SEC AND LEGAL DANGERS OF INVESTING IN ICOs

I want to cover the report that was issued by Securities and Exchange Commission. I think that everyone understands how important SEC is in the sphere of financial regulation. Even if you live in Cambodia, if you offer your tokens to US investors, you are under SEC jurisdiction. So, I hope this topic will be useful and interesting for someone who lives and works outside of United States.

Believe me, you do not want SEC to get interested in your persona, because the hands of SEC can reach you almost anywhere in the world. Extradition nowadays is a very popular procedure. Also, US regulators can go after people who issue tokens AND who buy them. Someone can say that it is unjust, but it is simply current reality. And if we cannot change that, we simply have to protect ourselves against legal risks that can arise after either issuing tokens or trading them.

It was only a question of time when cryptocurrency market gets clear regulation. This time is very near. Until then let’s see what SEC thinks about DAO token sale and how this information can be applied to other token sales.

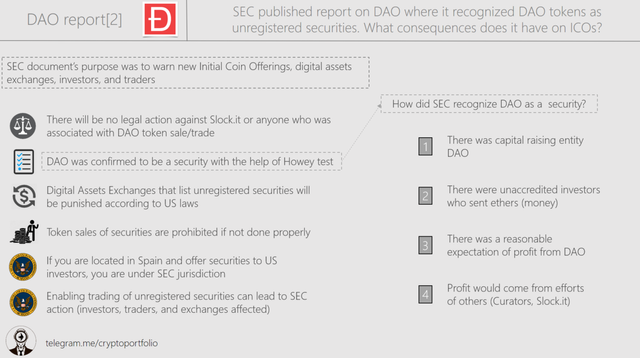

SEC published report on DAO where it recognized DAO tokens as unregistered securities. What consequences does it have on ICOs?

Let’s first of all see what kind of players on cryptocurrency market should be interested in SEC report.

First of all, it is very obvious, people who actually raise money. SEC made a document where it specifically concentrated on the management of Slock.it and curators of the DAO. So, ICO founders have to read document and get their ICO compliant with US laws.

Then we have Investors. Can you answer the following question: if you invested into ICO which was deemed to be breaking the securities laws, would you be also liable? If you answered no, think again. If you “enable” exchange of unregistered securities, you are breaking the laws. I do not think that SEC will go after small investors, but who knows? US investors are at biggest risk here, as I understand. Anything can happen. In order to avoid problems, do your research on cryptocurrencies before investing.

Traders will also suffer. The same thing about “enabling” exchange of unregistered securities applies to traders. Here I also can recommend doing your research before trading possible unregistered securities.

What about business? The main target here is exchanges, they will suffer the most if they “enable” or assist in exchange of unregistered securities. I will cover exchanges on other slide.

At this point, you have growing question in your head. How does SEC determine which token is, in fact, a security?

First of all, there must be a capital raising entity. The organization that collects money from people to do something. All ICOs apply to this category.

Next thing is the presence of investors who send money. By the way, the interesting thing was that SEC referred to ethers as money in the document.

Then we have reasonable expectation of profit. If investors send funds with the expectation of future profit, it is another point for regulators to deem the ICO to be the sale of unregistered securities. What does “profit” include?

• Dividends

• Other periodic payments

• Increased value of investment

Finally, if there is managerial efforts of others, it is another point for SEC to be interested in particular coin offering.

What was the reason for SEC to publish the document?

Many analysts agree that SEC document’s purpose was to warn new Initial Coin Offerings, digital assets exchanges, investors, and traders. That’s pretty much it…

…because there will be no legal action against Slock.it and other parties that participated in the tokens sale.

What else do we find in this document? DAO was confirmed to be a security thanks to Howey test.

But how did SEC find that DAO was, in fact, a security?

First of all, there was a capital raising entity. Virtual organization that used blockchain technology was this Decentralized Autonomous Organization.

Secondly, there were unaccredited investors who sent ethers (which referred as money in the SEC document) to this organization. What is the next important component?

There was a reasonable expectation of profit from DAO. This organization aimed at investing into other projects with the interest of receiving returns on investments. And then it would redistribute profits to the DAO tokenholders.

Finally, profit would come from the managerial efforts of others. In this case, we are talking about Slock.it team and curators of the DAO. Basically, this is how SEC recognized DAO as a security.

SEC also mentioned exchanges. Digital Assets Exchanges that list unregistered securities will be punished according to US laws. If you run an exchange, be sure to delist all the tokens which look like unregistered securities. BTW, this is why TAAS (the cryptofund that collected money during ICO and does payouts regularly to investors) isn’t listed on any American exchange.

Another point of SEC document is that token sales of securities are prohibited if not done properly. I will cover how to do proper offering of tokens (which are deemed to be securities) on the next slide.

If you are located in Spain and offer securities to US investors, you are under SEC jurisdiction. Another country won’t save you if you offered your securities to American investors. So, take care!

Enabling trading of unregistered securities can lead to SEC action (investors, traders, and exchanges affected). What does “enabling” means? Transferring, exchanging, trading, doing anything that token.

