Why Ethereum price will be huge long-term

It’s been a while since my last video on Ethereum fundamentals or why ether will be worth more than Bitcoin in terms of capitalization (I uploaded it on 20th of March 2017). In this video I forecasted that price would reach $210. Well, now the price is more than $300. The only exception is that Bitcoin is now worth certainly more than $18.9bln. Let’s now see what has changed fundamentally for Ethereum. Why Ethereum is the most attractive investment. What are the risks that can undermine long-term value of Ether. What can be long-term forecasted price of Ethereum if it absorbs value of certain assets.

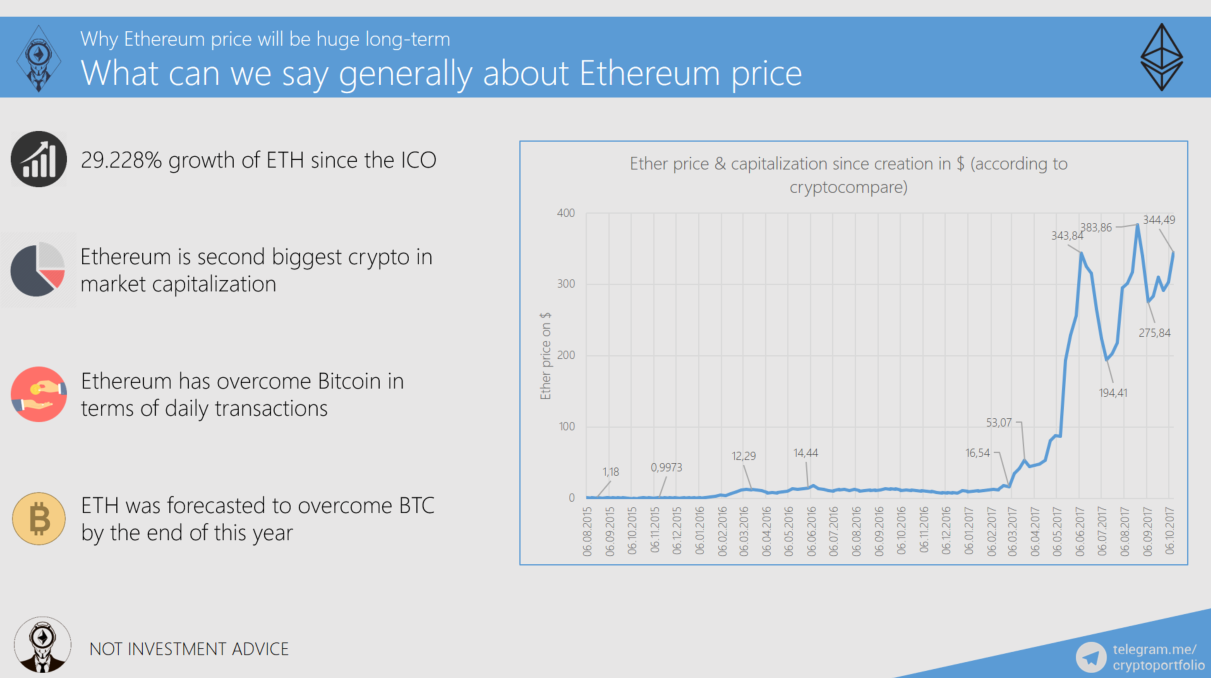

Ether has experienced 29.228% growth since its initial coin offering. As it always happens, the ones who bought a lot of ethers had better ROI than the ones who invested in ETH mining. Remember that mining is not that profitable as it was in the past. If you have some cash, better buy cryptoassets than mining hardware. If you want to know more, listen to the Bitcoin Uncensored with Simon Dixon. He invested in the Ethereum mining and concluded that buying ethers would be much profitable.

Ethereum is the second biggest cryptocurrency and it seems to be rock solid, no other crypto can take its place. Seeing how many projects are launched on Ethereum, we should expect this crypto to be number one, right? In reality, ICOs are double-edged sword. Why? I will explain later.

On 16th of October 2017, ETH has reached 408k transactions, while BTC had 314k transactions on that day. The same applies to number of nodes, 22k in Ethereum and about 9k in Bitcoin.

