Ethereum potential bombs

Today I want to share some insights on potential risks, especially in regards to ETH prices,

*Disclaimer : This is not meant to be a FUD article, but inevitably risks will create FUD so read this at your own discretion. While we all enjoy the ride of ETH skyrocketing throughout the year, it is always a good idea to know what you're investing in, understand potential risks in your investment. I will follow up with another article "ETH potential gems", so you get insights from both angles. Do your own diligence however and make your own investment decisions, what I write is by no means any investment guide, it is merely what I observe only.

Price Correction

Many think it is imminent, many think it'll continue to trend up. This is always 50/50 at any given time, so any prediction is no better than the other. You can however base your predictions on data and facts and some educated analysis. Based on historical data, no financial products/stocks go 5000% up without a correction, I do believe a price correction will happen, I don't know when and I am not going to predict that. Corrections are healthy in the aspect of psychological uncertainties, if we wish ETH continue to rally up in the long run, a true correction is necessary.

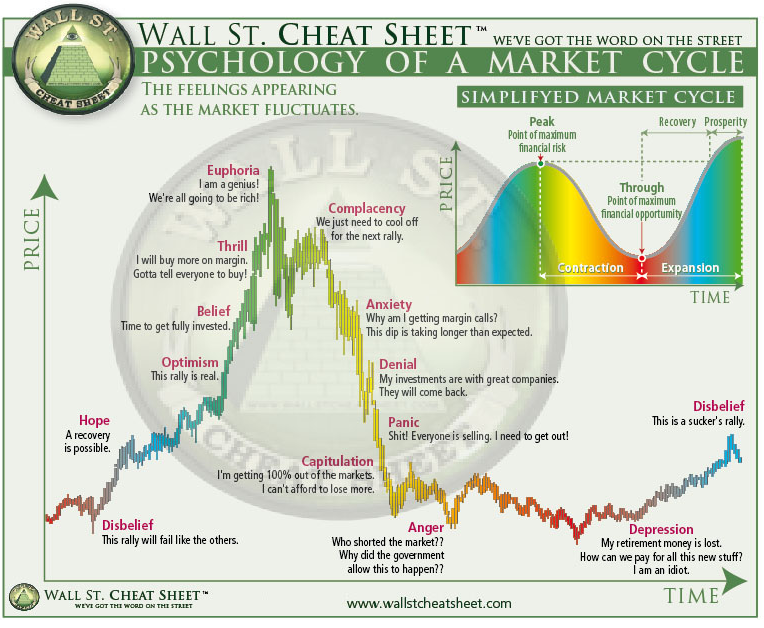

Correction != market crash, a correction is shorter in length and less damaging (usually ~10% for a minor correction and true corrections usually go up to 20% but probably no more than that, this also depends on the stock(or eth prices in this matter) performance in the past. So simply put, it is less severe and it is much needed 'evil' to cool off overheated market. You see terms like 'bubble burst' or 'capitulation', that's when FUD sells starting to occur, and everyone tries to get out of the market as soon as they can before more damage can be done to them, in that case we have entered a bear market where price falls can go 50% and beyond.

Dumb Money

Let's be honest here, all these moon hodlers barely understand what Ethereum is as a technology, its development progress and its technical capabilities today. They tend to disagree with anything that poses threat to ETH price, and only that. Investors like these fit to this image

Current reactions from various discussion threads I frequent, I'd say we're in Complacency stage, while many still post moon/lambo memes to mentally support the weak minds (including themselves!), I think sooner or later they will just repeat the same mistakes and fall right into the cycle of the above image.

