Governance in distributed organizations, part 3.

In the second part I’ve walked through fundamental internal problems with centralized organizations and tried to show how organizations learned to grow in highly uncertain environment. If you’re looking for the first part, you may find it here.

In third part, I’ll take a look on few of existing implementations of governance in blockchain systems.

Designing governance systems

Governance systems in blockchain projects are hot topics. They are varieties of them, of different design, cost, and efforts required to participate in them

As I’ve said on twitter, as a byproduct of another discussion:

When designing governance systems (at least in crypto), you’d better start with 3 questions:

- What voter losses in case of a bad decision or a conscious attack?

- What voter pays/contributes in exchange for the voting right?

- Who has the right to vote and why?

Let’s see how few governance systems in cryptocurrencies worked out..

Failed examples: TheDAO

The DAO was a digital decentralized autonomous organization, created in 2016 to mimic a venture fund on an Ethereum network. It a crowdsale it collected about $150mln worth of Ether (at May 2016 price) which was about 14% of all existing Ether tokens at the moment (12.7 mln ETH).

For several short weeks it seemed that the Holy Grail was found and future organizations would mimic TheDAO structure. Yet, in June 17, 2016, TheDAO smart contract was a subject of an attack, which siphoned about one third of the collected ETH, in violation of the spirit of the project (but strictly adhering to the compiled code).

What would happen if there would be no bug, or at least it won’t be discovered as fast? Would be TheDAO a successful example? Nobody now knows for sure, but for the short period TheDAO was alive, it collected enough criticism, besides code quality:

- The status of curators wasn’t quite clear

- The initial choice of curators wasn’t quite clear

- The process of whitelisting of proposals had to be yet figured out

- Various game-theoretical properties of splitting off TheDAO weren’t explored (and the attacker finally used exactly this feature to drain the funds)

Also, Dan Larimer pointed to other social problems that TheDAO had might face later:

- Low voting participation

- Proxy for proxy voting is performed on cultural (party/philosophical/like/dislike) lines, not on objective merits

Reliance on the price of the underlying asset (ETH) - Anti-spending movement: big proposals would sell the ETH, dumping the price and increasing the volatility.

- Voting coalitions

- Non-voters would be rewarded with minimal risks, voters can’t split out.

For sure, it would have been fixed with time, but the time it had not.

False examples: ICO’s

What TheDAO did do, is to create a tested roadmaps for various Initial Coin Offerings, ICO’s. In 2016 and, of course, in 2017, lots of blockchain (and not only) projects rushed to use this crowdfunding method to raise the funds.

Investing into ICO’s was a crazy gold rush in 2017, with all them collectively raising north of US$6bln.

Yet, most, if not all ICO projects lacked the major point of TheDAO: they were centralized with all problems and risks associated with having a single point of control.

Thus, when SEC issued its “The DAO report” in July 25, 2017, it was a cold shower for the market. And SEC’s subpoenas killed retail crowdfunding.

In 2018, to date (early Sep), all ICO’s collectively raised more than in 2017 ($6.9bln vs $6.1bln), but most of those funds were coming from big players (VC, hedge funds, family funds) and not from retail Joe Doe. And on month-by-month scale, the amount raised is declining.

Kinda success: Dash DAO

There’s another example of the DAO (lowercase “the”): the one of the Dash cryptocurrency.

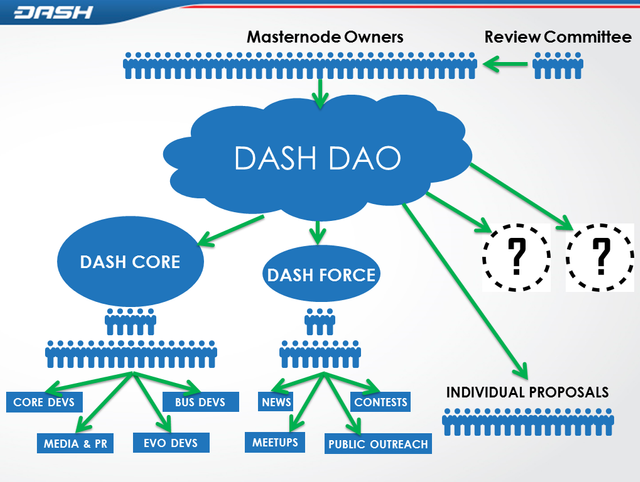

You may find more detailed explanation here and here , so I’d put just an overview.

Dash network recognizes that there are several participants in a successful blockchain:

- PoW miners, who supply security to the network

- Collateralized MasterNodes, who store the full copy of the blockchain and run second layer of the service

- Others, who are impossible to qualify on the protocol level, but human judgement would be able to sort them out.

Therefore, Dash network directs up to 10% of the block reward to the Treasury. Interested parties may submit human-readable proposals to the Treasury and MasterNode owners, who hold a significant collateral in Dash) vote for those proposals. Proposals, that had the majority of Yes votes, are given grants in order of decreasing Yes/No votes difference, until Treasury for this period won’t be completely used. Periods are approximately one month in length. Unspent, unclaimed funds aren’t created.

Grants can be one-time or multi-month. In the later case, MN owners can change their mind and downvote the project, so it won’t receive more funds from the Treasury.

So far it works pretty successfully, it wasn’t hacked, and it funded many projects around the world, yet…

- Grants are grants, not a loan, or investment, or any other commercial interest. The only thing that precludes the proposal owner from running away with funds, is his reputation.

- Dash Treasury is single layer system and, since Dash doesn’t support any 2nd level tokens yet, it could not be scaled in obvious ways.

Both of those caused misuse of funds (some may call them even exit scams) and difficulties in scaling the proposal system to support many tiny activities.

In the upcoming part I will outline a suggested system, that I’m working out, that’s designed to keep simplicity and clarity of Dash DAO while (hopefully) answering the challenges.