If you watched one of my livestreams, I covered the forecast of Fred Wilson, who is Union Square ventures partner. In his forecast, Fred predicted that Ethereum would overcome Bitcoin in market capitalization until the end of current year. And we still got time.

What are the main reasons for Ethereum to be one of the most attractive long-term investments?

First, convenience. With all those ICOs, it is still much faster and easier to send ethers than it is to send bitcoins. Some huge initial coin offerings can really sometimes clog the network, but just remember that soon Ethereum will have Raiden Network, Plasma, and other state channels, which will solve the transaction time problem. All transactions will be instant, it will be even faster than VISA. Also, do not forget about Proof-of-Stake adoption by Ethereum, it will also dramatically decrease the block time.

More projects and ICOs which will use Ethereum as its main blockchain. In the long-term, projects are certainly very beneficial for the ETH price but in the short term… In the short term, initial coin offerings are a double-edged sword. From one side, investors need to buy some ETH to acquire tokens. From the other side, projects try to hedge themselves by dumping collected Ether on the secondary market. In the long-term, such projects as Melonport will attract even more people into Ethereum ecosystem.

Even though, the Ethereum foundation doesn’t recognize Ether as a currency, it is already used as one. The more we use Ether as a currency, the more value it has.

Recently, Ethereum decreased rewards for miners from 5 ETH to 3 ETH , but now more blocks are mined. This situation kind of evens out everything. In the future, Proof-of-Stake protocol will be adopted by Ethereum. What does it lead to? To non-existent inflation. There will be simply no miners, only validators. You will be able to stake ethers and receive transaction fees as a reward.

Ethereum Enterprise Alliance is a very big deal for our blockchain, because in the end it leads companies to adopt Ethereum public chain. This will dramatically increase Ether price. If you want details, just watch my video about EEA(

Finally, we have price discovery. We are a very young blockchain and we need time to understand the true value of ETH. I am sure that we will not get disappointed when we find the way to value cryptocurrencies.

What are the main risks that can undermine growth of Ether price?

