Ethereum Go: Gotta Fork Them All

The Ethereum hard fork went off without a hitch. If the Ethereum Foundation (EF) thought their bastard child Ethereum Classic (ETC) would die a swift death, they were mistaken.

ETC is the Ethereum chain that did not bail out the DAO. Remember the DAO, that game changing investment vehicle that had to be bailed out by big daddy Vitalik because of poorly written code? The Ethereum protocol was hard forked so that DAO Muppets could get back their ETH.

Many, including myself, assumed that no exchanges or miners would support ETC. After the hard fork, each ETH holder pre-fork was entitled to an equal balance of ETC. The only way ETC has value is if miners and exchanges support it. Miners do the computational work to support the network and earn newly created ETC, and exchanges provide liquidity so that miners can monetize their magic internet money.

Due to the rushed nature of the hard fork, proper documentation relating to securing ETC and preventing replay or double spend attacks was sparse. It was not in the EF’s interests to make it easy to accept and use ETC. The goal was to definitively hard fork, protecting both their public image and foolish investors in the DAO.

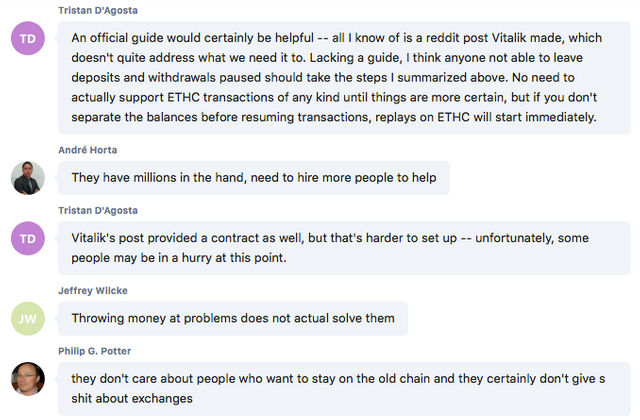

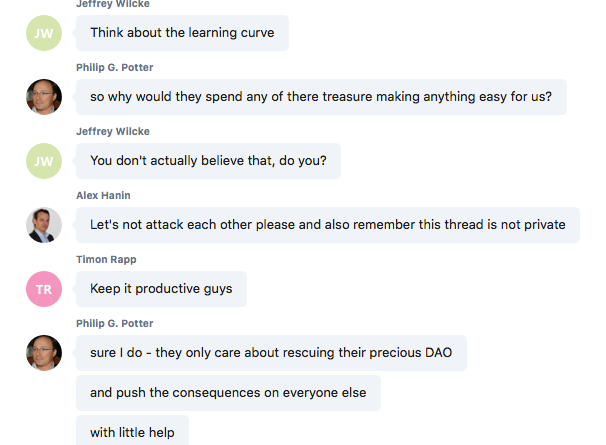

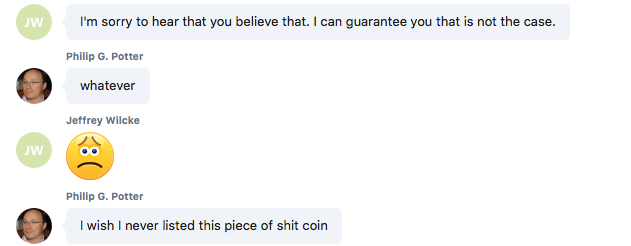

Phil Potter, CSO of Bitfinex, had this to say about how EF handled the hard fork:

“they don’t care about people who want to stay on the old chain and they certainly don’t give a shit about exchanges” … “so why they spend any of [their] treasure making anything easy for us” … “they only care about rescuing their precious DAO” … “I wish I never listed this piece of shit coin”

This conversation was public on Telegram and screenshotted here.

Hell hath no fury like a digital currency exchange scorned. The leading exchanges can make or break a coin. Without liquidity, a coin is nothing. The foundation is about to learn that the hard way as Poloniex and now Bitfinex will allow trading of ETC. Little birdies also tell me that Kraken will also list ETC.

The hash power of ETC is still considerably less than ETH, but now that the three leading ETH exchanges will list ETC, miners will have a financial incentive to mine ETC. ETC is exactly the same as ETH; therefore, if the profit margins are higher on ETC than ETH, miners will just point their machines at the ETC network.

