How the markets now run Brazil

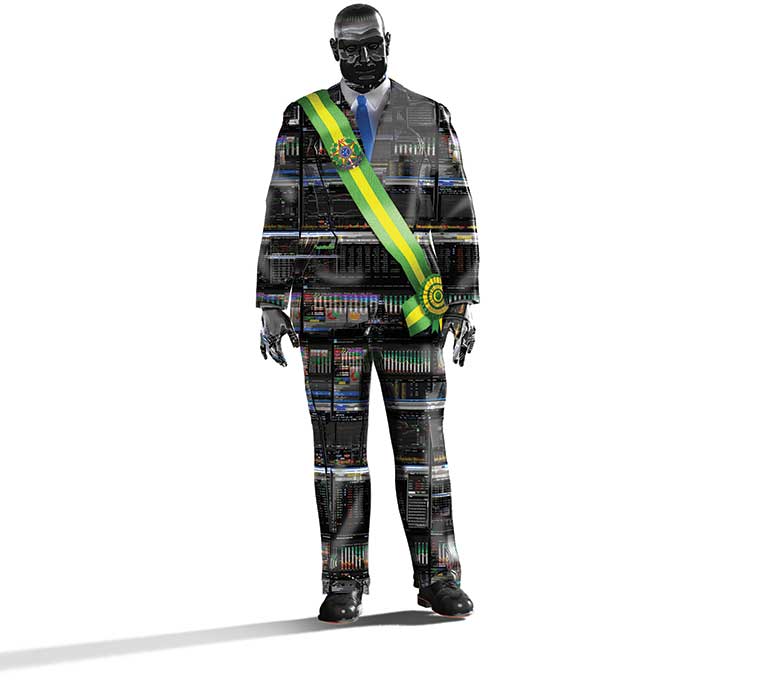

Financiers and speculators are progressively certain that the nation's next president will embrace a program of monetary changes, despite the fact that no driving applicants are remaining on that stage. Why? Since over the previous decade, Brazil has turned into a 'marketocracy'. Request Illustration: Barry Downard Brazil's majority rule government has included another component over the most recent couple of years: individuals can vote in favor of a president, yet the business sectors hold the privilege to convey a 'denunciation put' if that president is botching up the economy. For evidence, look no more remote than the destiny of previous president Dilma Rousseff. Her prosecution in 2016 was legitimately in light of fiscais pedaladas (bookkeeping anomalies).

Financiers and speculators are progressively certain that the nation's next president will embrace a program of monetary changes, despite the fact that no driving applicants are remaining on that stage. Why? Since over the previous decade, Brazil has turned into a 'marketocracy'. Request Illustration: Barry Downard Brazil's majority rule government has included another component over the most recent couple of years: individuals can vote in favor of a president, yet the business sectors hold the privilege to convey a 'denunciation put' if that president is botching up the economy. For evidence, look no more remote than the destiny of previous president Dilma Rousseff. Her prosecution in 2016 was legitimately in light of fiscais pedaladas (bookkeeping anomalies).