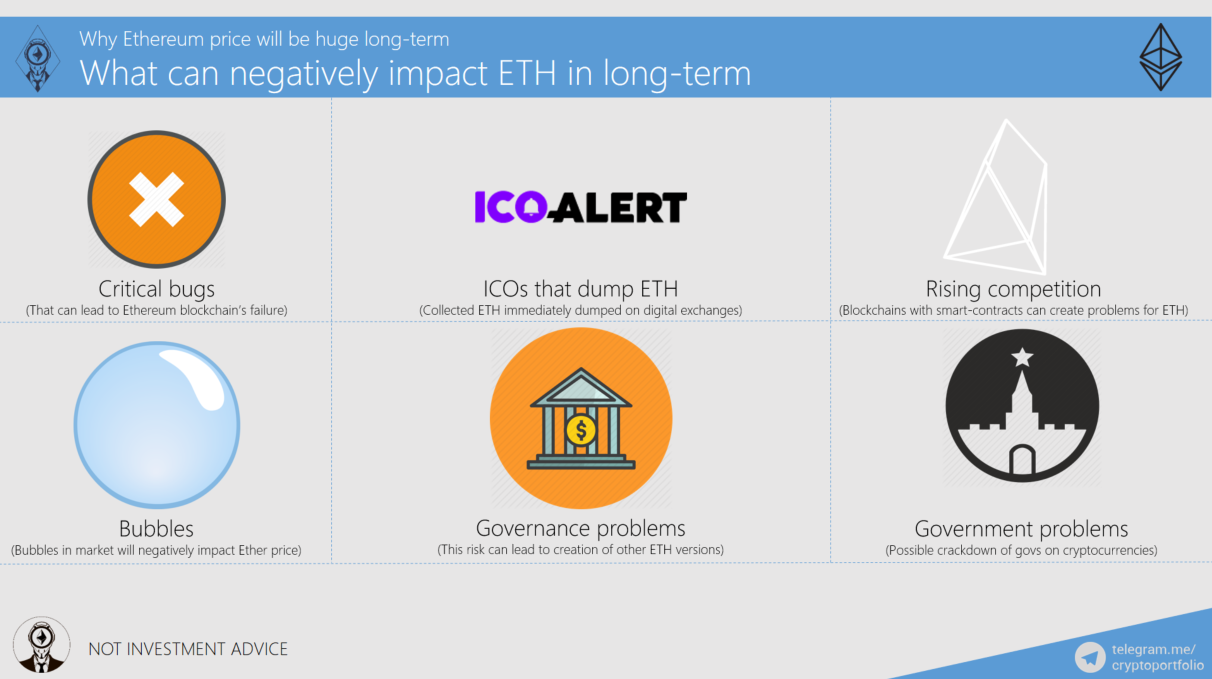

From my point of view, critical bugs are what can bring Ether to its knees. Developers from Ethereum foundation understand it too, so they test their code very meticulously before letting people use it.

A lot of projects that collect funds and dump ETH on digital exchanges for other assets. This hedging really suppresses ETH price.

Then, we have competition. Competitors like EOS, Aeternity, QTUM, and others. Well, ETH has certainly advantage here. We have working blockchain which is already capable of smart contracts. Also, our community has a lot of developers who will be reluctant to move to any other chain if Ethereum satisfies their needs.

Market bubbles usually burst. So, any cryptocurrency’s price can be affected during this event.

Then, what if there is a conflict inside developers’ house? What if the developers will be divided by different future vision for Ethereum? That may be a giant problem, actually. It may lead to hardforks and creation of new chains. It will certainly be a negative event for Ether price. I hope that in case Ethereum developers will have different views, they will turn to community to decide. That can be done by voting with ether.

Finally, what if governments start banning cryptocurrencies. Yes, I get it that cryptocurrencies have no borders. Still, if the main countries, which buy and sell crypto, (like USA, Germany, Russia) declare cryptocurrencies illegal, there will be negative consequences for ETH price. I hope it will not ever happen, but risk still remains

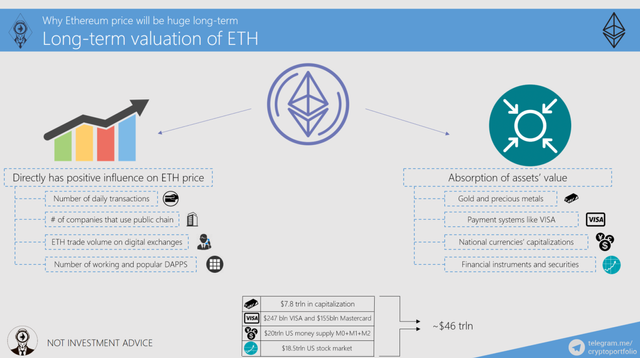

Let’s now examine the main drivers of Ethereum price.

• There is direct relation between number of transactions and Ether price

• The same applies to number of companies that actively participate in the life of public chain (transfer from point a to point b or use smart contracts, doesn’t matter if they do it on PUBLIC chain)

• The most attractive assets are actively traded on digital exchanges like Poloniex

• DAPPs have the biggest significance on ETHER price. Decentralized applications will be the gateway of ordinary people to Ethereum blockchain. The more DAPPs are used, the more transactions there will be, the bigger positive effect it will have on the price.

Do you know that you sometimes can compare shares of one company to similar company’s shares? This way you can find whether shares are overbought or oversold. Let’s try to compare Ethereum capitalization to assets which may be will be absorbed by Ether.

• Gold and precious metals. How can I compare those two assets? They both have limited supply (after ETH Proof-of-Stake adoption), they are means of exchange (even though, gold is not very popular at the moment), both assets are valuable to society.

• Payment mechanism. This is the closest comparison, because the only thing VIZA does is it accommodates cashless transactions between people to organizations and people to people. This is what ether also can do. Scalability solutions of Ethereum will create the strongest competitor to VISA and Mastercard.

• Currencies. Can Ether absorb value of a national currency? Well, Ethereum capitalization is already higher than the money supply of Ukraine. Right now, Russian government is so frightened by cryptocurrencies, it wants to create cryptoruble. They understand that cryptocurrencies are a direct threat to national currencies. The reason? It is not only much more convenient to use, it doesn’t have significant inflation, you can send it anywhere in the world, and there is no commissions. It is a threat to any currency. That is why Ether can absorb the value of national currencies if it becomes scalable enough.

