Winter is Coming - Ethereum Edition

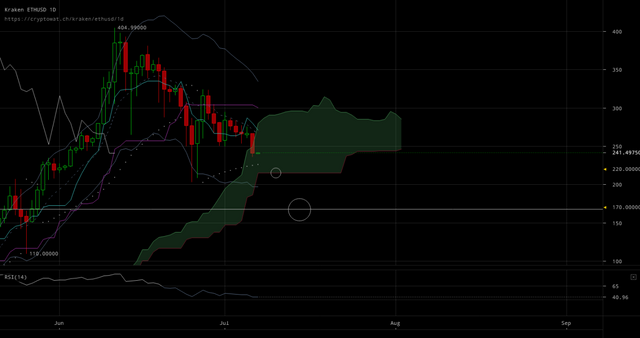

The recently growing horde of Ethereum holders have no doubt had a tough few weeks. With the general crypto market in a slump and the scare of the GDAX crash fresh in their minds, Ethereum has slowly slid from a post-crash high of $323 to just now $233.

Unfortunately for Ethereum fans, myself included, the light at the end of the tunnel is still far away and with summer in full swing, we may be looking at a prolonged slump til September.

By Winter I Meant Summer

For most equity markets, summer is a period of low volume bleeding away prices. During the popular vacation months, stocks and other equities tend to drift slowly downwards until September kicks off an infusion of fresh liquidity. Since crypto markets started picking up volume in 2012, overall market capitalization of crypto assets have also shrunk during Q3 in every year except one.

After a legendary run up this year, there is no reason to believe that this is the year that crypto, and especially Ethereum, will buck this trend. We will have some bull runs in these months but the general trend should be downwards.

August 1st Uncertainty

The uncertainty surrounding Bitcoin is culminating to a moment of truth on August 1st. Whichever way the debate resolves, this epic event will drag the entire crypto market through a period of uncertainty and uncertainty always leads to a healthy dose of dumping as people prefer to sit on fiat.

If things turn out badly for Bitcoin, the ETH-BTC ratio may still improve while ETH-Fiat takes a beating. If things turn out well for Bitcoin, the split will still cause a few days of confused dumping and a sharp rally back to 2500+ for BTC, taking Eth with it. Because most alt-coins are priced either against Bitcoin or Ethereum, those will take an added drubbing of dropping against the ratio while ETH/BTC loses against fiat.

Between now and August 1st, cash is king, and you want a healthy amount of it in your portfolio.

All that ICO Money

As suggested by fellow Steemit poster, @bingong, the crypto space has experienced a glut of ICOs over the last two months. Many of the crowdfunding was done in Eth, as the ease to which a startup could roll out an ERC20 and have it be instantly tradeable made a lot of sense for new dApps to be funded on Ethereum.

The dark side of this "killer app", is that millions of Ethereum tokens are being funneled out of wallets into a small number of smart contracts. Logical moves for a crowdfunded startup is to both convert some of the Eth to fiat to pay development expenses and to hedge parts of the funds into either fiat or Bitcoin -- both of which massively dilate the Ethereum supply. Even if large portions of ICO money gets converted through large institutional buyers and not public exchanges, these tokens will inevitably hit the markets sooner rather than later, creating downward pressure on Ethereum prices.

BearWhale(Pig) is Back

Image by kriegkopf | Reddit

Traders don't take ideological sides. Traders trade to make money (while bringing liquidity, rainbows, and all that other good jazz.) The recent crypto rallies and talks of Ethereum bubbles have woken up the BearWhales and they smell blood. They are keenly aware of everything that I've mentioned and they love taking lunch money from moonkids.

For serious investors, this means little. Continuing to pick up small amounts at each level, while dollar averaging remains a good long term strategy. For traders, however, this brings trouble. We've all seen fake walls, pump and dumps, and the myriad of other tricks BullWhales used to drive up Ethereum. Now that they have turned the other way, expect to see a fresh set of tricks to ripple FUD through the community.

Hope everyone makes it out of this summer with their portfolios in one piece and with lots of mooning to enjoy on the horizon!

Neat summation of the current season of uncertainty. I'm guessing the Ethereum based ICO's dumping their ETH for fiat is contributing as well to the downward trend

Good point! I'll edit that in when I get a chance.

At this point, it's not even a guess :/. Ever since Bancor, same thing is happening with every big ICO.