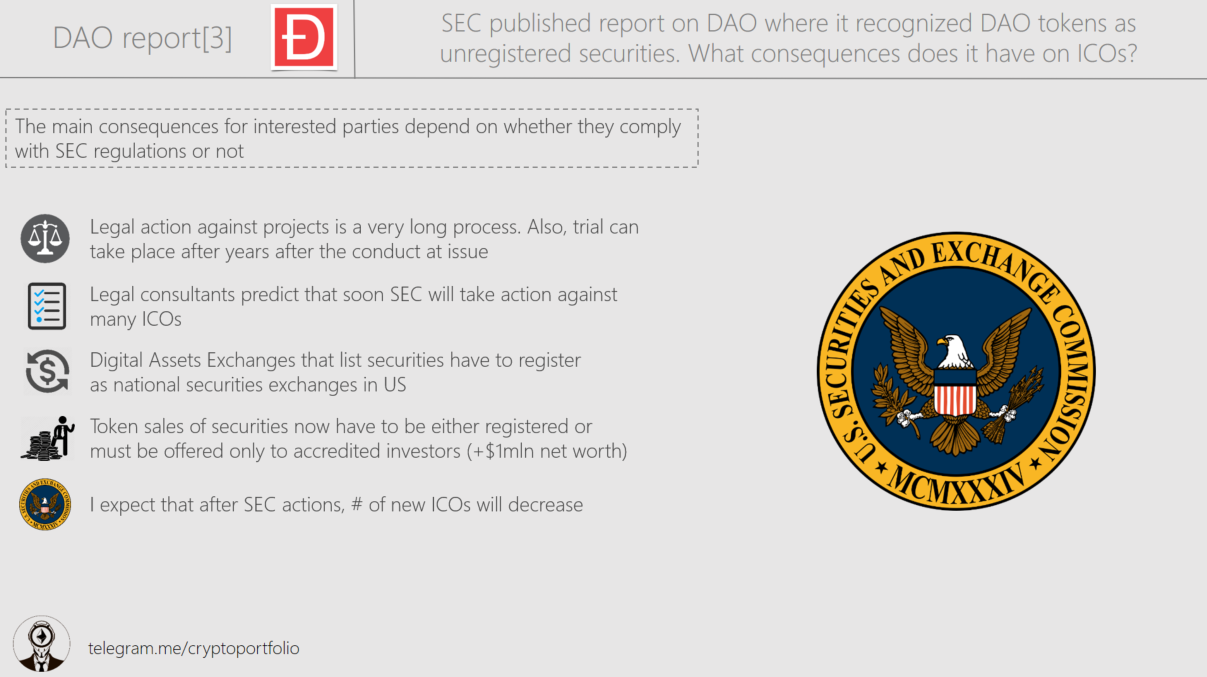

Finally. What are the consequences for ICO projects or other parties that participate in unregistered toke issuance?

The main consequences for interested parties depend on whether they comply with SEC regulations or not.

Legal action against projects is a very long process. Also, trial can take place after years after the conduct at issue. Yes, be careful, guys.

Legal consultants on blockchain predict that soon SEC will take action against many ICOs. They expect that in the near future we will hear about such cases.

Digital Assets Exchanges that list securities have to register as national securities exchanges in US. I do not know what the process of registering is, but I do not think that big exchanges are willing to become a national securities exchange. As I understand, if the exchange continues to list only usability tokens, everything will be ok. Is Poloniex safe? If it doesn’t list anything related to dividends paying tokens, yes.

Token sales of securities now have to be either registered or must be offered only to accredited investors (+$1mln net worth). Blockchain lawyers estimate that project needs from $1mln to $5mln to register as a security in the United States. Well, it is very expensive.

Finally, I expect that after SEC actions, # of new ICOs will decrease. The founders of many current ICOs are not that frightened yet. But I think that after a couple of legal cases, the market will be more decisive about new initial coin offerings.

Legal cases against existing ICO's might bring some volatility as risk adverse investors sell off in fear.

Thabks for the post! I heard that onG coin ICO will not be affected by this because it is a usability token. Looks good.

True. ONG Coin's ICO starts today!!

A very informative post, thank you. Could you also give some examples of ICOs most likely to fall in the securities category?

I mentioned TAAS. Also, vSlice, etheroll, edgeless. I think that VERI is a security =)

Great post, thanks for sharing! I gave you a vote. I hope you enjoy it.

I do

I just found a company on the SEC website that will be investigating crptocurrency blockchains. They work to ensure that crptocurrency financial institutions meet anti-money laundering (AML) compliance

regulations. The name of the company is Elliptic. I sent them a message to look into BCC.

What's up with BCC? Why did you send them message about it?

To have them look into the company and ensure it is not a scam. I recently invested and want to to be proactive in ensuring the company is legitimate. However, I recently looked up their address in England and found that the place is an apartment complex... I'm making my inquiries about that as well.

Thank you for a proper report. But I can not agree that # of ICOs will increase this year. As most of projects are just planning to go ICO, US market may be seeing a decrease, but there is a huge marker in Asia and Europe.

Are you kidding me? Where did I write about "increase"?

Seems very unlikely that any law SEC just made up can apply backwards in time. On top of everything Etherium is now considered "money" by them? This would mean that I could use ETH as a legal tender to buy goods and services in the U.S. Interesting article.

Verry poste good

There is one ico that will change the future of the web..I am so excited for this! For those aware of tne net neutrality shit going on to censor the web, there couldn't possible be better timing for this amazing project to liberate us! Their dev team in the past joined forces to work behind massive companies, like Disney, Facebook, HP, Apple, Kodak, the NBA and others! If you guys get the pre order and you want 5% more use my code nicknia If you want to follow whats going on, I just joined the slack community and everyone is really cool and helpful there.. Here is the link https://join.slack.com/t/substratumcoin/shared_invite/MjE2NDY5ODc1MjM3LTE1MDA3MzQ3MzItNmM5MjgxMDE4Zg