How to be prepared for CryptoCurrency bubble burst

Do you feel it? Euphoria. Growth will never end, right? What does an average cryptocurrency maximalist respond you with when you mention that current cryptocurrency market conditions are not healthy and remind you of a bubble? «It is cryptocurrency, bro, it is still not that widespread! Remember the $6.7 trillion dotcom bubble? We are not even close! ». It all sounds familiar. We’ve been here before. It was late 2013 and the beginning of 2014. I remember this time quite clearly, because a lot of people were talking about Bitcoin on the internet and how it made fortune for its investors.

Even I tried investing but was unsuccessful. Later a lot of investors realized that it was just a peak of the bubble which was fueled by the Chinese demand. February of 2014 will forever be in the history books as the day the first ever Cryptocurrency bubble ended with the fall of the biggest exchange at the time. Let’s try to see what we can do to prepare ourselves for this kind of events. Even though, you will never know when the market is going to crash. As always, bubble burst will come without a warning.

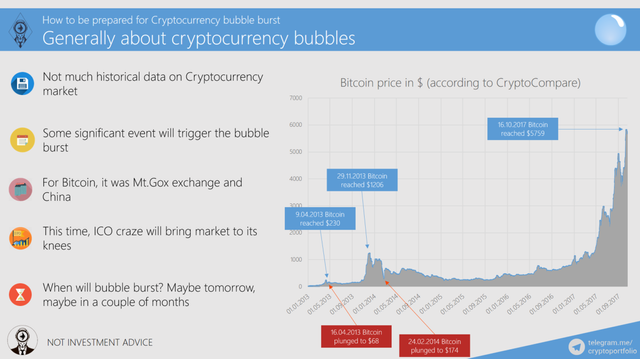

I need to start by saying that there is not much historical data to properly analyze Bitcoin and Cryptocurrency bubbles. The market is simply too new. Still, Bitcoin has been actively traded since 2013 (before that year the trade volume was just too low) and we can use this 5-year data to see how Bitcoin was affected by different external forces.

9.04.2013 Bitcoin had reached its all-time-high of $230. A lot of investors name the Chinese demand and “Willy” the trading bot as the main reasons for this price increase.

16.04.2013 Bitcoin plunged to $68. 7 days were enough to slice local all-time-high by almost ¾. Mt.Gox, exchange that handled 80% of Bitcoin trade at the time, halted trading during this freefall. Later, the exchange blamed the huge inflow of new traders as the main reason for the fall.

29.11.2013 Bitcoin reached $1206, setting a new all-time-high. As I mentioned before, the Chinese demand is brought as the reason number one for this historic event in Bitcoin history.

Here I want to note that some event should take place for the market to significantly react. From the information available, Mt.Gox played a very important role for Bitcoin at the time. It was a market monopolist which concentrated too much power in his hands.

What was the event that changed the Bitcoin history forever? This event was Mt. Gox exchange. 24.02.2014 was the day when Bitcoin reached $174. This month Mt Gox suspended trading, closed exchange and website, and filed for bankruptcy protection from creditors.

What about the next trigger event, will you ask? And I will tell you that with my absolute belief in this that initial coin offering craze will be the next Mt Gox for cryptocurrency market. Absolutely all cryptocurrencies will be affected. Shitcoins are going to be killed, major currencies will just suffer significant capitalization losses. Not very bright future, but this way market will clean itself from all those shitty ICOs.

When will this happen? I cross my heart, I do not know when. Nobody knows, because it is the nature of bubble bursts that you cannot simply predict when market is going to fall. That’s why if you made some great profits on the cryptocurrency market, enjoy them.

So, now you think that there is a possibility of the market fall. What should you do? Well, it depends on your targets in the cryptocurrency sphere.

