Ethereum - Anatomy of a Long-Term Breakout

I'm going to show you a chart of Ethereum this morning that should make you stand up and take notice. For months Ethereum was dogged by doubts after its massive run-up to $400 earlier in the year.

And those doubts are somewhat warranted. Structurally, I have problems with Ethereum, but at the same time, I also feel that the competition it is now facing from platforms like EOS, NEO, WAVES and others is strong enough to keep those in charge of Ethereum's evolution honest.

They may turn out to be incompetent but that's what competition promotes, pressure. And pressure brings out people's strengths and weaknesses.

But, put those considerations aside for right now because the crypto-market isn't trading on any of these things. The crypto-market is trading on a dangerous mix of capital inflow and the early stages of investor mania.

Now, with that said, let's look at the chart I was talking about.

Ethereum Coils Towards a Textbook Breakout and Explosive Price Move

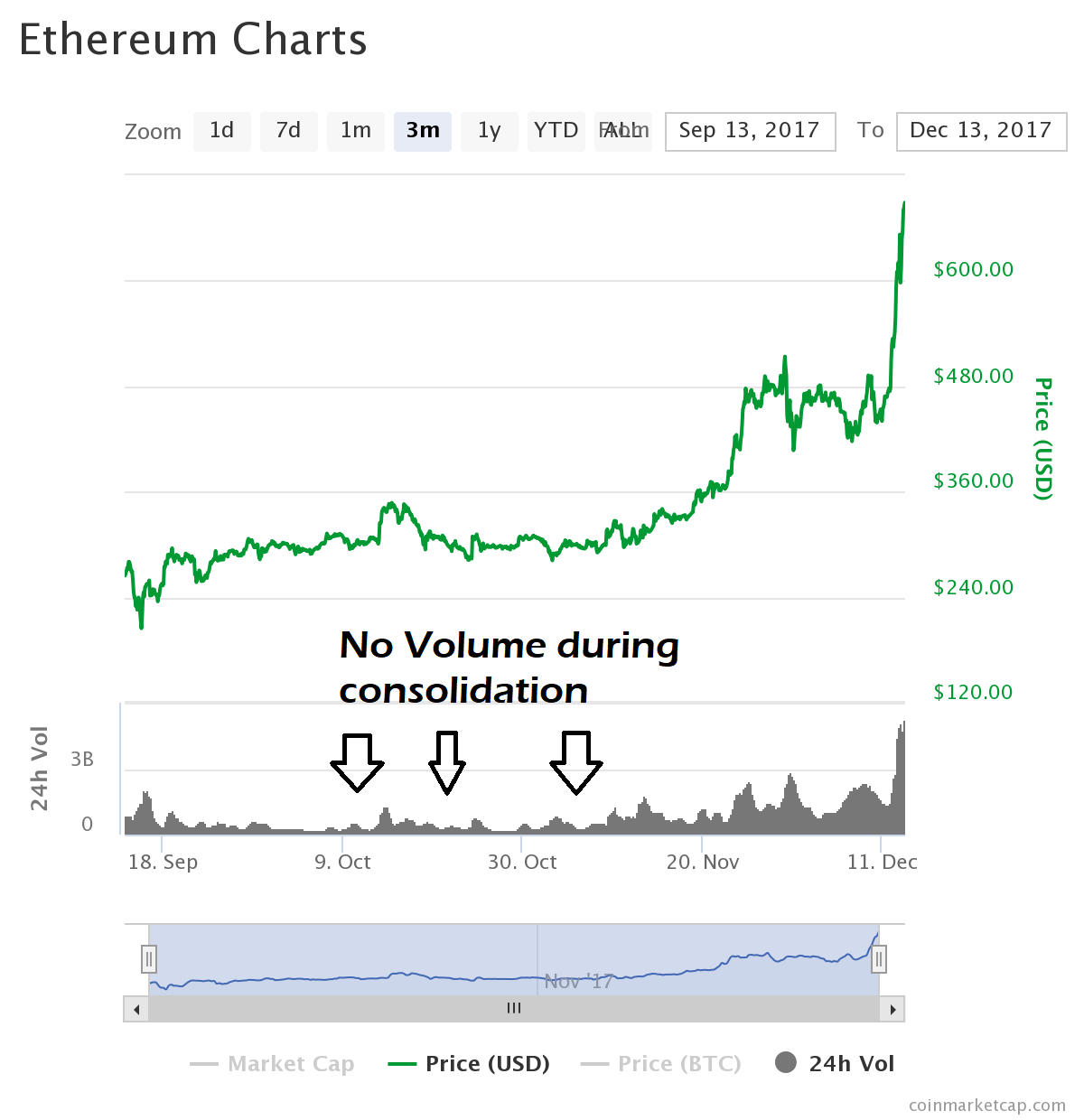

This is a weekly chart of Ethereum. Now you know I'm usually putting up 30 minute or 1 hour charts in the crypto-space because they are moving too fast to get interesting signals at anything longer than that.

But, with coins like Ethereum that have already gone through their initial burst of investor attention, longer charts have meaning now.

I recommended Ethereum in the first issue of the Gold Goats 'n Guns Newsletter because I felt strongly it was simply base-building after a blow-off peak in June.

Look at the three stage consolidation in the price between the June peak and the November breakout. The lows are marked with arrows that clearly show that investors kept coming in to support the price at higher lows. We even got a double-top at $400 to confirm that it was indeed the near-term top.

So, once the volatility died down, along with the volume (see next image) it would only take the right market conditions for it to begin it's move higher. That condition? The removal of uncertainty surrounding the Segwit 2x hard fork from Bitcoin.

Long story short, Ethereum is just getting started. The upside price is unknown here. The next big Fibonacci number is around $900. But, that could simply be an interim top as Ethereum rushes to play catch-up with Litecoin and Bitcoin.

As always, keep your emotions in check, sell small tranches into big peaks and don't kick yourself for making money if you do.

Posts like this are what I do regularly for Patrons of my Patreon who pledge at least $4 / month.

Thanks, it'll be interesting to see how eth goes. I wonder if coinbase will add a 4th coin that is <$100 per token.

I can tell you that I'd buy a ton of it immediately.. given what we just saw from Uncle Sam, I can tell you it won't be ZEC, XMR or DASH. :)

https://www.coindesk.com/uncle-sams-surprise-tax-reform-impact-crypto-investors/amp/