ICO Bomb

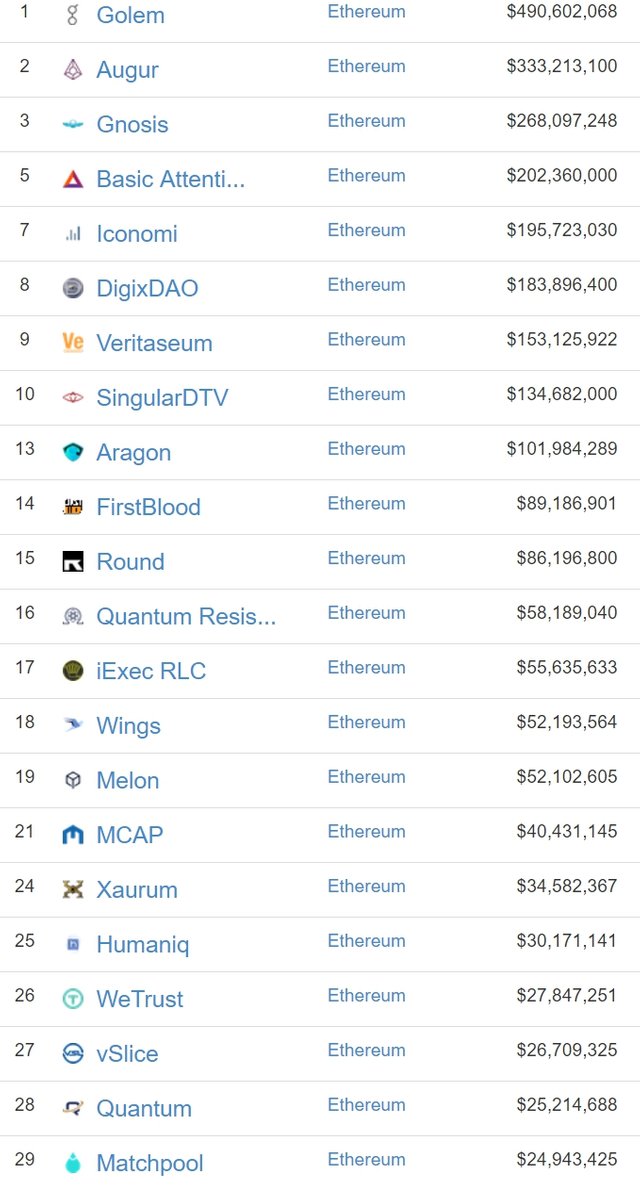

Crypto assets in ethereum market cap is around 3B USD, close to 10% of total Ether market cap, so the success or failure of ICOs will heavily influence ETH prices.

Let's look at one of the recent successful crowdfunding Gnosis, token sales were just north of 300 million (272 million as of this writing). This is simply RIDICULOUS, no companies in any industry should have a valuation like that before any ground work's done, proven model and actual sales (or users), whatever brings value to the company. What happened in reality was that all the FOMO buyers jumped in, majority of them didn't even read the whitepaper, some don't have the slightest clue what Gnosis is, but they just don't want to miss out with all this hype and ETH prices this year gave them that extra imaginary horse power thinking everything will just go fast. The Gnosis team invested $0 into this (besides manpower and some misc running fees) while investors put in actual fiat-converted artificial tokens into this. I am not going to the side of conspiracy theory here, but really they have nothing to lose, and a disgustingly over-valuated company, what do you think will happen next if the project did not go as planned and goes south? This is not targeting a specific company but ICO crowdfunding in general. When traditional startups first build a proof of concept, alpha launch beta test the standard deal, when you have something of value (sales or users or whatever), you raise funds then, in sequence (Seed funding to Series A, Series B etc). In crypto space, companies get insane amount of money over an idea, and I have no idea why would a company ever need that much money to run! There are some other even worse prepared ICOs (check out the iDice story and how they copied code straight up from other ICO and just launch it like a real deal).