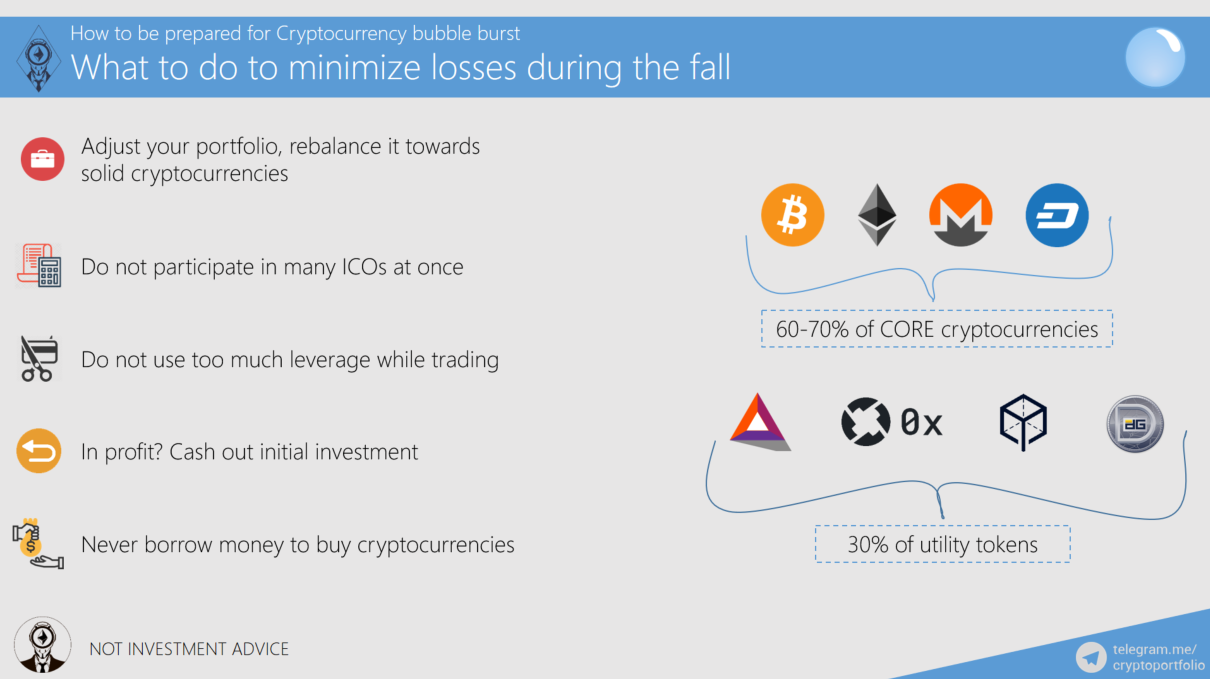

Adjust your assets. If you are a long-term investor, it is better to build portfolio which will mainly consist of the “core” cryptocurrencies, which are expected to survive from 2-3 years’ time. It is up to you how to build this part of your portfolio. Also, I would allocate a small part of long-term portfolio to utility tokens. Many of them will be first to go when bubble bursts. So, choose wisely.

Do not participate in many ICOs at once. In this sphere it is getting harder to earn each day with so many projects coming to the market. You can try to pick only the most popular ones but it seems that even the those initial coin offerings do not have such a huge payoff they once had. Try not to throw too much money.

Another thing is leverage. If you are not an experienced trader, you’d be better off avoiding this. Sudden market movement can crush all your positions.

Are you in deep profit zone? Cash out your initial investment. This way, you will sleep much better during the night. You have your money back plus you are still exposed to possible continual growth of the cryptocurrency market.

I have heard too many sad stories. Do not invest money you cannot afford to lose. We all remember dot-com craze. A lot of people put their 401k or borrowed money in shares of Nasdaq listed companies only to lose all they had on the next day. There are a lot of personal stories from people who experienced family tragedy when their fathers/mothers tried to gamble on the dotcom bubble and lost. Do not ever borrow money to invest into highly volatile and speculative assets. Cryptocurrency IS the future, but current valuation is unhealthy.

First of all, everything that I laid down here is just my personal opinion. It is crucial that you make your own financial decisions. Think of it as an interesting and simple tree of choice. In any case, do not take this slide as investment advice.

Who are you? Are you a holder? Will you not sell long enough so your chosen cryptocurrencies go to the moon? Or you are just a temporary guest who wants to make a quick buck on all those highly volatile cryptocurrencies? It is always about short-term investors and long-term investors.

The main question I will ask you is whether you are currently in profit zone. Let’s start with the Short-term investor.

