Rupiah slump to Rp 14.000 per USD, BI will raise interest rate?

Bank Indonesia Building.

Bank Indonesia (BI) is considering raising its benchmark interest rate. This is in response to controlling the weakening Rupiah exchange rate up to 14,000 per USD.

BI Senior Deputy Governor Mizra Adityaswara said the matter would be discussed in a Board of Governors Meeting (RDG) held this month.

"BI already told that in the RDG on 16-17 May there is a monthly RDG to determine the direction of monetary policy," he said at the Coordinating Ministry for Economic Affairs, Jakarta, Tuesday (8/5).

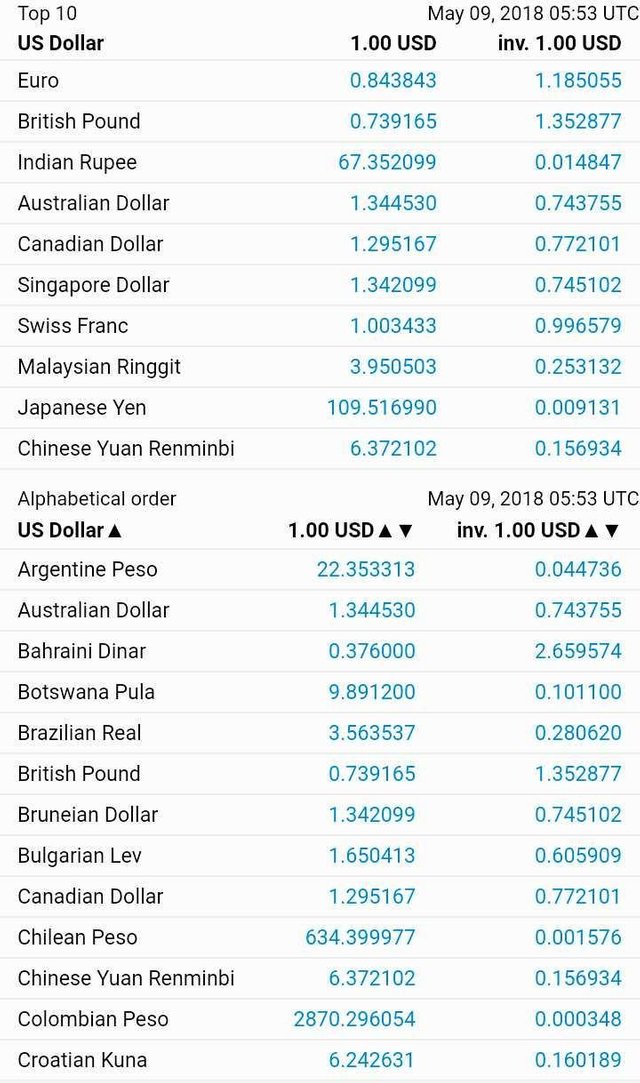

In deciding to increase the benchmark interest rate, BI will look at existing data, ranging from inflation to the movement of global capital flows. The policy of the US central bank will also be taken into consideration.

"And BI has told in the press release that BI will look to the data for inflation, import export, balance of payments.Of course we also see how the flow of capital in the world, we also see how the direction of US policy will rise in June," he said.

In addition, BI will also see how the movement of interest rates in other countries. Recognized Mirza, currently a number of countries have raised interest rates in response to the policy of the US central bank.

"As well as the interest rates of neighboring countries, Malaysia is rising, Korea is rising, Australia is going up We will access later If we need interest rate hike then we have to do adjusment," he said.

With the efforts made by BI and the government's move, he expects the Rupiah exchange rate to strengthen again, below 14,000 per USD. "(Rupiah can be under 14,000?) Can," he said.