Can you put a price on security? Let's examine the history, and predict the future, of the Ethereum block chain. 1 - 2 - 3... Dive!

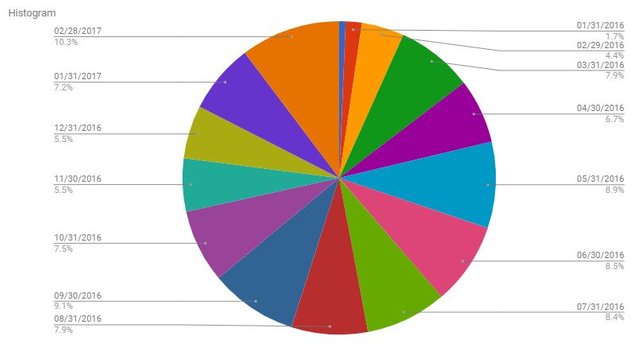

What you see above is a chart of the expenses paid to maintain block chain security as spent by the Ethereum block chain. The small Blue sliver is January, 2015. The big Orange slice is the amount spent February, 2017, or $13 Million.

Ethereum - Historical Ethereum Costs

https://docs.google.com/spreadsheets/d/1onjAoS1oBEE4B15i2u_VuXPAG4556v-nPfe7qktrEJU/edit?usp=sharing

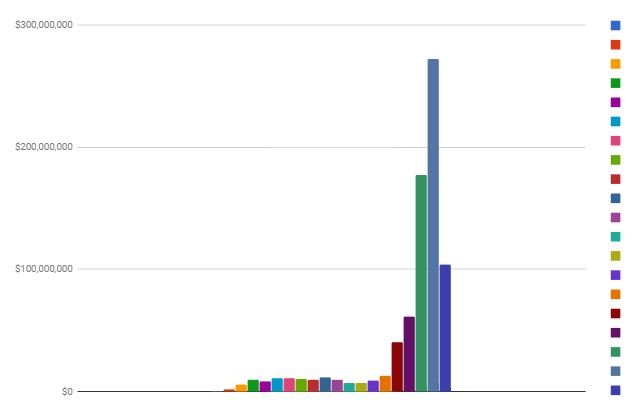

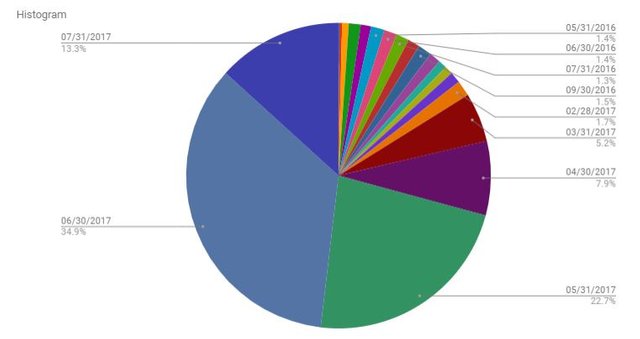

The small Orange bar is February, 2017 or $13 Million. The Red is March, 2017 (about $35 Million), April, 2017 (about $55 Million), May, 2017 - $170 Million, June, 2017 - $270 Million, and July, 2017 - $100 Million.

The question is, did the cost of computers change from $13 Million to $270 Million between February and June 2017, or increase by 2,000%? Note : June 2017 is the most ever spent in a single month by any coin, ever, including Bitcoin.

The obvious answer is that they did not, and Ethereum spending 20x more than they did in February was the result of poor code design, rather than an intentional desire to spend 20x more than they did 4 months prior. However, you will get numerous sycophants who suggest it was intentional. :P - The truth is that this issue was spoken of at length by Vlad and others, but had been ridiculed and overlooked during the run up of popularity, and hasn't been reconsidered until August 1st, 2017, when I brought the issue forward to Vitalik.

Many within the Ethereum organization still, unfortunately, do not appreciate the insight an economist can bring, and suggest worth of a business can not be evaluated using numbers. One of them suggested I was making up terms by use of the word "overhead". Programming smart, business management not so much. In either case, after numerous harsh responses without any justification, Vitalik stepped in and put forth the proposal.

I assure you most within the Ethereum foundation are violently dismissive in regard to understanding the simple business economics of block chain technology, and they need your assistance. Read on.

Ethereum - Cost of Block chain Security

In May and June Ethereum spent more for block chain security than it has during it's entire history. In each individual month, more was spent than was allocated during all of 2016.

Again, many will suggest Ethereum management is infallibility, and that spending $270 Million in June was appropriately allocated. The substance behind that statement is blatantly false, as it goes up and down both before and after.

In June, Ethereum Miners sold $270 Million ETH at market in order to pay for their mining equipment, and to reap profits. With a proper adjustment, this could have been only $50 Million.

The next part of the equation is, will eliminating $200 Million at market sales of ETH monthly have an impact on the price?

