USD-Pegged Loans in Decentralized Lending Review

Briefing on USD-Pegged Loans

Currently, cryptocurrencies face one major challenge in international markets. Trust. They are universally agreed to be an important future trend in Finance, whether one might believe they will remain or not.

There has been a strong volatility in prices in all crypto currencies e.g. a 50% loss of value and recovery in only a few months for Ethereum (denominated in USD) in the middle of this year. This is a major challenge for lending, especially if you intend to lend for longer than just a few days. Our lenders and borrowers cannot be sure about the value of their contract after a few months have passed. There is a multitude of borrowers who earn and spend in FIAT and suffer from high interest rates, as well as lenders who are not interested in crypto but still want to profit from the benefits decentralised lending can bring to their household. Therefore, we at ETHLend shall introduce USD pegged loans. They contain all benefits of our decentralized lending solution but add a strong value stability, like you would have it in any familiar bank loan (but much better).

How does the USD-Pegged Loan work?

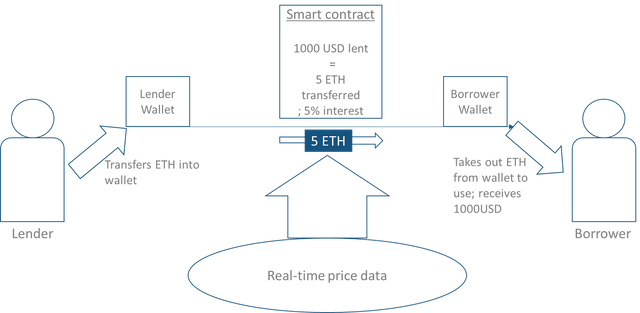

A peg means that the price of the contract is directly linked, glued so to speak, to the price of the USD (or any other currency you might choose). It could look as follows:

If I lent 1000USD worth of ETH at the beginning of the contract with 5% interest to the borrower somewhere in the world, this will be noted down in the smart contract. I hope to receive 1050USD at the end of the loan period. Thanks to the smart contract on Ethereum network I don’t have to rely on hope. The smart contract conducts all transactions at exactly the time agreed and uses real-time market data to ensure I receive my interest as I expect it.

