What's the story with Smart Contracts and Ethereum?

A smart contract is a computer protocol intended to facilitate, verify, or enforce the negotiation or performance of a contract

The term "smart contract" was first introduced around 1996 by Nick Szabo. He published formalized theoretical studies of such contracts including their expected properties and even tried to implement them in his Bit Gold project.

Turns out, cryptocurrency protocols, starting with Bitcoin in 2009, did become some of the most well known smart contracts in existence. They offered ability to reach agreement or "consensus" among many parties in decentralized manner using variety of byzantine fault tolerant methods.

In addition, custom smart contracts on top of existing blockchains were born with Bitcoin via scripting:

Satoshi Nakamoto gave Bitcoin an interesting feature that wasn't described in the original whitepaper. Instead of requiring bitcoins be received to a public key and spent by a digital signature, Nakamoto gave users the ability to write programs (called scripts) that would act as dynamic public keys and signatures. (source)

What could Bitcoin smart contracts do?

- Custom Scripting let people make dapps (Decentralized applications) with combinations of:

- multi-signature accounts

- oracles

- escrows

- time locks

- atomic cross chain trading

- payment channels

- multi-party lottery with no operator

and so on. Read more here: mastering bitcoin's book chapter, lottery, bitcoinj contracts, maraoz's summary, davidederosa's lessons, bitcoin.it wiki, bitfury's PDF, MAST summary, state channels.

An example of well known decentralized applications (dapp) using these strategies with Bitcoin include Open Bazaar, bisq (ex bitsquare), lightning network.

Additional layers like Omni, XCP allowed things like tokens, decentralized exchanges, and more on bitcoin since 2014. Projects on various blockchains like BTC and others including namecoin, nxt, bitshares, monero, burst, and so on in 2013–2014 were quickly coming up with easy to read naming alias schemes, decentralized autonomous organizations, decentralized DNS, other decentralized exchanges (nxt, bts), privacy, new consensus algorithms, account based models, price stable coins, and more.

Enter Premined Ethereum circa 2015–2016

Ethereum Foundation advertised decentralization and unstoppable code and state based accounting - all things that already existed in many projects. It wasn't faster and didn't have many of the features of some alternatives other than the advertised Turing complete smart contracts.

As expected they weren't Turing complete, as finally admitted by lead developer himself.

However it did allow for loops and recursion that people called "infinite attack surface" with highly unsecure scripting and EVM. As expected, the Ethereum blockchain was successfully attacked many times, in some cases making the entire blockchain unusable or put at risk without offering much new utility (ref1, ref2, ref3, ref4, ref5). Often the client code was pushed rushed (geth) and put entire blockchain at risk. Ethereum Foundation famously ignored most security precautions, like Satoshi's warning about multiple implementations, so as expected rushed changes (geth) led to chain splits and reversed/lost transactions. In effect, the biggest contribution from Ethereum was on how to make smart contracts previously used less secure.

Ethereum's countless security failures have since become go to examples for jokes about bad security practices.

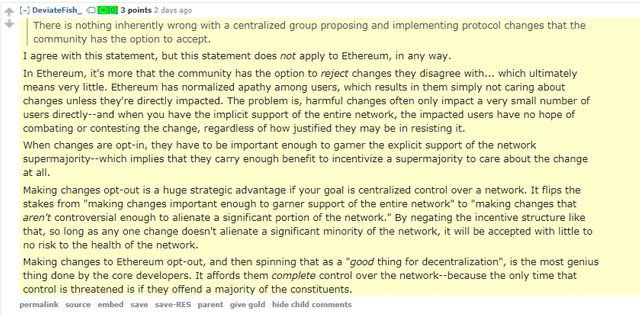

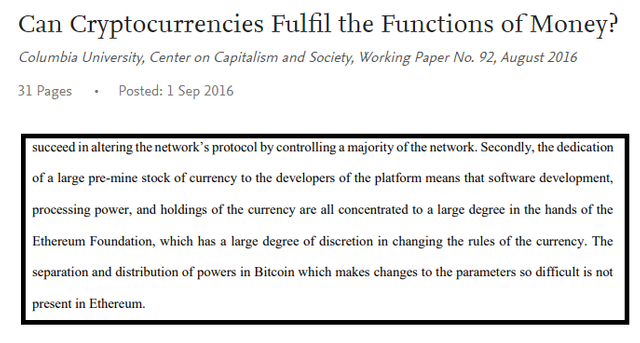

The decentralization was also non-existent. It seemed to have a lot of concepts taken from earlier coins including miners and nodes. But mining pools were still centralized (2 have over 50% hashpower) and their lack of effort to distribute the coins widely like in PoW was evident by their 70% premine and poor distribution via an ICO, despite plenty of other options available. The premine in turn gave Ethereum Foundation ability to go in and edit anything they want on the blockchain by changing defaults, holding ICO funding and updates hostage, and using the premine to punish others via markets. Centralized control is exactly what they demonstrated when some of them lost money on 3rd party contract called The DAO. A good summary was provided by one of the various developers observing the issues with Ethereum Foundation and Ethereum summarized later as this:

Ethereum Foundation provided the world a perfect example of how premines and ICO's lead to centralization, THE most significant security issue. Ironically, they even criticized debate over proposed changes as something worse than consensus failures

while they push forward towards further algorithms with backdoors. Requirement to trust them to honor the code or balances is the worst kind of security issue. Centralized/trusted entities are vulnerabilities to exploit for third parties and:

Despite countless criticism and community outcry they have nothing good to respond to with, Ethereum Foundation kept marketing themselves as secure and decentralized and only place to go to for smart contracts and put many new people at risk who don't know any better. Ethereum Enterprise Alliance was one of those efforts where they gave companies code to make their own modified/cloned private/independent networks in return for using their names to advertise themselves. They conveniently called these separate modified networks also "Ethereum" despite having virtually nothing to do with Ethereum public chain or its ether coin - confusing terminology given how countless modified clones of Bitcoin (like Eth) have never been called "Bitcoin". The code is, of course, just Ethereum Foundation's modified version based on effort and R&D of others that went into developing countless blockchains including Bitcoin. This in turn gave public the false impression the oblivious companies are somehow backing or supporting or building on their public chain. For example, getting somebody at Samsung to try their code gave Ethereum enormous popularity in Korea even among people who barely knew how to use computers. In another typical instance, J.P. Morgan's Quorum was commonly falsely advertised as using the Ethereum public chain.