• Financial instruments and securities. Some tokens on Ethereum blockchain are already called securities, I do not think we are too far away when money from financial institutions will flow into our blockchain. It is actually already happening. Maybe Ether is not a security itself, but I am certain that there will be a lot of money infusions into Ethers from Wall Street.

What about capitalizations of the assets mentioned above?

• Gold $7.8 trln in capitalization

• $247 bln VISA and $155bln Mastercard

• $20trln US money supply M0+M1+M2

• $18.5trln US stock market

$46trln in total.

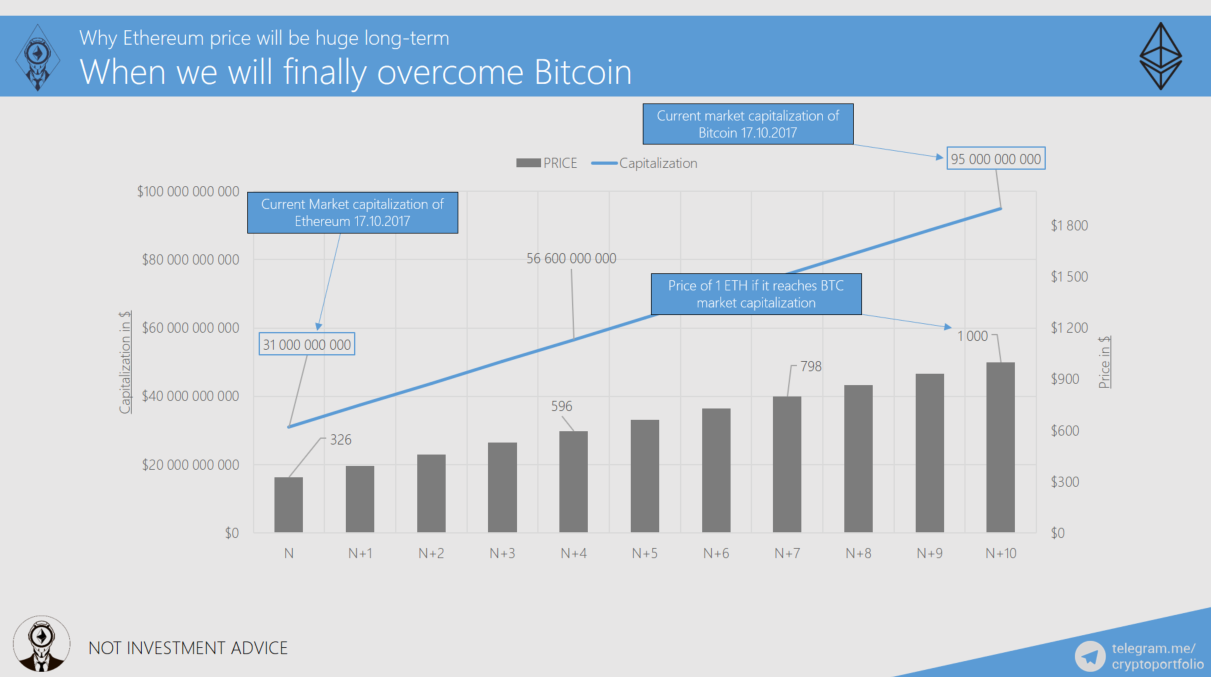

When will we overcome Bitcoin? It will happen when the capitalization of Ethereum will exceed the capitalization of Bitcoin.

Even though, Ethereum currently is twice as big as Bitcoin was in March 2017, it is still behind Bitcoin. Let’s assume that the Fred Wilson’s forecast comes true, what will be the price for ETH then?

