Price To Sales Ratio Says Ethereum's Prices Is Really Really Cheap

There are many forms of widely used Valuations Ratios to gauge the worth of an organization, such as Return on Equity (ROE) or Price To Book. These ratios are usually used to compare the performance of an organization with that of its peers. For instance, a major corporation with the highest ratios of sales to assets may be viewed as having excellent financial health relative to its peer group. On the other hand, an organization with low revenues might not be doing so well because its asset value is less than its assets.

When I think of valuation ratios, I think of the price to earnings ratio. In the technology sector, the price to earnings ratio is either too high, but ignored due to tremendous growth or a tech company won’t even have a P/E number due to having no earnings at all.

I never considered applying a valuation ratio to the crypto space, it’s so new, we never seen anything like it before. The Price to Sales Ratio is an important ratio used in the valuation of different businesses. The P/S ratio is actually an investment valuation ratio, which indicates the overall value of a business divided by its sales for the past twelve months. It's a good measure of how much an investor is paying for a given stock per unit of that company's sold shares. However, what I like about the P/S ratio is it doesn’t rely on earnings and as you saw in the previous paragraph graph very easy to calculate.

Ethereum was created by Vitalik Buterin to create a standardized protocol for a decentralized web. This would connect smart contracts on the fly between different e-commerce and network participants as he thought this was going to be the next big thing in Internet technology.

Ethereum 2.0 is the next upgrade to the Ethereum blockchain. Ethereum 2.0 will happen in multiple “Phases” starting in 2020 with Phase 0 with each Phase improving the functionality and performance of Ethereum. Proof of Stake (PoS) will also be upgraded with Ethereum 2.0. PoS is a consensus mechanism that relies on validators and staked ETH for the continuation of blocks on the blockchain.

To date, the total amount of staked ether continues to rise for the network. And with this rise, more and more ether is leaving centralized exchanges for Ethereum 2.0. Some experts are saying that Ethereum 2.0 validators could earn about 20% in annualized rewards.

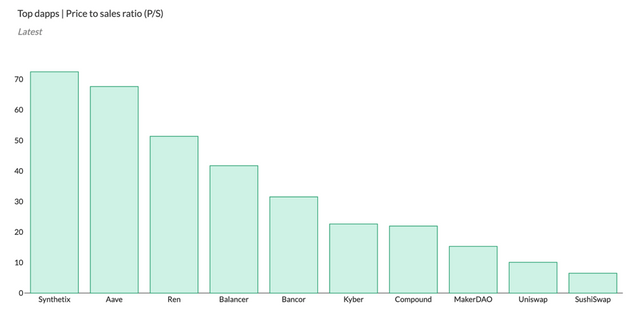

Financial metrics provider Token Terminal recently shared a report identifying the top-performing protocols in the market based on their Price to Sales (P/S) ratio. The P/S ratio compares a protocol’s market cap to its revenues. A low ratio would imply that the protocol is undervalued and vice versa.

The lowest-ranked protocol was SushiSwap, making it the most undervalued protocol according to this metric, followed by Uniswap and Maker.

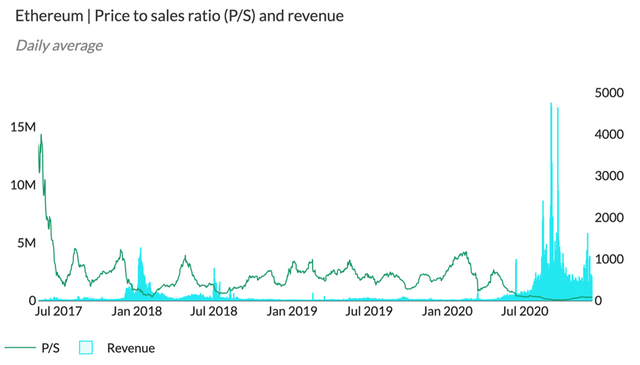

According to the above charts, Ethereum’s P/S ratio has fallen drastically over the past few months and is even on par with some of the market’s leading DeFi protocols. Daily revenues have also been consistently high during Q2 to Q4 of 2020, something that implies significant growth of late.

As the bull run in the crypto space is just getting started, buying Ethereum between $400 and $600 is like buying Bitcoin below $20k. See you in December of 2021.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.