Predictions for the Ethereum 2018

The blockchain to dominate market share for Turing complete supercomputer, such as Ethereum , will be one with the strongest network effects for developers: one that can mathematically implement formal verification to secure sensitive smart contracts while concomitantly driving strong enterprise adoption. Ultimately, the strength of the developer community will drive innovation: they will be the first-line of defense to see if the latest protocol and app layers are robustly tested against exploits and identify potential 0-day attacks before it’s too late.

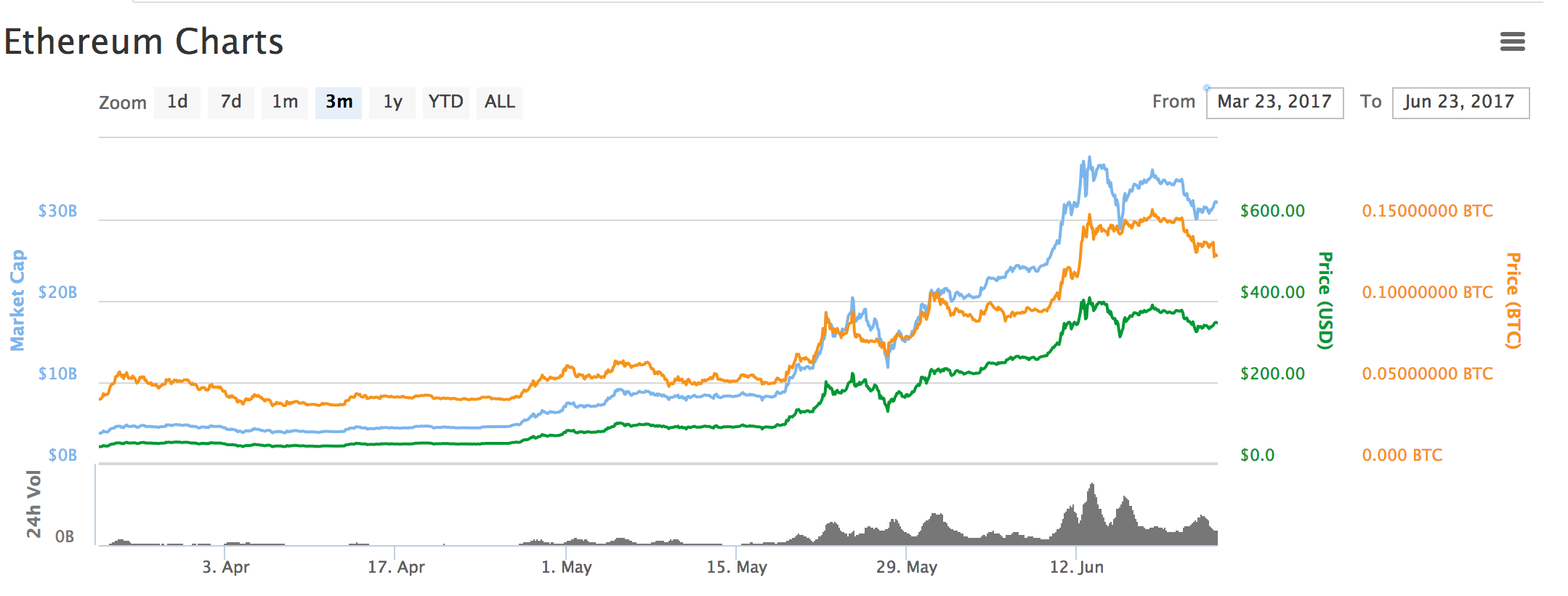

With the release of Casper’s long-touted PoS, I only see more money pouring in for development and speculation. On May 16th, 2017 with the price per ETH hovering around $87 I predicted that such developments may even drive the price beyond ~$150 by the end of 2017 and establish a new plateau in the $150–$200 range. I am amused yet concerned to see my call play out much faster than I anticipated. Again, this is 100% contingent on any significant 0-day exploit, major code vulnerability, or attack on the network or major exchange/wallet (especially with the release of new code via Casper and/or Metropolis’s zk-SNARKs ). Any attack like that would cause the market to drop prices like they were hot. Let’s hope Vitalik et al centuple-test the code before release.

The price can further be bolstered by any positive major developments with the EEA (Enterprise Ethereum Alliance) whose cooperating members currently include Microsoft, JPMC, Intel, UBS, Accenture, and the list is only growing. The EEA needs to demonstrate utility with DApps, which go beyond current R&D stage projects in the application layer. The quality and quantity of devs will certainly influence how soon their objectives are met to deliver configurable consensus, privacy controls, and rules-based access control to assign permissions and constraints.

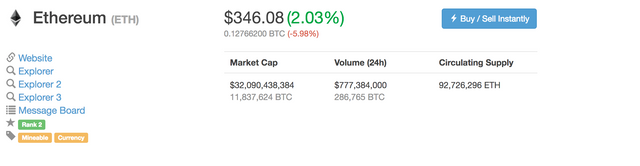

CoinMarketCap Today

That said, Ethereum’s future is only as bright as its developer community. This point can’t be overemphasized. Despite the controversy, it already has a proven track-record of tested technical ability to handle programmatic crises mid-flight. Although, as history indicates, unscheduled hard-forks will only divide the community even more deeply as the ETH network continues to mature past such youthful indiscretions.

Since the start of the year, we have seen Ethereum’s market cap increase +1,219% to date. That is a price movement of $8.24 to ~$94 today. Barring any correction due to an attack an exchange or its protocol layer, I only see sound support at the ~$85. As a result, I only further unfettered optimism for its trajectory and would not be surprised to see at least a doubling in its price by early 2018. This sounds like a phenomenal return on its own right — arguably, as far as this market is concerned — such an estimate may prove to be conservative.

Only time will tell.

Nota bene: Notice how the BTC:ETH ratio has steadily decreased with time. Nearly a year ago it hovered above a 1:35 ratio. Now it is within a 1:20 ratio; barring an unprecedented hard-fork by Bitcoin Unlimited Project this Fall (which would cause a dramatic downside correction). It is plausible to see a run-up in the price of BTC to $10,000 by 2018, if not earlier, which would drive the BTC:ETH ratio below 1:20. Perhaps peaking it at 1:10 ratio for a new ATH. This implies ETH to be worth north of $500, at the lower end, if not more ($1,000) by 2018 before correcting. This bullish view assumes many things are working well: EEA development is flourishing, 0 mission critical cyber attacks on ETH protocol and/or exchanges, etc… Again, I must caution that this market is also well primed to overheat as later adopters rush en masse with speculative fervor. At that stage, the seeming reward will simply overshadow any rational attempts to obviate downside risk.

Write in comments your predictions about it

Special thanks to Cyrus

Best,

Im not too sure about ETH, once it goes back up to around 400, I am going to convert it to some other altcoins.

I think that Ethereum will have difficult times until August and then will recover

I'm sure crypto in general will gain steam until some big security issue happens that may or may not be caused by the world central bank.