to have internal competitors pop up by the day, Ethereum has only one at this point: Ethereum Classic. The DAO event mentioned earlier caused a rift in the Ethereum blockchain with the creation of Ethereum and Ethereum Classic. While most people understood that the mantle was held by Ethereum, a few have held on to Ethereum Classic which continues to exist today.

Additionally, while Ethereum presently has a near monopoly on the dApps, tokenization, and smart contracts, this may not always be. Several competitors have arisen that promise to provide what Ethereum does with several advancements. One of these competitors, Cardano, was established by a former Ethereum CEO.

Ethereum enjoys the advantage of being first to market and having cachet and name recognition. Still, the advantage of being first can be overcome should the right competitor offer a compelling enough product. Ethereum will have to continue to develop and grow to overcome present and future competition.

Oversaturation of ICOs

Likely the biggest threat to cryptocurrencies in general. The rise of the ICO has led to an explosion in the market as new cryptocurrencies can be launched with ease. Projects that often have very small, inexperienced teams launch their coins and raise millions of dollars. These coins frequently have lofty aspirations and goals that realistically cannot be met. It's as though anything with "crypto" attached to it is worth $30 million. If this sounds familiar, it's because it is. This is VERY similar to what happened during the dot com bubble in the late 90s. Anythign with a .com attached to it received huge sums of money. These companies often didn't produce anything substantive, certainly not enough to justify the money they raised, and created false wealth for investors. Once everyone started to realize what was happening, it was too late and the market collapsed.

Part of the problem with ICOs is that many are not vetted properly prior to launch. While companies used to go through venture capital funding to receive early stage investments, they now turn to ICO. While this has allows more far flung ideas to get funded, it has also exposed investors to increasingly risky projects, the vast vast vast majority of which will fail.

I hope that ICOs do not lead to the same fate that fell on early internet companies. Still, even though the market crashed, some companies did emerge from it stronger than before (looking at you Amazon). In the event of a crash, Ethereum would still have a very good chance of surviving as it still provides value as a platform moving forward.

Conclusion

Ethereum emerged from Bitcoin because its founder did not feel that Bitcoin was reaching its full potential as a cryptocurrency. By implementing smart contracts, Ethereum has distinguished itself from other cryptos and has become the second most valuable cryptocurrency. Its presence as a platform has also enabled the growth of the cryptocurrency market in general to both good and ill effect. Going forward, Ethereum will continue to appreciate in value as both a currency and a platform. The actualization of Proof of Stake will also help redemocratize Ethereum and help maintain the vision set out by its founder. While it is difficult to valuate Ethereum, it is hard for me to see it falling from the second position in terms of value. At one point, it was valued at 0.1 BTC. As of December 2017, that has fallen to 0.04 BTC (partially because of Bitcoin's explosive growth as well as because of Ethereum's inability to keep pace). As more people become aware of Ethereum's potential as a platform and centrality to other cryptocurrencies, I expect its value to rise back toward the 0.1 BTC threshold.

Further reading/listening

I full recommend listening to the below podcasts. I found them informative and interesting regarding cryptocurrencies.

Invest Like The Best - Episode 1 - Understanding Blockchains

Invest Like the Best - Episode 2 - Investing in Cryptocurrencies

Invest Like the Best - Episode 3 - Funding, Forking, and a Creative Future