That she was separated from everyone else among capable lawmakers not to be refered to in the general Lava Jato defilement enquiry was insufficient to spare her. Outside powers still figured out how to expel her from office. Presently, after two years, couple of senior market members significantly try to imagine the bookkeeping charge was something besides a business sectors driven established fig leaf to evacuate an awful president, whose shocking financial arrangements pushed the nation into its most profound ever subsidence. Talking at a Credit Suisse Investors Forum prior this year, Luis Stuhlberger, CEO and boss venture officer of Verde Asset Management, stated: "The conclusion that one compasses is that any hopeful will do [fiscal] changes in 2019, either proactively or responsively, in light of the fact that on the off chance that we have a [president] with altogether different thoughts, he or she will be indicted. Since if GDP goes down, the subsidence will return, and he or she will be removed. This has been obviously illustrated." Stuhlberger, a speculator worshipped by numerous in Brazil, included: "previously, when I was more critical and I figured [Rousseff's] denunciation wouldn't occur, a representative let me know: 'Whether you are in the administration without the capacity to oversee, we will figure out how to get you out.' I think this is clear in the brains of everybody." Paulo Guedes, another notable Brazilian agent, populist competitor Jair Bolsonaro's financial guide and potential priest of fund, viably said a similar thing: "It used to be that expansion must be 2,000% to be denounced, yet now if it's at 10%, the president is removed." Guedes at that point likewise contrasted the arraignment on bookkeeping grounds and Al Capone's indictment for tax avoidance. Stuhlberger and Guedes were trying to say in broad daylight what numerous are presently progressively glad to state in private. "Our framework has balanced governance, and Dilma was expelled by the constitution," one investor tells Euromoney. "One can contend whether the pedaladas were the genuine reason – and obviously they weren't, she was destroying the nation and in the event that she wasn't indicted in 2016, god knows where we would have been today. Toward the start of 2016, our financial group estimate a 4% compression in GDP, yet they said it might just be 5%. Would you be able to envision?" Everyone is acting like they all went out celebrating the prior night and they all did awful things, everything got messed up, however now they're simply stowing away and nobody is standing up - Banker, New York As Euromoney revealed in May 2016, capable business pioneers were in truth the ones pushing lawmakers to expel Rousseff, as renegotiating dangers undermined to make an influx of corporate defaults all through Brazil. In 2012, Brazilian corporates and budgetary organizations brought $46.8 billion up in the worldwide markets – a substantially less expensive wellspring of back than nearby banks or capital markets. By differentiate, in 2015, the aggregate brought up in the universal markets was simply $7.2 billion. In the initial five months of 2016, no arrangements had gone to those business sectors. The business sectors had given their own particular vote of no trust in Rousseff. Banks did likewise. Their arrangements against the danger of corporate bankruptcies spiked; in 2015, 5,500 organizations looked for chapter 11 insurance – the most since 2008 – with gauges of a huge number more to come as monetary market liquidity dissipated. Weight manufactured. The vent was reprimand. To be reasonable, some were glad to be open about the genuine purposes behind denunciation at the time. A March 22, 2016 tweet from Aécio Neves, Rousseff's presidential challenger in 2014 and a key promoter of arraignment (who has along these lines been by and by inundated in the defilement outrage), indicated its political convenience: "Indictment is the most brief conceivable course to beginning another stage in the nation's history." Today's expanding bluntness about the genuine explanations behind the 2016 prosecution is to a limited extent an element of the time that has passed and the unmistakable change in the nation's monetary direction it achieved.

That she was separated from everyone else among capable lawmakers not to be refered to in the general Lava Jato defilement enquiry was insufficient to spare her. Outside powers still figured out how to expel her from office. Presently, after two years, couple of senior market members significantly try to imagine the bookkeeping charge was something besides a business sectors driven established fig leaf to evacuate an awful president, whose shocking financial arrangements pushed the nation into its most profound ever subsidence. Talking at a Credit Suisse Investors Forum prior this year, Luis Stuhlberger, CEO and boss venture officer of Verde Asset Management, stated: "The conclusion that one compasses is that any hopeful will do [fiscal] changes in 2019, either proactively or responsively, in light of the fact that on the off chance that we have a [president] with altogether different thoughts, he or she will be indicted. Since if GDP goes down, the subsidence will return, and he or she will be removed. This has been obviously illustrated." Stuhlberger, a speculator worshipped by numerous in Brazil, included: "previously, when I was more critical and I figured [Rousseff's] denunciation wouldn't occur, a representative let me know: 'Whether you are in the administration without the capacity to oversee, we will figure out how to get you out.' I think this is clear in the brains of everybody." Paulo Guedes, another notable Brazilian agent, populist competitor Jair Bolsonaro's financial guide and potential priest of fund, viably said a similar thing: "It used to be that expansion must be 2,000% to be denounced, yet now if it's at 10%, the president is removed." Guedes at that point likewise contrasted the arraignment on bookkeeping grounds and Al Capone's indictment for tax avoidance. Stuhlberger and Guedes were trying to say in broad daylight what numerous are presently progressively glad to state in private. "Our framework has balanced governance, and Dilma was expelled by the constitution," one investor tells Euromoney. "One can contend whether the pedaladas were the genuine reason – and obviously they weren't, she was destroying the nation and in the event that she wasn't indicted in 2016, god knows where we would have been today. Toward the start of 2016, our financial group estimate a 4% compression in GDP, yet they said it might just be 5%. Would you be able to envision?" Everyone is acting like they all went out celebrating the prior night and they all did awful things, everything got messed up, however now they're simply stowing away and nobody is standing up - Banker, New York As Euromoney revealed in May 2016, capable business pioneers were in truth the ones pushing lawmakers to expel Rousseff, as renegotiating dangers undermined to make an influx of corporate defaults all through Brazil. In 2012, Brazilian corporates and budgetary organizations brought $46.8 billion up in the worldwide markets – a substantially less expensive wellspring of back than nearby banks or capital markets. By differentiate, in 2015, the aggregate brought up in the universal markets was simply $7.2 billion. In the initial five months of 2016, no arrangements had gone to those business sectors. The business sectors had given their own particular vote of no trust in Rousseff. Banks did likewise. Their arrangements against the danger of corporate bankruptcies spiked; in 2015, 5,500 organizations looked for chapter 11 insurance – the most since 2008 – with gauges of a huge number more to come as monetary market liquidity dissipated. Weight manufactured. The vent was reprimand. To be reasonable, some were glad to be open about the genuine purposes behind denunciation at the time. A March 22, 2016 tweet from Aécio Neves, Rousseff's presidential challenger in 2014 and a key promoter of arraignment (who has along these lines been by and by inundated in the defilement outrage), indicated its political convenience: "Indictment is the most brief conceivable course to beginning another stage in the nation's history." Today's expanding bluntness about the genuine explanations behind the 2016 prosecution is to a limited extent an element of the time that has passed and the unmistakable change in the nation's monetary direction it achieved.

