Lending Ether on EthLend and how to choose the right amount of ECR20 Token collaterals

What is EthLend all about?

Can you imagine a world where borrowing and lending value is fully democratized, without the need for any bank dictating interest rates, amount, time and usage? Pure market, where anyone has the possibility to participate and where only the participants decide upon the conditions for their agreement. The EthLend DAPP provides a fully decentralized peer to peer lending Smart Contract on Ethereum blockchain for lending Ether by using ECR20 tokens as a collateral. As soon as a loan is repaid, the borrower gets back his tokens and simultaneously Credit Tokens (short: CRE) will be mined for the lender and borrower as a reward for the successful transaction.

What are ECR20 Tokens?

ECR20 tokens are based on the Ethereum blockchain and follow the ECR20 Token Standard. These standards describe functions and events, such as transferring tokens or extracting data, that an Ethereum token contract has to implement in order to increase the interoperability within the Ethereum network.

How to choose the right collateral amount?

As a borrower, your main goal is to find a lender who is ready to fund your loan request. Choosing collaterals that do not cover at least 100% of the Ether requested, bears the risk for the lender of never getting Ether back and making a loss on the collaterals transferred. From the lender's perspective, you would probably never get the loan request funded, especially when you are new to the platform and have no accumulated CRE representing your credit score.

Additionally, all tokens are subject to high volatility (risk through price fluctuations), which makes borrowed Ether, that is even fully covered by tokens collateral, a risky investment for the lender. So, to make the loan request much more attractive, a borrower should consider the future price fluctuations and put a certain mark-up (additional tokens) on the loan request.

We worked on this problem and calculated for Golem the volatility for different lending periods.

Let us go through some examples and show you how to choose the right amount of collaterals:

- Token: Golem

- Lending Period: 1 month

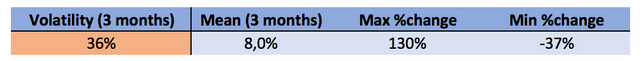

Taking monthly returns for the last three months, we find that Golem (short: GNT) against Ethereum (short: ETH) is currently fluctuating around it’s expected mean price by 36%, with the highest price increase of 130% and biggest drawdown (price decrease) of -37% in the same period.

That means, in order to have an attractive loan request, the lender would have claimed 136% in GNT collaterals (100% to cover Ether + 36% securing against fluctuation in the case of a default).

In current market terms (18. June 2017):

1 ETH = 620 GNT (100%)

= +237 GNT (36%) -> 857 - 620 = 237

= 857 GNT (136%) √ -> 620 * 1.36 = 857

One could argue, that Golem’s biggest price decrease in a day was -37% and that using this percentage would have been more secure. The higher the collaterals, the more security the lender has, which is correct. However, the drawdown of -37% is not representative since it relates to a single day. Those are outliers (exceptional price movements) and under current market conditions, the 36% mark-up would have been sufficient on most days, as it can be inferred from the volatility.

Now, let us have a look on two more lending periods:

- Token: Golem

- Lending Period: 1 week

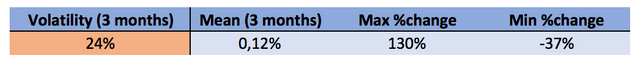

Notice, that the volatility for weekly returns is decreased to 24%. One could infer, that the shorter the time period, the lower the observed price deviations and the less risk is involved. For this lending period, the borrower could provide a +24% mark-up on the GNT tokens.

- Token: Golem

- Lending Period: 1 day

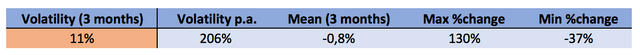

Given a 1 day lending period, the risk in terms of volatility is decreased to 11%. Basically, on most days the 11% mark-up would have been sufficient to cover losses.

Notice also, that the volatility for a lending period of one year is at least 206%!

Conclusion

From the numbers observed, we can see that the longer the lending period, the more collaterals should be provided due to higher risk (volatility). Also, the volatility differs not only for various lending periods, but also between different tokens. Currently, we work on a solution for providing a risk profile for any single tokens on the platform in real time.

However, there is no guarantee that any of those numbers will give a 100% security in the case of a default. Sure, you will definitely receive the promised tokens since they are saved in the Smart Contract, but nobody is able to predict the price fluctuations of the tokens.

The purpose of this article is to give the users of EthLend an idea of how to assess the amount of collaterals, in order to meet the needs of all parties involved.

Author: @sergej.stein

--------------------------------------------------------------------------------------------

Disclaimer

Our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our Website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.

Accordingly, we will not be liable, whether in contract, tort (including negligence) or otherwise, in respect of any damage, expense or other loss you may suffer arising out of such information or any reliance you may place upon such information. Any arrangements between you and any third party contacted via the EthLend are at your sole risk.

Great article Sergej on volatility on Tokens. Will look forward to see how tokenization will evolve and what kind of volatility real property tokens will have.

Thank you for coming into my post. I'm not really good at crytocurrency, have no ide for sure. 😅😅

great job, very nice article