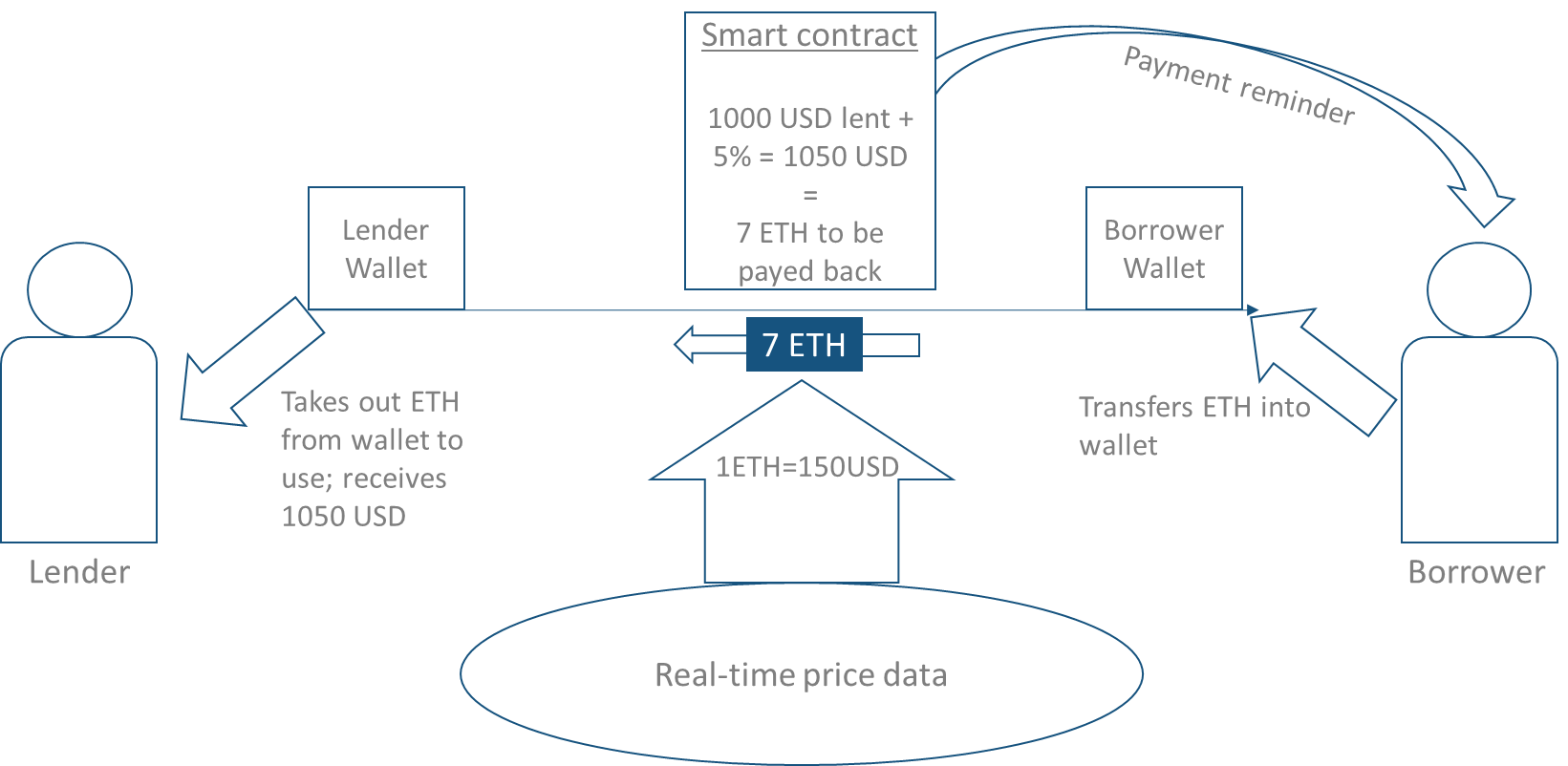

At the end of the trade I will receive 1050USD worth of ETH, no matter what value changes ETH might have had at that point in time, everything will be calculated and taken care of in real-time without me or the borrower moving a finger. I made a great deal, earned 50USD that I can spend on a nice dinner and my borrower had time and money to expand his business, without any of us worrying about price volatility.

Are there any risks to USD-Pegged Loans?

Not really. The concept is entirely based on the idea to reduce risks and enable all parties to use their loan in the real world. The borrower transfers their received ETH into FIAT (e.g. USD) and uses it for their needs, maybe he buys a new garden shed. After the trade he turns FIAT back into ETH at the current rate and transfers it back to the lender + interest. The entire concept is designed to increase real-life usage opportunities and is also perfectly suitable for loans that have a long running time. It only works perfectly when both parties transfer to ETH only when needed, to avoid the volatility. Even if one party would hold the received ETH the contract would still work. If I lend 5 ETH equalling 1000USD, then over time the value of ETH increases and I receive 4.5 ETH equalling 1050USD at the end of the trade it seems like I made a loss in ETH, but I didn’t really make a loss in USD which I use on a daily basis. My only loss is opportunity costs: holding ETH would have been more profitable. This even allows me to actively diversify my portfolio: to be safe I could invest part of my portfolio on speculating in crypto currencies and additionally lend money, where I am bound to receive interest in FIAT, making it safer.

Result

USD-pegged loans offer a low volatility, great real-life usage and realistic interest rates. Thanks to ETHLend, everybody (even you!) is enabled to use decentralised loans at fair market prices, anywhere in the world with minimal risk, like your usual bank loan, just much better. At the same time lenders can be assured safe interest profits without worrying about crypto volatility, whilst still enjoying all its benefits and helping someone somewhere in the world.

![]()

To learn more about ETHLend, join our ETHLend Slack and ETHLend Telegram

For more information about ETHLend, read the White Paper

Follow us & participate …

Homepage: http://ethlend.io

Facebook: http://www.facebook.com/ethlend

Twitter: http://twitter.com/ethlend1

YouTube: http://www.youtube.com/channel/UCZUFYgrvO7xpxzMjijgqWyQ/videos

Discord: https://discordapp.com/channels/340569845454340096/340569845454340096

Slack: http://join.slack.com/ETHLend/shared_invite/MjAzMTM0MzEyNzA3LTE0OTg0MDk0NDItOGY0MTlkMTlmZA

Steemit: http://steemit.com/@ethlend

Medium: http://medium.com/ethlend1

Reddit: https://www.reddit.com/r/ethlend/

Telegram: https://t.me/ethlend

Disclaimer

Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our Website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.

Accordingly, we will not be liable, whether in contract, tort (including negligence) or otherwise, in respect of any damage, expense or other loss you may suffer arising out of such information or any reliance you may place upon such information. Any arrangements between you and any third party contacted via the ETHLend are at your sole risk.

Looking really good .. exciting opportunity for everyone! I will re-steem this.

What if the borrower does not pay back?

The collateral system that is in place and reinforced by way of smart contract agreement. The collateral is always pre-agreed before the lender commits to the terms of the loan. In case of default on the loan by the borrower then the collateral automatically gets passed to the lender to cover the non payment. Further to this, it will affect the reputation of the borrower in the system much like a credit rating system does within a banking institution.