ICO Details: Hive Project

What is the hive Project? “Hive provides new financial liquidity to small businesses by leveraging blockchain technology, giving them a range of crypto-currency based financing options”

*From the Whitepaper*

- Hive (HVE) uses blockchain (distributed ledger) technology to assign a unique fingerprint to every invoice issued. This makes it possible for businesses to automate their invoicing process and take advantage of factoring services. Hive serves as a decentralized data room for all invoices submitted, each of which has a unique record for the issuer, owner and payer. These invoices can therefore be made available as a shared source of liquidity for factoring and invoice financing. Furthermore, businesses can take advantage of the cryptographically secure nature of the Hive blockchain network to upload all of their financial documentation. Access to detailed financial data about a specific company or invoice can be granted only by the company itself or the recipient of the invoice. This enables real time auditing to be conducted, improves the credit scoring process, expedites credit approvals, etc.

- Hive provides other services for companies willing to make their business and financials more transparent. Financial items can be uploaded regularly to the Hive blockchain, with a time-stamped record of every transaction made. The company then decides how much information it is willing to expose to the counterparty, with the benefits including increased transparency and the eventual ability to expedite the credit scoring process as a result.

- Once the Hive network has become established, the second stage in the development process will be devoted to setting up the liquidity pool, which will enable investors to benefit from short-term financing, such as factoring and invoice finance, an industry valued at USD 2.4 trillion in annual volume worldwide.

- Hive’s algorithms will be used to assess the credit ratings of each client, selling this data on to third parties who are interested in entering into business operations with the client or perhaps to someone who wants an insight into the business (shareholders, auditors, regulators, etc.).

- A HVE token grants the token holder the right to purchase invoices on the Hive platform and obtain credit scores for certain entities which have a sufficient financial track record on the Hive blockchain. Invoices are uploaded to the ethereum blockchain regularly and at no cost by claim sellers looking for liquidity. A HVE token is therefore the entry point to the Hive network. If the funds raised during the Hive ICO exceed BTC 1,500, the token holders will have the value of their tokens backed by Hive’s initial liquidity pool, which will selectively invest in invoices at a discount that is sufficient to enable a proper yield in risk-reward terms.

The three paragraphs above summarize the 5 page whitepaper but doesn't go into to much or any detail of the exacts of how they plan on doing this. You can read way more about how they plan on using Smart Contracts, the Ethereum Blockchain, and enabling invoice trading on their Bluepaper. There is also a Hive Roadmap where you can check out the estimates release dates for their product.

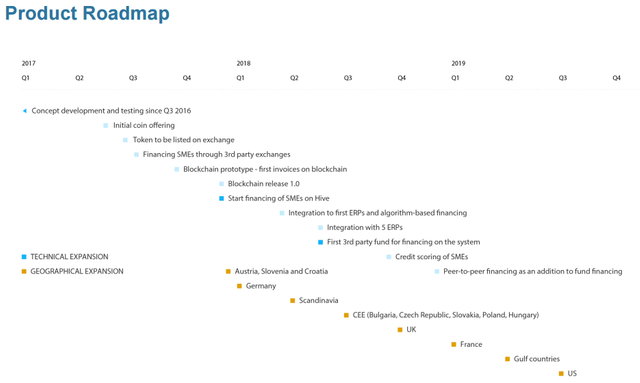

Hive Project Roadmap

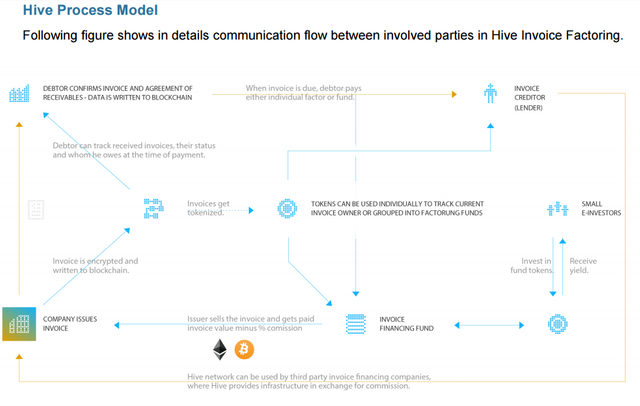

Hive Project Platform Model

The Team: (Click names for LinkedIn Profile)

