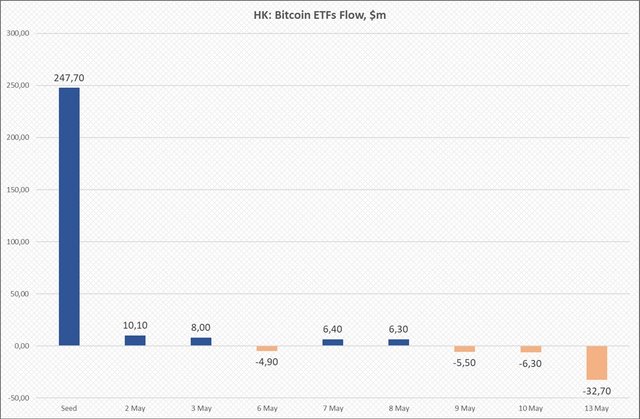

Record outflows from Hong Kong ETFs

The last major event to move Bitcoin's price was the launch of spot ETFs in Hong Kong in early May. The ETF market's small market capitalisation of $50 billion (versus $9 trillion in the US) has been offset by rumours of an imminent connection to the Stock Connect system, which will open up access to mainland Chinese investors.

The hopes were false, though. The Hong Kong stock exchange denied the rumours. On 13 May, Chinese Bitcoin ETFs saw their largest outflow, $32.7 million.

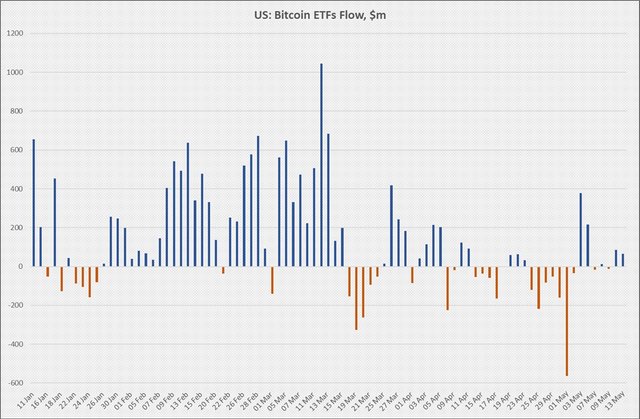

US ETFs don't look much better. After a month-long sell-off, they returned to regular inflows, closing the last week at $286 million.

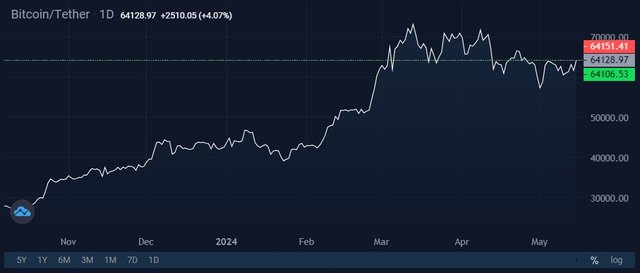

Despite that, Bitcoin is performing well enough and hasn't fallen into a full-blown correction. The maximum drawdown from the record high is only 23%. In previous bull cycles, it ranged from 36% to 71%.

One key factor for the price's stabilisation is institutionalisation. Bitcoin sees less price turbulence because it's recognised and incorporated into the traditional financial system via the same ETFs. In the past, large US investors overlooked the asset because of the risk that companies would suddenly ban cryptocurrency transactions like what happened in China. However, these companies are now increasingly looking to invest in it.

Even JPMorgan, whose head called Bitcoin a fraud and a worthless asset, declared to the SEC on 10 May that it purchased shares in spot Bitcoin funds worth a total of $760,000. Compared to the bank's total amount of assets under management, the purchase size is modest, but the start of cryptocurrency investments has now taken place.

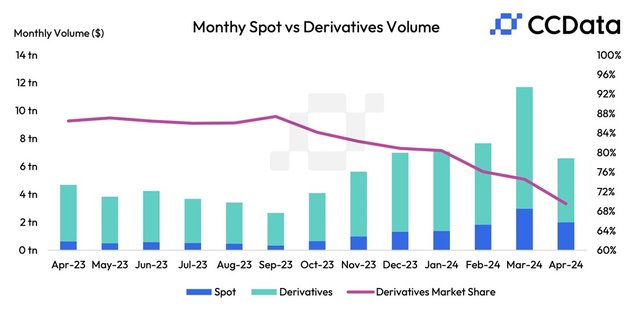

With inflows into spot ETFs slowing considerably and exchange-traded activity already down 43.8% in April (compared to March), macroeconomic factors are coming to the fore.

The focus this week will be on data from the US. The Fed previously planned to cut its key rate in June. However, the jump in inflation to 3.5% in March forced the regulator to reconsider when it would begin cutting rates.

The data for April may have a surprise in store. If inflation declines significantly, the chances of a monetary policy reversal in the summer will increase significantly. This, in turn, will be grounds for risky assets, including Bitcoin, to strengthen. The indicator will be released on 15 May.

StormGain Analytics Group

(an all-in-one cryptocurrency platform)