If the answer is yes, you have managed to receive over 100% or less on your initial investment, then I would cash out the invested money and a little bit more to reward myself. It is especially to do for people who have achieved some unbelievable numbers. If you are that person, then I would advise you to enjoy at least some part of hard-earned money.

If you didn’t manage to make any return on your investment in cryptocurrencies and you are a short-term investor, then I would choose to either reallocate the available funds more efficiently, leave it as is or quit the market. It is up to you to decide.

Long-term investors. You are here to hold until you can buy 10 lambos at the same time, right? I hope you chose your long-term portfolio well. If you doubt your choice, check out my article on how to create long-term cryptocurrency portfolios (https://medium.com/@EthereumRussian/how-to-create-long-term-cryptocurrency-portfolio-my-top-long-term-picks-b415b8320747). If you have some magic returns on your investment, I would cash out the initial investment and leave other part of the portfolio alone. In case market plunges, you will be able to buy even more of cryptos you want. If the market doesn’t stop to grow, well, you still have a lot of crypto, right?

If you are a holder and you do not have some magical returns on your investment, then I would advise you to leave your portfolio alone for a couple of years. If you truly believe that it is the most solid portfolio out there, then just forget about crypto for some time. Do not overreact when market will make its moves, do not repeat the mistakes of the guys who sold their ETH at $8 to buy more bitcoins. Check the prices once a month and take it easy, mate.

Most big cap altcoins haven't had any real growth in 4-5 months. Its just bitcoin/forks and a few lucky small cap coins that have had growth recently. Look at the chart of the top altcoins in both /btc and /usd. Look at ETH, ETC, XMR, LTC, XRP, DASH all way down vs bitcoin and haven't sustained any growth since the alt boom in march. Look at steem and bitshares too way down.

Good read, but I have Ark as my Core currency, i think it has the potential to be near the 4 you mentioned in the image in the future (2018 i hope)

I'm a long term investor and a strategy that I use which helps is that I put away my coins in the least convenient (and most secure) wallet. This removes the temptation to get into the market during a fluctuation and keeps my nerves in check. Really enjoyed reading your insightful post.

Thanks for sharing helpful info

You bring up some very valid point. However, I totally disagree with you about this even being anything close to a bubble, yet.

Sure you can point to certain coins and say they are bubble...perhaps even Bitcoin. That said, the underlying technology, which is what these coins represent is in its' infancy. The upside in all of this is tremendous. Does that mean every coin will go to the moon? No. As you said, choose wisely....there is a lot of garbage out there. Many of the platforms these coins represent wont even get off the ground.

Prudent financial management is always welcomes. Nevertheless, many like to throw the term bubble around simply because something went up in a quick period of time. I bought Tsla at the "bubble" price of $240 and have ridden it up to $380 and now it sits at $350...of course many are still calling it a bubble.

Thank you for your honest opinion. I hope some people will read your post and choose their decision wisely. It's too bad to see already many people who bought the heights and lost a lot of money.

Keep calm and hold your portfolio, if you have chosen to believe for example in Steem then hold it, just because it drops to 1$ it does not mean the project is over what so ever, if you once bought a crypto because you had solid reasons then you should stick with it and overcome the fear of bubbles.

Do not let euphoria or fear affect your investments. I am not an expert in the subject but I do know that it can be so easy to sell after a coin drops over 20% of its value. Keep cool.

good

I agree with crypto (more like bitcoin) being a bubble that may burst in the future. I see alts with more potential and they should be given much more attention and value.

It is hard to be that person warning of the dangers of investments, but I agree with what you are saying. I think the rule should always be to never sell off an entire asset. Maybe you wouldn't see the sky-high profits that you would have with holding, but you at least have something to show for it and something left in the market just in case.

Steemit has been influential in me getting into cryptocurrencies, but I was very skeptical at first. I'm not in anyway a professional trader, but Steemit has enabled me to get into Bitcoin and several altcoins. If it all goes to nothing tomorrow I can at least say I made something from it, and the experience has been worth it.

Do I wish that I have held onto every Bitcoin? Sure, but because the way that I have been involved, I can say that at least I still have some left. If the market continues to move with BTC rising, I think I'm going to invest more into STEEM. What do you think?