- Co-Founder: Jure Soklic (CEO)

- Jure is an executive and consultant with extensive experience in the international financial industry. He is an expert in eCommerce, digital marketing, omnichannel, retail, business development and start-ups, and has strong track record in the field of finance, consumer durables and marketplaces. A true believer in a decentralized economy.

- Co-Founder: Dejan Jovanovic (CTO)

- Dejan is a seasoned executive with over 25 years of experience in software engineering and leading large technology teams. Well practiced when facing complex challenges, and in times of rapid change, Dejan applies his broad business perspective to finding technological solutions in the application development life cycle – from the business vision and requirements all the way through to application deployment.

- Finance Lead: Oliver Muldoon

- After spending ten years in the City of London, gaining experience at various magic circle law firms, Oliver began working for Bank of America’s legal department in London. In 2008 he took over the AVP position at the bank’s asset based lending division. As lenders of last resort to distressed companies, Oliver was tasked with ensuring that the bank’s exposure to its clients was protected. Invoice financing is just one of the many forms of financing Oliver has experience in, and his practical experience in this area will be important in helping Hive achieve its objectives.

- BlockChain Lead: Stanimir Savov

- Stanimir has 7 years of experience working in the US and Europe as a senior developer in the fintech, automotive, insurance and CPG industries. He was recently involved in the development of the loan application, lending flows and user profile verification process for BitLendingClub, the Bitcoin crowd-lending platform.

Advisers:

- Finance Advisor: Ugur Yildirim

- Ugur has over 15 years of investment management experience and is a co-founder and partner of Elements Capital Partners, a firm which specializes in distressed investment opportunities and turnaround cases. The firm, which is trusted by global institutional investors, currently advises and manages EUR 800 million of NPL transactions in Eastern Europe. A member of the World Turnaround Management Association (TMA), Ugur has also served on the boards of several investment management firms in SEE. Ugur studied at Ljubljana University, Harvard Business School and the London School of Business & Finance.

- Business and Strategy Advisor: Vasja Zupan

- An accomplished professional with a strong track record of overseeing comprehensive project success and delivering top performance in challenging situations, Vasja is the COO of Bitstamp and responsible for the daily operations of the exchange. His specialties include Bitcoin, blockchain technology, cryptocurrencies, digital media strategy, operations, product development, consultancy services and turnaround management.

INVESTING DETAILS: ACCEPTING BTC AND ETH

Token Name: HVN (Hive Token)

ICO Duration: July 3rd - August 14th 2017

Total Token Supply: 500,000,000; only 375,000,000 HVN for crowdsale participants.

Funding Goals: 2,000 - 10,000 BTC

Price: *Price released 7 days after ICO ends*

Investment Bonuses: Week 1 = 15% bonus, week 2 = 12% bonus, week 3 = 9% bonus, week 4 = 6% bonus, week 5 = 3% bonus, week 6 = 0% bonus

Official Website: https://www.hive-project.net/

Venture Capital Breakdown

I think Hive shows a lot of promise even though it seems to be flying under the radar a bit at the moment. Populous got sold out in the pre-sale, yet Hive addresses the same issue. They'll buy the invoices themselves though, instead of creating an invoice marketplace. This revolution of the invoice industry doesn't have to be a zero-sum game, and even if it is, Hive might just surpass Populous at a certain point. We'll see when the dust settles ;)

Yea I was going to mention in the article about Populous selling out but wasnt sure where to include it haha. I read about Populous literally just before it sold out, I really wanted to invest after reading into it D:

I'll follow this more in the mean time