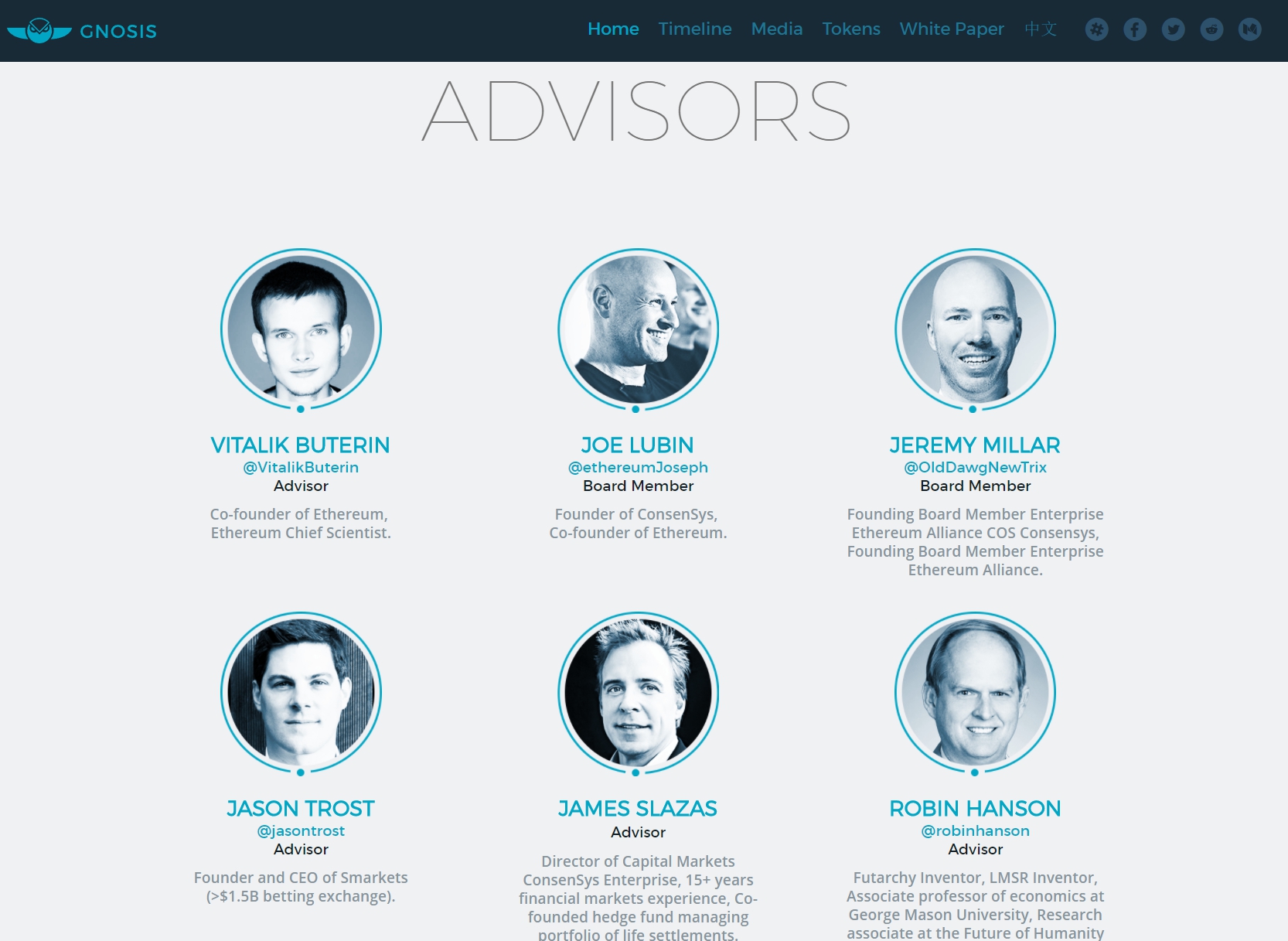

Let's also take a look at the advisors for Gnosis, impressive isn't it?

BUT!

Vitalik Buterin: 2. @omise_go and @loi_luu 's Kyber are only exceptions; nothing after this point

Vitalik Buterin: 5. Most existing projects that listed me as an advisor never paid me a cent for it.

So much faith for a company that pulls stunts like this. Even after Vitalik's public denial of being an advisor, until this writing, they're still not removed from the page.

