Ethereum Stunted by Greed

So, for all you crypto-enthusiasts. I wanted to share a post regarding Ethereum, and where it could potentially be heading.

Ethereum has seen an exponential rise in the number of transactions per day over the last few months as they went from 50k to 300K in just a few weeks.

There’s an easy explanation for this kind of growth as it all comes down to coin transactions (ETH), ICOs and dapp interactions. The latter is something not seen on the Bitcoin network and that’s the whole reason Bitcoin has some time left for discussions about bigger blocks, SegWit and more. In “Ethereum heading to its limits” I already explained why I think there will be trouble in the near future. Ethereum has quite some scalability issues and the fear of missing out (FOMO) makes people greedy to the max jumping on whatever hype that’s created. The 150 million dollar Bancor ICO was a good example. Just ask yourself: for what reason does a team need 150 million dollar to build contracts on a blockchain system? With a 100K salary you could have 1500 devs working for you a whole year long. Does it take that much effort to build your idea (one which won’t work by the way)?

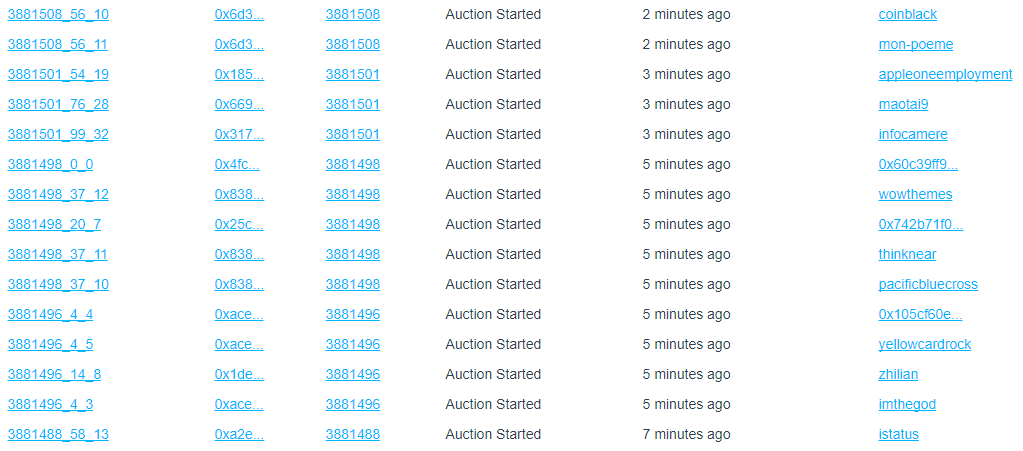

Latest hype in the Ethereum community is the Ethereum Name Service (ENS). Well, that must be a simple contract to register a domain isn’t it? Wrong! Of course there’s speculation build in the core of this idea. With “auctions” people can secretly bid on a domain. Driving up prices for names like Samsung.eth and Realestate.eth

Why on earth does someone think the name Samsung on a blockchain is worth almost 100.000 dollar? It’s probably for the same reason one person/group bought 3443 domains all together. The hope is that other fools will one day pay them even more than they’ve invested themselves.

The ENS is growing in popularity at the moment as people really feel the need to register names like: Gunstores, Netflixs and Lasercut for some reason. Several new auctions start every minute and every auction is open to hidden bids. And as you probably guessed; all these bids/auctions/registrations take place on the blockchain which can handle only a few transactions per second. In my last blog I predicted that Ethereum can’t handle 10 Ts/sec. and we’re heading quite fast in that direction.

I discussed elsewhere that a few weeks ago, about 1 or 2 dapps were able to take up all miner capacity:

"Chances are big that Ethereum will kill itself before the innovation arrives. Miners will exclude a lot of Dapp interactions as they can only fit a certain amount of “people” in a room."

Over the last few weeks I actually got 100% sure that Ethereum will hit the iceberg within a few months. All growth-trends point in that direction and you can see it yourself if you follow several variables. I list them all below for you to see for yourself:

-The number of auctions started per minute on the name service is growing at a fast pace.

-The number of registered hashes is also growing at a fast pace.

-The number of bids on domains.

-Here’s the number of pending transactions for Ethereum and we’ve seen thousands of them when the Bancor ICO went live.

-Here’s the number of blockchain transactions per day. It gets updated on a daily basis. Make sure to follow this one.

-The number of transactions per second can be found here. I predict it will crack at around 7 even though the Ethereum devs claim it’s between 10 to 20 per second before there’s trouble. The Bancor ICO made me think otherwise as we’ve seen thousands of transactions pending for quite some time.

Thanks to Yo Banjo for facts and graphs.

Congratulations @jaycapz! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!