ETHBTC: Bottom is Out There

ETHBTC analysis and the updated middle-term forecast for Ethereum. ETH key levels and general outlook of the most popular altcoin.

In this post I applied the following tools: fundamental analysis, all-round market view, oscillator and indicators, key levels, trendline analysis, Renko and Linear break charts.

Dear friends,

I go on my series of cryptocurrency price predictions and today, I’d like to update ETHBTC trading scenario.

The current state of the ETHBTC pair

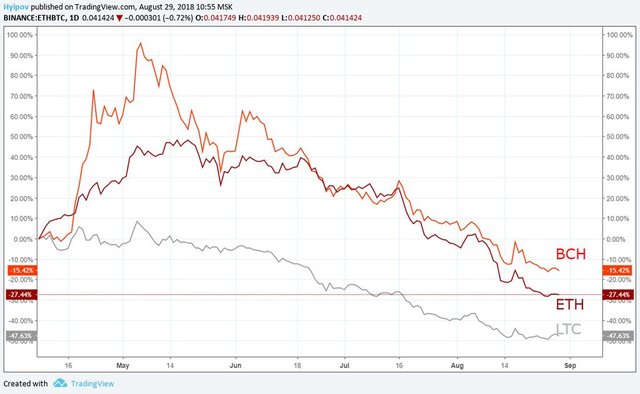

As you see from the chart above, Ethereum is performing not that worse than other altcoins that are DApp-platforms. I compared it with the largest coins of this class, like EOS, ETH, XEM, NEO.

Moreover, if you compare Ethereum with the altcoins that have always served only as payment means, like Bitcoin Cash or Litecoin, you won’t find any substantial difference between BCH and ETH trends, and the crypto “silver” is preforming far worse than its peers.

This fact makes me doubt that Ethereum weakness results from sales among ICO founders, launched on the Ethereum platform.

Basically, the major reason for the altcoins drawdown is simple, being nothing else but the capital outflow from the altcoin to the cryptocurrency market.

In the ETHBTC chart above, you see that with a decline in Ethereum trading volume, Bitcoin volume is increasing. Besides, the Bitcoin share is likely to continue growing. You see, that the downward trendline is broken and the tendency of Bitcoin declining dominance has stopped. Now, the nearest target for increasing the positions is the growth up to 65% from the current 52.90%

This scenario suggests nothing but that the altcoins will grow weaker in relation to Bitcoin.

(forecast dated August 14)

Two weeks ago, I wrote the ETHBTC forecast, where I suggested that Ethereum should gradually fall down to the Keltner channel’s bottom border at 0.02863 BTC (see ETHBTC chart above).

(the current market situation, compared with the forecast dated August 14)

Ethereum Technical Analysis

Finally, the present results are displayed in the chart above. The forecast, made two weeks ago, seems to be going as expected. To make sure it is relevant, I suggest analyzing all-round market view and revise the ETHBTC current state.

In ETHBTC monthly chart above, you see that the last August candlestick is very close to the point of control in the volume profile. It provides bulls with a chance to take rest and retrace the price a little.

However, the general situation in the monthly timeframe is extremely bearish:

- The last candlestick has a long black body.

- The trading volume is increasing on the price fall.

- The ETHBTC ticker is below Keltner channel’s central line.

- 0.232 Fibo from the last growth wave has been met.

Finally, I think the target at 0.0289 BTC to be relevant. It now matters how the ticker will go to it.

The ETHBTC weekly chart also indicates the bearish situation:

The last week closed lower than the previous low.

- MACD oscillator is directed downwards.

- RSI stochastic is at the bottom of oversold zone.

- Chaikin oscillator is in the negative zone (the thin green line).

- No bullish divergences or convergences.

- ETHBTC ticker is below the control point of the volume profile.

All of this is the further evidence that Ethereum will continue trading down.

Unfortunately, there are no reversal signals in the ETHBTC daily chart. MACD indicator has been slightly up and the RSI stochastic in the balance zone; but these signals are rather typical for a sideways trend than for an uptrend.

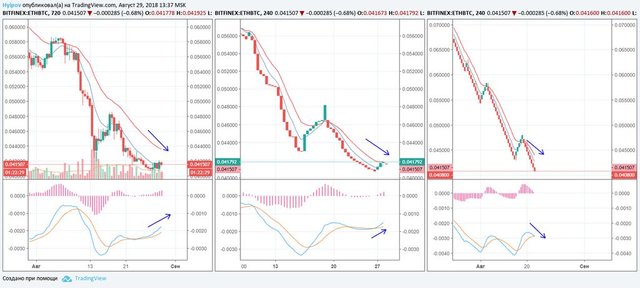

As it is clear form four-hour price charts during my experiment, Renko charts proves its main function and filters off all the minor sideways price movements very well.

By means of MACD, I adjusted the box size for ETHBTC so that there are hardly any false signals. It is 0.0008 BTC

Finally, you see the oppositely directed indicators in the Japanese candlestick chart (on the left). There, MACD indicates price growth, but the moving averages suggest its drop. The same is in the Line Break chart (in the middle).

The only tool that doesn’t change the suggested Ethereum price direction is the Renko chart (on the right). You see, its moving averages and MACD moving averages are sending sell signals.

The combined analysis of all three charts suggests the following:

Renko chart indicates that ETHBTC ticker is trading down.

Oppositely-directed indicators in the Japanese candlestick chart and in the Line Break chart suggest that bears are weak at the moment and the price rebound is possible.

Probable scenario of development of trades on the pair ETHBTC

Summing up all the above, the most likely ETHBTC trading scenario looks like this:

- ETHBTC is trading down in the global bearish trend.

- On the short-term scope, the price may rebound towards the trading channel’s top border at 0.044 BTC.

- The nearest supports (targets for the bearish trend) are at 0.038 BTC and 0.036 BTC.

- The assumed low of the bearish trend is at 0,028 BTC;

- I expect ETHBTC to hit the low on September 21.

That is my ETHBTC trading scenario. Go on following the rate and staying informed. I wish my Ethereum price predictions are useful for you!

I wish you good luck and good profits!

Regards,

Mikhail @Hyipov

You write well, @hyipov!