Ethereum’s supply has been inflating for 73 days straight

The supply of ETH has gradually increased since mid-April, with the Dencun upgrade decreasing competition for block space on the mainnet.

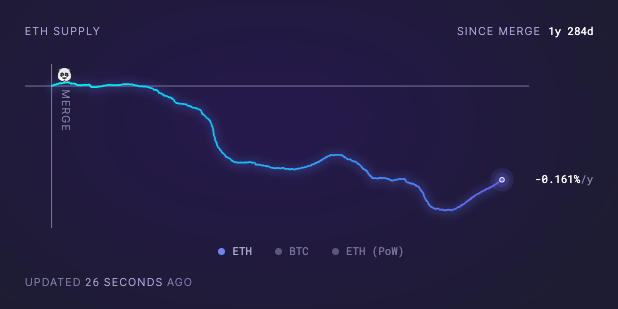

The supply of new Ether is in its most extended inflationary spell since the Merge in 2022, and the blockchain’s Dencun upgrade in March seems to be responsible.

The supply of Ether

ETH

tickers down

$3,379

has gradually inflated, with over 112,000 ETH added to the overall supply since April 14, according to Ethereum data dashboard ultrasound.money.

Much of this inflationary activity can be attributed to the Dencun upgrade implemented on March 13. This upgrade introduced nine Ethereum improvement proposals (EIPs), including EIP-4844, which seems to be the primary cause of the inflation.

EIP-4844 introduced “blobs,” a mechanism that allows transaction data to be stored separately and temporarily, reducing the fees paid for block data on Ethereum layer-2 networks.

Additionally, Dencun introduced proto-danksharding, which saw more efficient data availability for block space on the Ethereum mainnet.

Related: Ethereum futures markets suggest rally to $3.7K is highly unlikely

While this saw a massive reduction in the cost of executing transactions on Ethereum layer-2 networks such as Abritrum and Optimism, the total amount of ETH burned on the mainnet has fallen significantly.

While ETH supply has flipped inflationary in recent months, the total supply of ETH has still decreased significantly since the Merge.

In total, more than 1.5 billion ETH has been burned since September 2022, while 1.36 billion ETH has been added, resulting in an overall supply reduction of 345,000 ETH, equating to just over $1.1 billion at current prices since Ethereum switched to a proof-of-stake consensus mechanism.