Blockchain Backed Loans

I don't see a lot of people talking about this. I only just found out about it recently so maybe a lot of people, including crypto enthusiasts, simply don't know about it yet. Soon™ it will be very easy to put your crypto up as collateral and take out a loan. For now, it's pretty difficult to do so, but several projects are working on it.

How it works.

Say you have $2000 worth of Ethereum and you want to use that to take out a loan. The price of Ethereum is volatile, so there is no way you're going to get a $2000 loan for your Ether. You have to over-collateralize the loan so if Ether loses value the loan can still be paid back. Let's say you take out a $1000 loan. Now your collateral is 200% of the loan. You won't have to worry about it until it gets close to 100%.

If it does get close to 100% there may be a margin call. This would cause some or all of your collateral to be sold in order to raise the percentage or pay off the debt in full. As you can see, a loan with collateral is very low risk for the person lending the money (no need for credit scores). At the same time, it's also low risk to the person taking out the loan. If you were simply going to hold that Ethereum anyway, you haven't really lost anything except for the interest rates on $1000.

If you hadn't taken out the loan, your $2000 worth of Ether was going to be worth $1000 regardless. Having taken out the loan, you're still left with $1000 or whatever you spent the $1000 on. This is where it gets risky. What did you spend your loan money on?

Why take out a loan?

There are many reasons why someone would want to take out a loan with crypto collateral. Delaying capital gains tax is one of them. Apparently, an asset being used to leverage a loan can't be counted as a gain until the loan is paid back and the asset is returned to the owner. We could see some very sneaky dealings with this in the future if the market gets pumped to the sky again right at end of the year like it did last Christmas. Investors aren't going to get fooled so easily this time around.

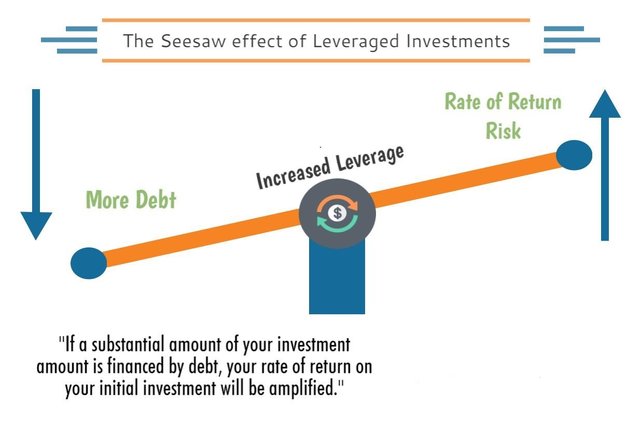

Leveraged Investment

A leveraged investment is the ultimate risk. That's not going to stop people from doing it. In the previous example someone got $1000 by staking $2000. What did they do with that $1000 if they want to make a leveraged investment? Buy more Ethereum. Brilliant.

This is why I laugh when people say crypto is a bubble. Yeah? It's a bubble? Just wait till people figure out they can take out a loan and then double down. If you thought the market was volatile now just wait till we have a 20 trillion dollar market cap and people are leveraging their investments. The weak hands are going to get shredded. Luckily, if your reading this now while the cap sits at a third of a trillion dollars, you realize that everything has to go x60 before this all goes down.

Example

Bob takes out $1000 loan on $2000 worth of Ether. Bob uses the $1000 to take out a $500 loan. Bob uses the $500 loan to take out a $250 loan. Now, if Ethereum loses half its value how much money is bob left with? $125... OUCH. However, if Ethereum doubled in value how much would Bob have? Without taking out any loan it would be $4000, but with all these leveraged investments he now has ($2000 + $1000 + $500 + $250) * 2 = $7500 minus all the loans he has to pay back: $7500 - $1000 - $500 -$250 = $5750. That doesn't even count interest. If it seems not worth the risk that's probably because it isn't, but that's not going to stop people from doing it anyway.

What if Ethereum went x10? Without the loan bob has $20,000. With the loan he has $35,750. Clearly, if you "know" that crypto is going up a leveraged investment is the way to go. Let's take a look at the projects that are actually making this scenario a reality.

SALT (Secured Automated Lending Technology)

This is the first project I heard about when it came to securing loans on the blockchain. There is some overhead and friction tied to using the SALT platform, but they will likely provide certain services that other loan blockchains will not. The team will likely focus on being able to use as many coins as possible as collateral. The Downside to SALT is that it's not peer to peer lending. The lenders are institutionalized and SALT has all kinds of know your customer (KYC) rules.

EthLend

This project is a bit removed from me because I heard I was banned in the USA (maybe that was just the ICO). Still, EthLend seeks to be a P2P lending/borrowing platform. Lenders and borrowers pair off and create their own custom contracts directly on the blockchain.

Lenders take much more risk on EthLend because everything is measured in Crypto instead of fiat. You might borrow 1 Ether with the promise of paying back 1.02 Ether. This means that the lender accepts the volatility of the asset used to collateralize the loan. The reverse is also true, it may cost borrowers more to pay back a loan than they originally expected.

https://blockonomi.com/salt-vs-ethlend/

MakerDAO and Dai

I wanted to save the best for last. Maker and Dai are already working products, although they aren't easy to use and I'm still trying to figure it all out (more on this later). Maker is a coin that pegs Dai to $1, but in the process loans are being taken out. Instead of P2P loans it's basically like giving yourself a loan. You lock up your own Ether on the Maker platform and you get it back after you've paid the Dai back. Interest gets paid off with Maker coins and Maker coins spent in this way get DESTROYED. Which is great for the long term value of Maker coin.

What's the best part of the MakerDAO? The interest rates are set to 0.5%. Can you imagine getting a loan on half a percent interest? And it's all done with smart contracts. The "person" lending you the money is basically a smart contract online robot. With a strong team of 40 developers, I really think that Maker is going places.

Conclusion

Cryptocurrency collateral backed loans are complicated when you try to figure out the inner workings. However, this complication is quite simplified from the outside looking in. Lock up your crypto, get a loan. Simple. This is a service that will most definitely be widely used in the future while very few people even know about it today. There will be volatile market swings created by leveraged loans. The only way to sleep at night will to be to get in and invest in the space BEFORE this happens. Make no mistake, if SMTs allow for this kind of thing you'll be able to take out a loan backed on Steem in no time. ALL of the smart contract platforms are eventually going to have this functionality.

I would love to see these blockchain applications eschew random and pointless tokens. This is the problem w/ blockchain, if you want to make money, you need to issue tokens, but if you issue tokens, you don't build anything useful

I can see why some tokens are redundant but it's not super obvious why creating a redundant token would kill the value of the platform.

I've been wanting to learn about crypto loans for a while, thank you for a head start.

Have you looked at services like BitBond? I don't know it well but it looks interesting. People ask for loans and others can put crypto in there to help fulfill the amount they're asking for. Looks pretty much like a crowd funding where you get your money back later with interest.

Getting loans is a very interesting usage for crypto, lower fees, less bureaucracy, more control, etc.

Yeah I'm finding crypto loans to be super interesting. I can't help but assume that they will be all the rage at one point.

I have not looked at BitBond yet but it sounds interesting. Honestly I have a lot of faith in MakerDAO, because not only are you simply granting yourself a loan with smart contracts, but they've also created an asset that's pegged the the dollar. It's also not going to be hard for them to start pegging assets to gold, silver, and a myriad of fiat currencies.