Surprisingly, many are perplexed at such a proposal, and claim the outcome is unknown. I can 100% assure you that if less people are selling Ethereum at market, that the price will go up more than it would have otherwise. It takes about $5 Million at market ETH sold in a single day to have a significant impact on the price (+/- 10%), in my opinion (more math). This would reduce the monthly at market sales of ETH by $200 Million, at the $400 price point.

Keep in mind security costs are relative to market price, thus as the price goes up, so does the amount spent on security. This can only be manually corrected, as I am suggesting here.

Thus, for miners and for 'security', it creates a bit of a paradox. The less Price Deflation allocated to mining, the greater the price stability, the more fixed dollars spent on mining security. Put another way, if it was cut in half (reduced inflation) and the market cap doubled, then the amount spent on security would be the same as would have been otherwise without change. Thus, it is important to realize reducing inflation (and likely has the converse effect) does not necessarily reduce total amount spent on security.

The overall objective is to maintain between $50 Million to $100 Million monthly.

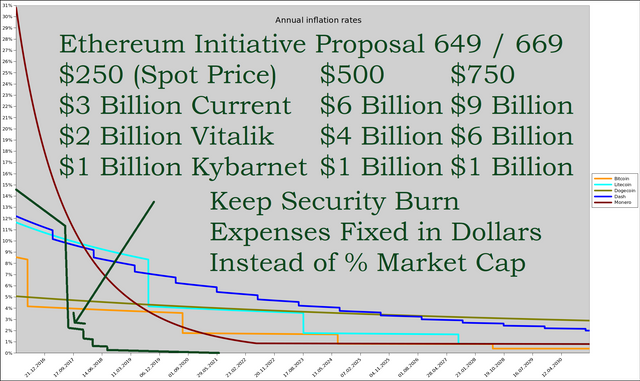

EIP : 649 / 669

Above you have my suggestion. By reducing inflation 80%, eliminating $450 Million at market sells of Ethereum over the next 3 months, Ethereum will still pay $40 to $26 Million monthly toward security, at prices between $250 and $150. However, you'd find that the price would quickly rise, perhaps to $1,000 within 3 months (this is my prediction), at which point you'd be paying the same fixed dollars for security with 2% inflation as you would have paid with 11% (at $200).

It's not really that complex mathematically, but it requires a bit of time to think and digest. Block chain can change forever. Please support my proposal. Thanks for reading!

https://github.com/ethereum/EIPs/pull/669

A bit more math:

$200 (spot price) x 93 Million x 11.6% inflation = $2.2 Billion total spent for block chain security

$1,000 (spot price) x 93 Million x 2.2% inflation = $2.2 Billion total spent for block chain security

$1,000 x 93 Million x 11.6% = $11 Billion spent for block chain security

Which is more important, total dollars spent or a fixed percentage of market cap?

Bitcoin spends $1.6 Billion, at 4% which is an unalterable guess for 2017, locked in during 2008 / 2009.

LiteCoin spends $200 Million annually and everyone else spends less than that, other than Ethereum.

I am suggesting $50 to $100 Million MONTHLY - which is 80% less inflation than today.

At the $400 spot price, Ethereum must spend $4 Billion, without the manual fix I suggest.

Note how the Bitcoin price ABSOLUTELY SOARS each time Security Burn Expenses as a % of Market Cap is cut in half.

1 ETH is an 80% Reduction, thus price would Soar hugely. 3 ETH is 40% Reduction.

Effectively what this shows is that $ value Security Burn Expenses actually goes up as the % payout goes down, due to the increase in popularity because of the improved efficiency. Once this gets below 2%, it becomes more difficult to become marginally more competitive, due to economies of scale.

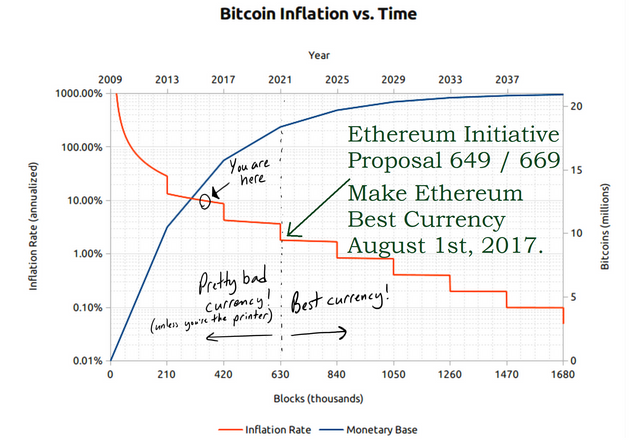

Rough Graph made in 2015 demonstrating the importance of obtaining less than 2% rates of inflation, as it creates the "Best Currency!" vs "Pretty Bad". Although the math is simplistic, the conclusion was correct.

This Bitcoin enthusiasts believes this can be obtained in 2021. Fortunately any currency can claim this spot as their market cap begins to exceed $500 Million, and it will be grabbed much sooner than 2021. Ethereum had the objective of securing this spot with Casper, but it can come closer than anyone else has to date with Metropolis, by implementing Ethereum Initiative Proposal 649 / 669, August 1st, 2017.

Good article