Ethereum NewsNewsOpinion Ethereum is Struggling With Scaling, Despite Lack of Actual User Base

The Ethereum network, which is valued at around $31.8 billion at the time of writing, is struggling to deal with scaling issues despite its lack of actual user base.

Over the past few months, Ethereum co-founder Vitalik Buterin emphasized that the vast majority of decentralized applications are either coded poorly or in a manner which unnecessarily bloats the size of smart contracts.

More importantly, he explained that the rapid increase in the average fee of Ethereum transactions is a direct result of the explosive growth of the ICO market. For instance, an investor in the BAT ICO included a $2,220 transaction fee in order to secure his investment in the project. Hence, Buterin noted that the average transaction fee is not an accurate measure to describe the scaling issues Ethereum is struggling with.

However, a new debate in regard to the scalability issues of Ethereum sparked after the controversial statement of FarmVille co-creator Sizhao Yang in which he stated that Ethereum transaction fees are much lower and the network itself is much more flexible than bitcoin. Yang emphasized that while bitcoin is facing a serious scalability issue, Ethereum network is prospering with appropriate scaling.

Yang’s statement in regard to the scalability of Ethereum is evidently non factual as various bitcoin trading platforms and digital asset exchanges including BTC-E and Coinbase halted trading due to the unstable operations of the Ethereum network

On June 20, major cryptocurrency trading platform BTC-E issued the following statement:

“More Due to the unstable operation of the Ethereum network due to the network load, the ETH withdrawals is temporarily unavailable.”

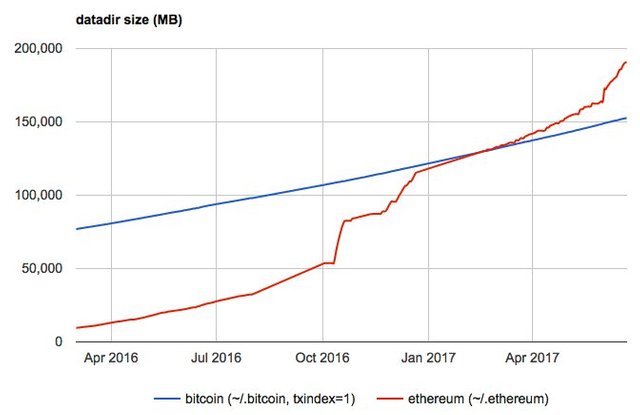

Jameson Lopp, engineer at BitGo, revealed that apart from the average fee statistic, Ethereum’s scaling issue is demonstrated with the growth of its blockchain size. Despite lacking actual decentralized applications and ICO projects with actual user base, Ethereum’s blockchain size surpassed that of bitcoin’s, exceeding 200 gigabytes

It is important to consider the fact that the Ethereum network still does not have commercially successful or widely utilized applications because if the network starts to see a spike of actual active users, current scaling issues will worsen.

There are certain investors and analysts that claim Ethereum is being utilized as a currency. However, Ethereum’s token Ether was designed to act as gas or fuel to power decentralized applications. Thus, unlike bitcoin or Ethereum Classic, it has an inflationary monetary supply rather than a fixed supply. Investors in Ethereum can consider Ethereum as a store of value but in reality, a very small portion of its users are utilizing Ethereum as a digital currency or store of value on a daily basis.

Peter Todd, a Bitcoin Core developer, criticized Gavin Andressen for his statement which read:

“Ethereum has 80% of BTC volume and is scaling with little drama. BTC’s scaling ‘problem’ is due to a few ‘we know what’s best’ developers.”

In response, Todd explained, “Meanwhile, today multiple exchanges are halting trading due to Ethereum’s failure to scale.”

Tuur Demeester, a bitcoin trader, investor and analyst, noted that the implementation of a proof-of-stake (PoS) protocol and sharding could in theory scale the Ethereum network proportionally. However, he explained that Raiden doesn’t seem to be a smart contract scaling solution, which is crucial and necessary for Ethereum.

To Ethereum’s credit, the network targets a more complex problem than bitcoin’s value transfer. It prioritizes flexibility and the development of smart contracts to ensure decentralized applications are provided with an infrastructure they need to operate autonomously.

However, realistically, Ethereum still doesn’t have an actual user base and decentralized applications on top of Ethereum also do not have large regular user bases.

Disclaimer: The views expressed in the article are solely that of the author and do not represent those of, nor should they be attributed to CCN.