It is likewise a decent message for the business sectors: 'Don't stress excessively over who gets into the Planalto in light of the fact that on the off chance that we see the nation veering off a conventional track, we can and will act.' One broker tends to Euromoney's inquiries regarding the ethical quality of this market 'put' being used against a justly chosen president: "Take a gander at China. It's run like a corporate – it's trying the world for having a non-majority rule process that oversees effectively to the advantage of others. They commit errors, yet they adjust them and, on the off chance that you ask individuals in China, they put stock in their administration." Then he gives his point setting for a remote columnist: "In the event that you endeavor to transplant that framework to England, it would detonate." He delays for accentuation. "Be that as it may, it works for them." Complication There is an accord that the champ will be from the middle right," says a head of obligation capital markets for an European speculation bank in New York. "In any case, on the off chance that you request that I clarify that agreement, I can't. I think the factors are too huge to make that expectation, however the market is completely settled that this will be the result." This statement insinuates the second part of the business sectors' indifferent view that the following Brazilian president will consequently be a financial reformist – a conviction that is totally unshaken by the confounding truth that the two people driving the early appointive surveys are not seen as competitors who might quiet the business sectors. Nor is it clear who the fundamental market-accommodating competitors will be, nor how a conceivably swarmed field of anti-extremist hopefuls will abstain from part the reformist vote and confuse the computation of who will battle the last run-off race between the best two applicants from November's first-round survey. Put basically, the agreement is based on the acknowledgment that the disassembling of Brazil's liberal Workers Party (PT) has gone sufficiently far past Rousseff's indictment to keep its arrival. Previous president Lula da Silva (in office from 2002 to 2010) is driving the surveys for this decision however has been condemned to 12 years and one month in jail for defilement and tax evasion. He is rapidly debilitating lawful difficulties that would enable him to remain as an applicant (and in addition keep his detainment). Previous president Luis Inácio Lula Da Silva is driving the early surveys yet might be banned from running Meanwhile, in late February, the PT's 'plan B' should Lula not have the capacity to run, Jaques Wagner, ex-legislative head of the northern province of Bahia, had his home assaulted and stands blamed for stealing R$82 million ($25 million) identified with the 2014 World Cup. "There is no left-wing competitor who can be a genuine contender display in Brazil. We have never observed the left wing as frail as they are today," says one senior capital markets financier in São Paulo. "This race will be unique in relation to past ones as there is no extremity." The left say Lula is being focused by the tip top who need to keep the PT from coming back to office. His rivals say the charges of defilement are simply and mirror the monstrous and fundamental routine with regards to directing cash from state-run ventures to the nation's intense political gatherings (the PT's leaders ran coalitions, and all the main gatherings – including the PMDB and PSDB – have been involved in the Lava Jato debasement enquiries). The fact of the matter is the two variants are right. Lula's PT grasped existing practices of charging for political support from state-possessed and privately owned businesses that needed to win government contracts. The scale ended up supercharged as the span of these organizations and contracts developed, bolstered by the nation's developing monetary weight amid the wares blast. In any case, individuals brisk to name Lula a slanted variation helpfully disregard past organizations' comparable illicit practices and the way that Brazil's divided (there are as of now 28 political gatherings in congress) and intrigue based framework nearly ensures defilement in view of the need to 'purchase' votes to get parliamentary larger parts. Since Rousseff's indictment, Brazil has been controlled by her appointee, Michel Temer, an individual from the anti-extremist PMDB party, who drove the move to remove her and stays in control, yet with low endorsement evaluations (they have as of late multiplied to 6%) in the midst of defilement affirmations of his own. President Temer basically disregarded his absence of command and disagreeability and at first delighted in great manageability in congress, passing business sector amicable work changes, and also other smaller scale changes like the difference in the financing cost connected to state advancement bank BNDES.