(Yes I do think some of the ongoing ICOs seem promising and I hope they deliver, this is one of the most important aspect for Ethereum success. I'll leave that to the next article since I am discussing potential risks in this one).

Waking of the Dragon

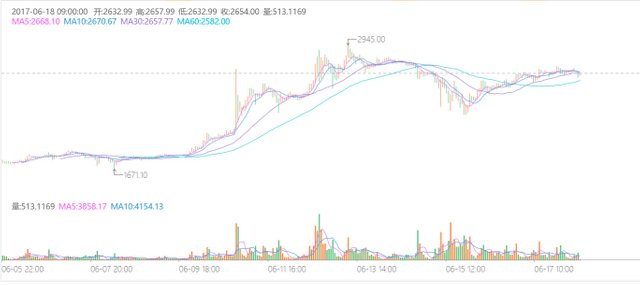

I see a lot of ignorant posts claiming that once we wake the dragon (CHIINA!), we'll be driving our lambo on the moon!! Well, sorry but again, DUMB MONEY. BTC's been covered by major media in China for years, I'd say the dragon has already been awaken to BTC. Now lets look at trading volumes in CNY exchanges

Roughly 25% of global trading volume in ETH

Roughly 10% of global trading volume in BTC

So it is clear that not only is China very aware of ETH, they account for a quarter of all global transactions.

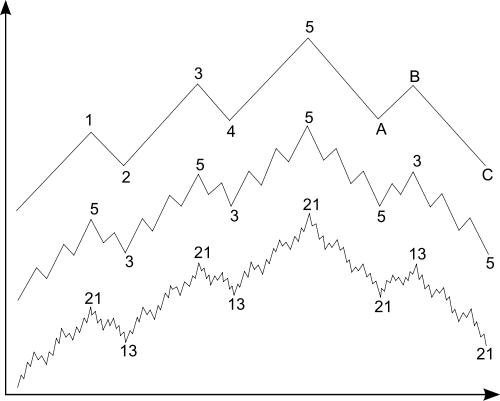

Wave Five

Wave five is the final leg in the direction of the dominant trend. The news is almost universally positive and everyone is bullish. Unfortunately, this is when many average investors finally buy in, right before the top. Volume is often lower in wave five than in wave three, and many momentum indicators start to show divergences (prices reach a new high but the indicators do not reach a new peak). At the end of a major bull market, bears may very well be ridiculed (recall how forecasts for a top in the stock market during 2000 were received). See full details from Elliott wave principle

As far as I can tell, if we base on Elliott wave, we're pretty close to wave five, being a believer, again I think the price will soon face correction.

Government Regulation

S.1241 - Combating Money Laundering, Terrorist Financing, and Counterfeiting Act of 2017

ELI5: Essentially US government wants to stay in control, digital currencies will be governed in a way that you're obligated to report transport of 'Monetary Instruments' in excess of US $10,000. It is a crime if you don't do so and can face up to 5 years imprisonment. This is not a brand new idea if you have traveled overseas before and needed to fill out this form at the custom. They want to do the same to cryptocurrencies is basically what this bill is trying to accomplish here. Also the obvious, exchanges will need to register and follow US regulations. How much governance is moderate is not up to anyone in the crypto community but the US government, kinda defeating one of the main purpose of cryptocurrency. Can this possibly get out of hand? Certainly.

Please leave your comments, criticisms are welcomed, I believe more discussions like this will help improve the community. Also upvote if you want to see more contents like this so I know I am not talking to myself here :) Thanks for reading!

Follow :)

Thanks man!

Detailed analysis, like your approach and activate my thinking, keep up more posts

Thanks! Glad to be of help, will share more insights soon!

Disclaimer: I am just a bot trying to be helpful.

hello does you trade eth?

Yes I certainly do, and for what its worth I am a believer in ethereum, but I think its only fair that we dont treat this technology as a fantasy and claim that ETH will reach the moon without any stops! Be more objective, less ignorant and open to criticisms.