What's the Supply: An Ethereum monetary policy?

Bitcoin maximalists and ETC pumpers will go on and on about how the supply of ETH is not capped and how terrible that is. What is the monetary policy of Ethereum? How many coins will there be in 6 months? 20 years? Has the Ethereum foundation wavered on the future Ether issuance?

Bitcoin is special. There will only ever be 21 million bitcoins in circulation. This point is central to the core monetary consensus around Bitcoin as a whole. The total issuance and inflation rate over time were parameters known from day one. These were both important properties for Bitcoin investors. Deflationary assets with very public inflation rates are rare; Bitcoin fills an extremely unique store of value property not necessarily found in other markets.

Not all assets need a strictly defined monetary policy in the same way as Bitcoin. Even gold differs with the ability to mine at different rates. With Ethereum, these monetary supply parameters were not set in stone in the same way as Bitcoin. Consensus formed around a model with an essentially undetermined cap. Ethereum's vision and the ultimate issuance mechanism were unknowns at the start of the project. The Proof-of-Stake consensus Ethereum hoped to transition to was uncharted waters. Early investors understood this uncertainty and the undetermined supply cap.

Well undetermined is not entirely true; the current Ethereum Ice Age implemented as calcDifficultyDiehard in the Homestead release essentially limits the coin supply to just slightly over 100 million. By 2018 the blocktimes will be hundreds of seconds and increase rapidly. However, the implication of the Ice Age or 'Difficulty Bomb' is such that the community must form consensus on how to evolve the monetary policy at a certain point in time, otherwise the blocktimes will grow so long that the system becomes unusable. If people want to keep using Ethereum, there must be a hardfork to change the mining difficulty and thus the inflation rate. Consensus must be formed by the community as to how best to evolve the economics.

Ethereum is a system built with problems hinging on problems with unknown solutions. There is even uncertainty that Proof-of-Stake and the implementation of Slasher consensus will be possible in the first place. Casper (the PoS algorithm) represents a significant area of economic and technical uncertainty around the Ethereum project.

Vitalik and representatives from the Ethereum Foundation have been pretty clear that issuance under Casper (PoS) will be much lower than the current mining curve. While zero (or even negative from fee-burning) inflation rates have been mentioned as potentially possible, it has been made clear that it unknown what the exact rate will be. This coin emission rate will be determined by the lowest amount needed to have a secure PoS consensus.

Vitalik Buterin writes:

I think we've been consistent on the issuance question. The issuance is whatever it needs to be to ensure reasonable lvl of security.

Based on further comments by Vitalik, it looks like the initial version of Casper can expect to dole out .5-2% inflation. It will be interesting to see how this inflation rate marriages with the burning of Ether and the loss of coins that will come with a heavily utilized system.

Once Casper comes out, ~0.5-2% annual seems feasible. Once we add partial tx fee burning and if fees go up, may go to 0 or lower.

World GDP growth represents a realistic long-term cap on inflation. I do not think a higher rate of inflation is sustainable long term. This hovers around 2.5 percent this year but historically annual rates between 2 and 5 percent were common.

As the Ethereum Foundation continues their groundbreaking work on PoS consensus and protocol validation, users will get a much better view of what the long term monetary supply will be. A 1% annual inflation still represents an unlimited coin supply. Negative inflation is interesting. We just don't know.

The monetary policy is not the hot topic for today.

What about Ethereum Classic

Well not to mention anything about the stark contradiction to their immutability claims but Ethereum classic has implemented and finalized a monetary policy.

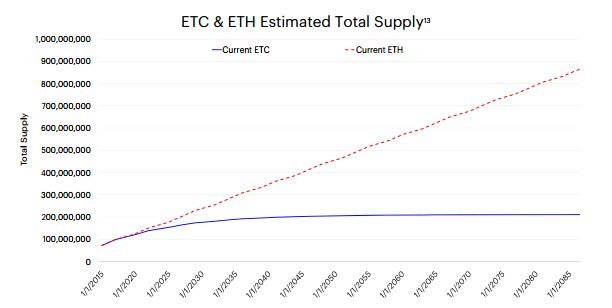

Barry Silbert likes to poke and prod on twitter about Ethereum being 'uncapped' and the Silbert-owned Grayscale investments blabs on about this in their 'Investment Thesis'. Going so far as to post graphs comparing ETC and ETH without even following the code as implemented today: with the difficulty bomb. Ethereum Classic makes false statements about ETH supply not consistent with the Ethereum Foundation's roadmap or guidance. This is misleading and frustrating from an asset with a monetary policy designed especially to be attractive to institutional investors through the shady Ethereum Investment Fund.

ETC is not moving to PoS consensus so this discussion is not entirely relevant; only Ethereum Classic pumpers misleading others about the monetary policy of Ethereum. None of them know what they are talking about. They just want their classic coins to be worth something, maybe they will be.

Safe investing,

Kyle

I was active in the Tweet thread about this. Good article.

https://twitter.com/EeksTheUnwise/status/880068393558081536

I would add that the point of a blockchain is not "monetary policy" and blockchains that focus on it to the detriment of everything else are missing the point. Inflation exists to pay for security. It serves a purpose. And for Ethereum, inflation under POS will be less than inflation under POW. Because POS as contemplated allows for a more efficient security design than POW. So Ethereum's inflation should be very low. This has been the design forever yet opportunists and partisans lawyer this point as if Ethereum has crazy highm uncapped inflation. So it goes.

I saw that, would have liked but I don't have a Twitter.

What was with that troll.

I love this quote. Making bold:

Disclaimer: I am just a bot trying to be helpful.

great post, and much needed for many including me, Is it possible that there could one day be more than 21 million bitcoin if for some reason there needed to be?

Well technically.

Someone could fork bitcoin and make more coins. The problem is getting everyone who uses Bitcoin to use that version. Not many people conceivably would because the main social contract behind Bitcoin is the coin limit.

There is a reason that limit is so highly regarded.

The inflationary aspect of the currency is what scares me as well, over the long term it seems like currencies with a finite production limit should do better.

Well we don't even know if inflationary is what ethereum is going to be. There is nothing wrong with inflation. It might be necessary to provide the security of the network.

Great post. I too am really concerned about Ethereum's lack of monetary policy. I have a suspicion that ETH might well run into issues if killer dApps don't start to be released soon. Is ETH to be the internet of agreements, or are other blockchains going to take that title from it? I think there needs to be something big happening in the Ethereum world really soon, and Casper just won't really cut it.

The whole point of this post is to show that Ethereum does have monetary policy. Casper is the best shot at scaling blockchains to date. Nothing else compares. There is plenty big happening in Ethereum.

Where else is it bigger?

Great thoughts as useful. I really need to keep up with ETH developments better. There are just so many things happening. Do you know how progress is going on sharding? All I know is that it is technically difficult and potentially increases the attack surface for the network. I really need to finally get the guts to trade 50% or so of my BTC for ETH, it's just that ETH has had such a crazy run so far....... sigh

Sharding -- years.

Discount Ether today lol

Sharding and Casper are unsolved problems that have glimmers of light but a lot of work ahead.

I believe that ETH has a competitive advantage over ETC. ETC's price is going up only because people think that it is similar to ETH with a lower price.

Wonderful explanation for those of us (me) that don't take enough time to really understand these things. I wish my upvote counted for more solely to give you credit for your on-point posts

Disclaimer: I am just a bot trying to be helpful.

I believe in ETH. Most of my savings are ETH based!