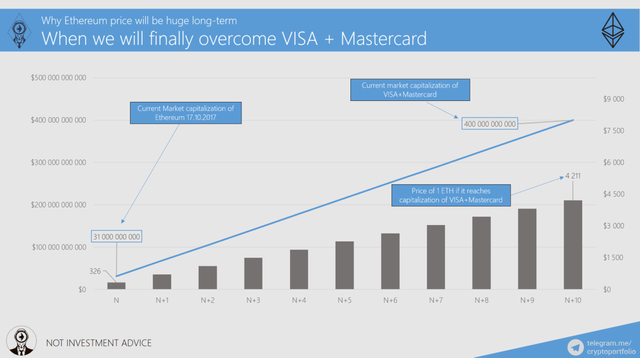

First of all, this is the current market capitalization of Ethereum, a little bit more than $30bln.

Here you can see the current market cap of Bitcoin.

Finally, on the right, there is approximate price for ETH, it is $1000. If we are to overcome Bitcoin in 2017, price for 1 ETH will be bigger than $1k.

Finally, let’s see what will be the price for 1 ETH if Ethereum conquers the business of VISA and Mastercard.

If Ethereum happens to steal payment systems’ business, market capitalization of Ethereum will exceed $400bkn, and price for 1ETH will be more than $4200.

Many good points in this article.

I doubt a ban on cryptos would happen as many of these regulators and politicians are probably already invested in the space.

If they decided to do draconian ban, the backlash from their constituency will be quite severe. I think it's too late for a ban as there is already too much VC money invested in various crypto startups, and those VCs have lobbyists.

The one thing that bother me about ETH going into POS is that nobody knows what the long-term inflation rate is going to look like! Secondly, how would Vitalk and/or the foundation know what the best course of action in determining this variable? BIG question right there.

I think there are important things that you forget:

You cannot own shares or coin of Ethereum, you can only own tokens in the ecosystem. ETH token is equal than any other token except that it will pay dividends if you stake it. However, dividends cannot be very high because transaction costs should be as low as possible.

Ethereum has the problem that ETH token is not used as payment in most Ethereum apps. First this makes it less valuable, second in my opinion 99.9% of apps based on a business model relying on revenue in their own tokens will fail.

Adding to that although often glorified. ICO model is in any way flawed except for the people who intend to receive the funds and run away with it or make a Non profit project.

In my personal opinion Ethereum was amazing the first year it launched. I took Bitcoin consensus mechanism and updated it to its full potential. Now they want to shift to POS but the models they are suggesting will lead to monopolisation. New competition will find new consensus models. Not based on POW and not centralised POS. The ones who find a new model better than Ethereum may make Ethereum obsolete in only couple of months.

The speed at which technology in this space develops now makes it very unlikely for any existing blockchain technology to be leading in 2-3 years time. Newer not blockchain based models with free, instant transactions will come to the market and they will dominate.

Good points. Have you checked out NEBL? Low float and has been making new highs since it's post ICO. Gone from .10 to almost 5.00 in about a month. Looking at clearpoll.io next. Also a low float. Easy 6 figure gains.

Both of those look very interesting - cheers for the tip!

Always good to read one of your in-depth article.

That's funny you are so invested in ETH that you say "we" when you speak about it ;)

I am also a big believer of ETH. Because there is sooo much work done on it right now. It has to pay somehow in the future.

Now, as you say, there are risks. Competition might be the biggest for me. But let's take the example of Bitcoin. As Bitcoin was the first coin, it managed to keep its advance a very long time before a concurrent gets close to it. The history of BTC worked for BTC itself.

I think it will be the same for ETH : even if its price does not reflect it currently, a very big amount of work have already been done. Competitors have a lot to do (in terms of investments, popularity, functionality...) before being a threat to ETH. Its history will serve ETH as well. At least for 1-2 years.

Then... who knows ?

Congratulations @cryptoportfolio! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPNice post again :)

I was wondering what happened to the Big Ripple post you were going to publish, any ETA on that?

I tried to contact Ripple company through their site to ask the details, they still haven't responded.

Thanks for the reply and update :) Keep up the good work man!

as usual, nice and clear analysis @cryptoportfolio.

Please consider to check up on IDERA and educate us afterwards.

maybe in the comparison format?

Are you sure that when we move to Proof-of-Stake no new coins are going to be created?? My understanding is that validators will be rewarded with new created coins like minners today .

On the other hand, I think that there is a push to limit the price of ETH, with all those DAPPS needing to pay Transactions fees, they will be become unusable with a e.g. 6000$ ETH