It is likewise a decent message for the business sectors: 'Don't stress excessively over who gets into the Planalto in light of the fact that on the off chance that we see the nation veering off a conventional track, we can and will act.' One broker tends to Euromoney's inquiries regarding the ethical quality of this market 'put' being used against a justly chosen president: "Take a gander at China. It's run like a corporate – it's trying the world for having a non-majority rule process that oversees effectively to the advantage of others. They commit errors, yet they adjust them and, on the off chance that you ask individuals in China, they put stock in their administration." Then he gives his point setting for a remote columnist: "In the event that you endeavor to transplant that framework to England, it would detonate." He delays for accentuation. "Be that as it may, it works for them." Complication There is an accord that the champ will be from the middle right," says a head of obligation capital markets for an European speculation bank in New York. "In any case, on the off chance that you request that I clarify that agreement, I can't. I think the factors are too huge to make that expectation, however the market is completely settled that this will be the result." This statement insinuates the second part of the business sectors' indifferent view that the following Brazilian president will consequently be a financial reformist – a conviction that is totally unshaken by the confounding truth that the two people driving the early appointive surveys are not seen as competitors who might quiet the business sectors. Nor is it clear who the fundamental market-accommodating competitors will be, nor how a conceivably swarmed field of anti-extremist hopefuls will abstain from part the reformist vote and confuse the computation of who will battle the last run-off race between the best two applicants from November's first-round survey. Put basically, the agreement is based on the acknowledgment that the disassembling of Brazil's liberal Workers Party (PT) has gone sufficiently far past Rousseff's indictment to keep its arrival. Previous president Lula da Silva (in office from 2002 to 2010) is driving the surveys for this decision however has been condemned to 12 years and one month in jail for defilement and tax evasion. He is rapidly debilitating lawful difficulties that would enable him to remain as an applicant (and in addition keep his detainment). Previous president Luis Inácio Lula Da Silva is driving the early surveys yet might be banned from running Meanwhile, in late February, the PT's 'plan B' should Lula not have the capacity to run, Jaques Wagner, ex-legislative head of the northern province of Bahia, had his home assaulted and stands blamed for stealing R$82 million ($25 million) identified with the 2014 World Cup. "There is no left-wing competitor who can be a genuine contender display in Brazil. We have never observed the left wing as frail as they are today," says one senior capital markets financier in São Paulo. "This race will be unique in relation to past ones as there is no extremity." The left say Lula is being focused by the tip top who need to keep the PT from coming back to office. His rivals say the charges of defilement are simply and mirror the monstrous and fundamental routine with regards to directing cash from state-run ventures to the nation's intense political gatherings (the PT's leaders ran coalitions, and all the main gatherings – including the PMDB and PSDB – have been involved in the Lava Jato debasement enquiries). The fact of the matter is the two variants are right. Lula's PT grasped existing practices of charging for political support from state-possessed and privately owned businesses that needed to win government contracts. The scale ended up supercharged as the span of these organizations and contracts developed, bolstered by the nation's developing monetary weight amid the wares blast. In any case, individuals brisk to name Lula a slanted variation helpfully disregard past organizations' comparable illicit practices and the way that Brazil's divided (there are as of now 28 political gatherings in congress) and intrigue based framework nearly ensures defilement in view of the need to 'purchase' votes to get parliamentary larger parts. Since Rousseff's indictment, Brazil has been controlled by her appointee, Michel Temer, an individual from the anti-extremist PMDB party, who drove the move to remove her and stays in control, yet with low endorsement evaluations (they have as of late multiplied to 6%) in the midst of defilement affirmations of his own. President Temer basically disregarded his absence of command and disagreeability and at first delighted in great manageability in congress, passing business sector amicable work changes, and also other smaller scale changes like the difference in the financing cost connected to state advancement bank BNDES.

Be that as it may, he has since been made up for lost time in defilement charges, and the administration's chance and assets are going into shoring up his political base in congress. The earnestness here is enormous. Obligation levels are getting troubling and individuals will soon begin to get spooked - Roberto Sifon, S&P Global The suspicion is that Brazil's current market-accommodating principle will proceed, however disliked it might be with the electorate: the way ahead having been shown when the monetary recuperation at last landed with 1% GDP development in 2017.

Be that as it may, he has since been made up for lost time in defilement charges, and the administration's chance and assets are going into shoring up his political base in congress. The earnestness here is enormous. Obligation levels are getting troubling and individuals will soon begin to get spooked - Roberto Sifon, S&P Global The suspicion is that Brazil's current market-accommodating principle will proceed, however disliked it might be with the electorate: the way ahead having been shown when the monetary recuperation at last landed with 1% GDP development in 2017.

In any case, this could well be tried.

In any case, this could well be tried.