Many in the Ethereum community opposed the hard fork. These traders will place ideology ahead of profits, and that is very positive for the staying power of ETC. Profitable ETC mining will only encourage them further.

Traders can now go long or short ETC. ETC24H is the only leveraged ETC product, and the only way to short ETC.

Trading Ethereum Classic

If you held physical ETH pre-fork, you are indifferent to price ratio of ETH vs. ETC as you hold both. However, you do care about the total market cap of ETH + ETC.

If ETC sticks around, it will start to spread Fear Uncertainty and Doubt (FUD) amongst Ethereum’s corporate cheerleaders. The value of Ethereum emanates from large multinational technology and financial firms’ interest and usage of the protocol.

These companies are very fearful. Senior managers are fearful that any application built on Ethereum won’t last. They are also fearful of public perception of their company’s adoption of the protocol. That is the key reason why the foundation is quick to point out that Ether is not a currency. Banks wouldn’t touch the protocol otherwise.

The DAO bailout signified that the foundation will bail out an application if the financial impact is large enough. That is comforting to large financial institutions because that is necessary in the Too Big To Fail business model.

If ETC is still around in a month and the hashing power increases, many uncomfortable questions will be asked. Will miners switch allegiance en masse to ETC if that is what the community truly wants? Should an organisation be building services on top of a protocol where immutability of the code is more valued than intent?

As FUD spreads, the total market cap of ETH + ETC will decline. Many ETH holders are sitting on large gains since the initial coin offering (ICO). They will begin dumping ETH if it becomes clear that the large corporate backers are getting cold feet.

What Would Bitcoin Do?

The controversy surrounding the Ethereum hard fork presents an interesting question for Bitcoin if ever challenged by a similar situation. Exchanges are rising up and miners are declaring '51% attacks' on ETC. More forks may be in our future.

So, what would Bitcoin do if there were a similar theft of from an exchange? The DAO's "theft" was massive - about 10% of market cap. For BTC, that's just over $1 billion.

Would the miners and mining pools bail out the exchange with a hard fork? What if miners, core devs, Bitcoin companies and exchange CEOs lost funds from the theft? What if you had your life savings tied up in the theft? This is a common sentiment: just recently, one of the largest Bitcoin mining pools unofficially stated they would support a bailout.

Choosing to fork could spell the end for Bitcoin as a cryptocurrency of choice. Satoshi's whitepaper strongly suggests Bitcoin's purpose is to avoid control through decentralisation, and therein lies its value. Bitcoin's role is not to correct theft but to promote trustless transactions. Can a ledger be trusted when it is susceptible to revision by social forces?

Let's say the fork is declined instead. I believe Bitcoin would survive, but would raise usability doubts from companies thinking about investment. Such a loss could actually draw more regulation to the industry.

The question creates a serious moral hazard. Both options have major drawbacks.

Ethereum and Bitcoin are different and serve different purposes. The EF's decision to fork may not serve as a good indicator to what would happen in Bitcoin's case. There have been a number of hacks to show that Bitcoin stays strong to its beliefs and the community should be reminded that recourse is not guaranteed. My best advice is to store your Bitcoins in cold wallets and be wary of FOMO'd projects like The DAO.

#investments #steem #investment #exchange #bittrex #poloniex #dao #etc #eth #mining #hardfrork #money #cryptocurrency #crypto-news #pokemon #funny #blockchain #business #blog #secret-writer #trade

Oh yeah ETH dan ETC

lol, thanks for your image @blackjincrypto

nice post and great news @budilontong

Upvote all $1000 , cheers

Great post @budilontong. Was a good read. Here's to happy trading. Cheers Daycrypter

thanks @daycrypter

thanks @donaa

I have been enjoying watching this drama play out. It's kind of like a. Crypto coin multiverse. I agree with the Etc position that the code rules. I think they will gain hashing support. As time goes on.

yes we still see what is really best, thanks @andre-ager

Hi OP! I am @jeeves, a public service robot (PSR). I want to thank you for this wonderful post. I'm here to deliver my sincere upvote. For readers: if you liked this blog, you might also be interested in these other posts tagged "ethereum".

Here are the top 3 most popular posts tagged "ethereum":

thanks @jeves

The DAO bailout (I mean hard fork) was one of the most shameful things that ever happened to crypto, it is up there with GOX, Josh Garza and Paycoin. I am on team ETC.

I like the humor, so its getting an upvote from me!