Common tactic has become for Ethereum Foundation to downplay work of others, portray even Bitcoin's development falsely as stale, and promote their own derivative work as one of a kind.

To further demonstrate how wrong that is, Bitcoin development is still on going with an enormous number of developers (e.g. even for basic client alone) working on many solutions with high focus on security. This deception is easiest to show how wide the Bitcoin development research is:

They have managed to upgrade entire blockchain with several major improvements every year while testing them thoroughly and avoiding uncontrolled client splits like Ethereum's.

Segwit, one of soft forks in 2017, enabled easier upgrades in future to enable expanding capability of Bitcoin's native scripting further for updates like MAST. New languages were also created.

Elements includes countless work on sidechains, new privacy technologies like Confidential Transactions and Schnorr Signatures.

Drivechain is determined to enable some of Bitcoin's 1:1 pegged sidechains that would let the owner of each Bitcoin to move to chain with qualities like speed and security risks they find acceptable.

One of such sidechains is Rootstock that brings all capabilities in EVM to Bitcoin without the Ethereum Foundation, modified, without exposing entire blockchain to it. (initially not drivechain)

Layer 2 solutions to increase transaction capacity, often Lightning Network (LN), are some of the most well manned blockchain research efforts in the entire field with 5+ teams (1,2,3,4,5,6,7,8,9,10,11,12,13,14,15). Rootstock has their own layer 2 solutions, like Lumino. Bitfury's Flare is one of several routing proposals for LN. (summary)

eltoo update mechanism for Lightning and off-chain contracts

Design like sharding and tree-chains (1,2,3,4) are further examples of improvement work like discussed at conferences.

Ethereum managed to market itself as inventor of the already invented wheels like smart contracts, childchains, lightning-like networks, and ICO's (initial coin offerings) with a history of not citing prior art. However, the strange willingness of their community to give money for easily made whitepapers appears to be the biggest attraction and gives impression of majority of development, but little comes out or projects tend to leave after raising money. Projects like etherdelta, 0x, and many others provide nothing that hasn't been done since 2013–2014 but now done on a centralized blockchain - capitalizing on misinformation about Ethereum and lack of knowledge about past efforts on the real blockchains. Trading card game like Spells of Genesis on Bitcoin & XCP was one of many examples introducing video game asset trading using cryptocurrency blockchains, yet Ethereum's far later CryptoKitties is often falsely marketed as their invention of game asset trading.

Ethereum has only a history of countless security failures, putting people at risk, misinformation, developers who appear not to understand basics of computing, and provides virtually no positive technical contributions to cryptocurrency space. In effect, Ethereum has nothing to do with decentralization or decentralized smart contracts. The dangers of premines and ICO's are largely unnoticed since to their successful marketing campaign, allowing more to be accepted with as high as 30–50% of coins reserved (OmiseGo, Neo, Cosmos). The act of ICO'ing a premine requires trust that the developers won't secretly buy with additional anon accounts from their own sale, getting money right back, and effectively be able to capture up to almost 100% of supply for free while nobody else would know any better. Even worse, despite being centralized in Proof of Work, it becomes even easier with Proof of Stake with literal premined stake (e.g. Casper). More transactions than ever are put at risk with centralized trust based security model equivalent to Onecoin or Paypal. Having learned nothing, they continue to market and yet ignore security design concepts that gave us decentralized censorship resistant blockchains and smart contracts elsewhere.

The point of the story is of them not addressing knowledgeable users and professionals when criticized on the important issues like the enormous pre-mine & poor distribution leading to centralization and thus lack of security rendering it no different or a worse version of pre-satoshi era tech. They ignore the biggest possible issues and continue to instead target a far larger pool of new people with marketing who wouldn't know to even ask those questions. Instead of focusing on the technology, the Ethereum group achieves far greater returns by growing the user-base through marketing, taking credit for others work, and falsely describing the system as "decentralized" or "bitcoin, but with smart contracts". The large funding from the significant pre-mines gives ICO'ed projects an enormous marketing budget. This created a shift in what the new entrees into the space are exposed to and taught, therefore normalizing and rewarding highly unsecure irreversible practices to new extremes.

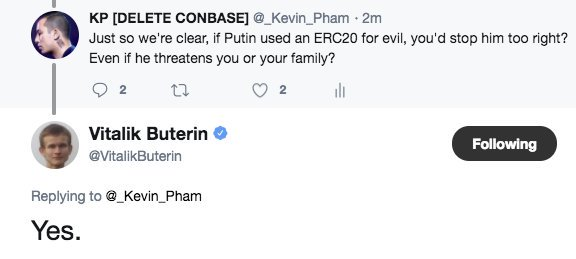

To think about what supporting Ethereum has done, I'll leave you tweets showing how much confidence Vitalik and Vinay Gupta's (Release Coordinator for Ethereum Foundation) have for being able to censor users again:

Congratulations @eosfan! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @eosfan! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!